MetaStreet announces integration with USD.ai to provide infrastructure financing for decentralized physical infrastructure networks (DePIN).

Key developments:

- MetaStreet's Liquid Credit Token technology has processed over $300M in onchain lending

- Partnership aims to address $500B funding gap in AI and compute infrastructure

- USD.ai will offer yield-bearing synthetic dollars backed by DePIN hardware and Treasury assets

Technical implementation includes:

- Automated Tranche Maker (ATM) for risk-adjusted loan issuance

- QEV Auctions system for automated DePIN asset liquidations

The platform will enable hardware operators to access loans while depositors earn yield. Project waitlist available at USD.ai

MetaStreet is powering @USDai_Official’s upcoming DePIN infrastructure loans Our Liquid Credit Token tech has facilitated $300M+ in onchain lending — battle-tested and built to close the $500 bn funding gap in AI and compute infrastructure. Stay tuned

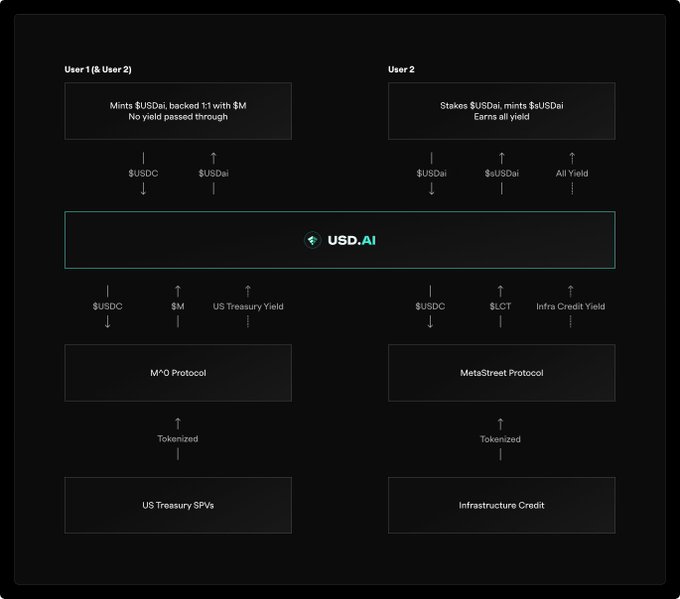

2/ The USDAI protocol creates 2 tokens: USDai and sUSDai $USDai = a non-yield-bearing stablecoin, over-collateralized with T-Bills -- powered by @m0foundation (a programmable platform for creating stablecoins) $sUSDai = a yield token, earning all the yield from the T-Bills plus