Market Watch Monday: USDC.e Lower-Risk Vault Performance Update

Market Watch Monday: USDC.e Lower-Risk Vault Performance Update

📊 Sonic Vault Beats Expectations

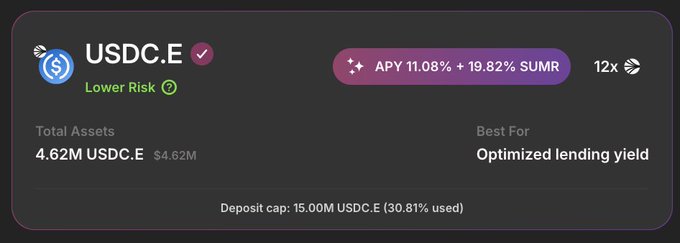

The USDC.e Lower-Risk Vault on SonicLabs continues to show strong performance:

- Current APY: 11.08%

- 30-day APY: 8.58%

- Total Assets: 4.62M USDC.e

The vault leverages multiple DeFi protocols on SonicLabs, with risk management by BlockAnalitica. All protocols undergo thorough security and performance vetting.

Week-over-week metrics show stable performance, maintaining similar yields from last week's 11.14% APY.

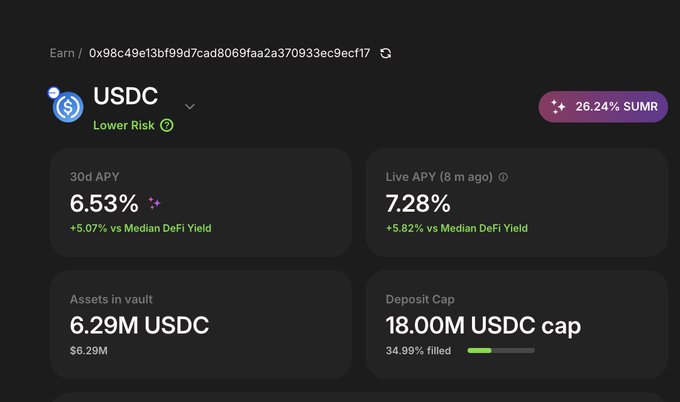

📊 Market Watch Monday: Lazy Summer Vault Spotlight This week’s standout: the USDC Vault on @base, a go-to for stable yield seekers - Live APY: 7.28% (+5.82% vs median DeFi yield) - 30d APY: 6.53% (+5.07% vs median) - SUMR reward: 26.24% - Assets in Vault: 6.29M USDC - Cap:

🧵 Morpho x Lazy Summer: How Seamless WETH Delivers Safer ETH Yield on @base Lazy Summer's ETH Lower Risk Vault isn't just a passive ETH yield tool - it's an automated, smart vault composed of multiple curated strategies across DeFi. Let's dig into the details 👇

Lazy summer latest dev update covered Cross-Chain Vaults - Summer.fi just got... lazier 😴 The problem: Yield opportunities appear and disappear in HOURS across chains. Large allocators move 8-figure sums daily to capture better rates. Cross-chain yield farming

Say 👋 to Seamless @MorphoLabs Seamless WETH now live in Lazy Summer ETH Lower Risk on @base! Get more info blog.summer.fi/say-to-seamles…

Say 👋 to @OriginProtocol Ether (OETH) in Lazy Summer ETH Lower Risk Vault The Lazy Summer Protocol has officially integrated OETH on Ethereum Mainnet unlocking another source of sustainable, automated ETH yield. 👉 Dive in: blog.summer.fi/say-to-origin-…

📊 Market Watch Monday: Lazy Summer Vault Spotlight USDC.e Lower-Risk Vault on the @SonicLabs Live APY: 11.08% 30d APY: 8.58% Assets in Vault: 4.62M USDC.e Best for: Optimized lending yield Explore: summer.fi/earn/sonic/pos… #LazySummer #DeFi #SonicNetwork #MarketWatchMonday

Lazy Summer Protocol - July Dev Update What we've been building Introducing Cross-Chain Vaults: Summer.fi just got… lazier 🤭 Read to get full info blog.summer.fi/lazy-summer-pr…

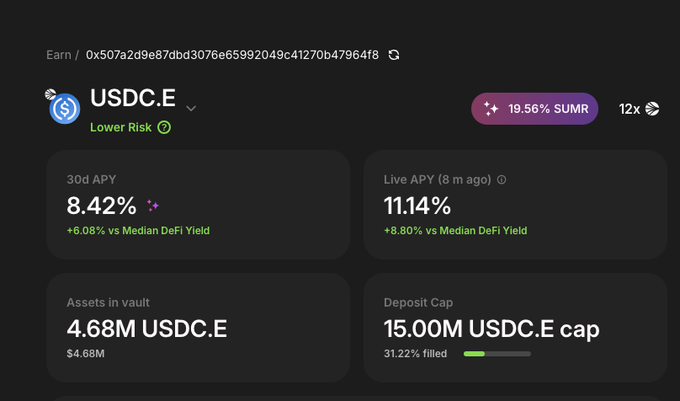

📊 Market Watch Monday: Lazy Summer Vault Spotlight USDC.E Lower risk on @SonicLabs Live APY: 11.14% (+8.80% vs median DeFi yield) 30d APY: 8.42% (+6.08% vs median) 19.56% $SUMR Rewards Eligible for 12x Sonic points Assets in Vault: 4.68M Cap: 15M (31.22% filled) 👉 Try it

Say 👋 to @SiloFinance Apostro USDC higher risk Read more blog.summer.fi/say-to-apostro… #DeFi #USDC #LazySummer

Vaults FYI: Silo Apostro USDC Higher-Risk @apostroxyz was added to the USDC Higher-Risk Vault last week and it’s already expanding the yield frontier. Read thread🧵

Say 👋 to Hyperithm USDC, now live in Lazy Summer USDC lower risk on Mainnet Now you can earn higher USDC yields with @hyperithm USDC automatically integrated and rebalanced in Lazy Summer’s USDC lower risk vault on Arbitrum.

State of DeFi Yield 2025 Survey - Rewards and Prizes Announced

Summer.fi has launched their annual DeFi Yield Survey with attractive incentives for participants: - **Grand Prize**: 1,000 USDC for one lucky respondent - **Exclusive Merch**: Limited edition Lazy Summer merchandise - **Token Rewards**: SUMR token giveaway for selected participants The survey aims to gather insights about DeFi yield preferences and strategies. Previous data shows their USDT Lower-Risk Vault achieving 4.96% APY (30-day) and 13.20% live APY, significantly outperforming median DeFi yields. [Complete the survey here](https://form.typeform.com/to/E9MigPmO)

Lazy Summer DAO Advances SUMR Token Transferability Initiative

The Lazy Summer DAO has launched a significant governance initiative focused on enabling SUMR token transferability. The SUMR Transfer Readiness Working Group Charter [SIP5.8] is now live, with three core objectives: - Define token transfer readiness criteria - Draft actionable Smart Implementation Proposals (SIPs) - Enable safe and credible SUMR transferability The formal ratification vote begins July 30. This follows recent governance activities including: - Multiple RFCs for new vault proposals (BTC-denominated, RWA) - Technical upgrades to Raft contracts - Implementation of forum polls for proposal signaling Community members can track progress and participate through the [DAO forum](https://forum.summer.fi)

Summer.fi Governance Proposal: Adding sUSDe Strategy to USDC Vaults

Summer.fi's latest governance proposal (SIP2.19) considers adding sUSDe strategy to both Lower and Higher-Risk USDC vaults on Ethereum mainnet. This follows previous successful governance actions including: - Integration of Maple Finance Syrup USDC - Launch of new Higher-Risk USDC vault - Optimization of governance parameters The proposal is currently under discussion on the [Summer.fi forum](https://forum.summer.fi/t/sip2-19-add-susde-strategy-to-usdc-mainnet-lower-higher-risk-vaults/307). Community members can participate in governance through staking or delegation.

Market Watch Monday: USDC Vault on Base Chain Performance Update

The USDC Vault on Base chain continues to demonstrate strong performance metrics: - Current APY stands at 7.28% (5.82% above DeFi median) - 30-day average APY: 6.53% (5.07% above median) - Additional SUMR token rewards: 26.24% - Total deposits: 6.29M USDC - Vault capacity: 35% utilized (18M cap) Compared to two weeks ago, while APY decreased from 9.14% to 7.28%, the vault maintains above-market yields. The vault focuses on automated, passive income generation through optimized lending strategies. [Learn more about the vault](https://summer.fi/earn/base/position/0x98c49e13bf99d7cad8069faa2a370933ec9ecf17)