Market Highlights:

- ETH up 5% with whale selling 5,002 ETH at $2,625.76 for $231K profit

- BTC steady at $110K with whale opening 20x long position (2,817 BTC, $300M+)

- Trump-backed American Bitcoin acquires 215 BTC

Key Developments:

- U.S. CLARITY Act raises concerns over token status

- Guggenheim launches tokenized DCP on XRPL

- Binance announces 400 $RESOLV airdrop

- New mixed BTC+ETH ETF application filed

- Silhouette Privacy Layer secures $3M funding

- Spot SOL ETF filing progresses

- Bitwise releases GameStop Covered Call ETF

🚀 Crypto moves fast. Stay faster. 🚀 Get real-time price predictions, AI-driven market analysis, daily insights and more. Powered by SWFTGPT, the first domain-specific LLM built for #crypto. 📲 swft.pro/#Download #Crypto #AI #DeFi #Web3 #CryptoNews #LLM

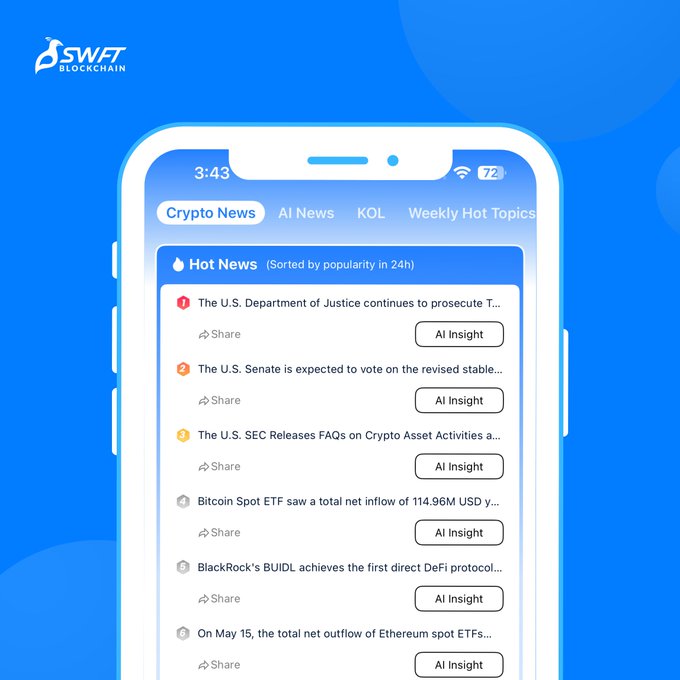

Catch up on the hottest crypto headlines with SWFTGPT 🔥 Here’s what’s making waves in the #crypto world today: 🏛️ DOJ continues prosecution of Tornado Cash co-founder Roman Storm — some charges dropped, but key ones remain. 🪙 U.S. Senate eyes stablecoin bill vote before

📰 SWFT GPT Daily – May 27, 2025 Crypto Market Sees Mixed Moves | ETH Surges | Elderglade +285% | SharpLink $425M Deal 🧠 Headlines & Highlights: 🔹 SharpLink closes $425M PIPE with Consensys; will convert to $ETH treasury. 🔹 Cantor Fitzgerald launches $2B Bitcoin financing

🧭 Crypto Market Snapshot – June 2, 2025 Total Cap Down | Volume Sinks | All Sectors Green | $MASK +31.7% | NFT Sector Leads All 16 tracked sectors are up today — led by NFT, RWA, and SocialFi: 🎨 NFT +3.88% (PFVS +13.3%, DOOD +11.9%, ANIME +11.5%) 🏛 RWA +2.43% (KTA +30.4%, OM

🚨 Crypto Market Roundup! 🚨 Here are the key updates: •Bitcoin hit a record high near $112,000 [$1]. •Senate advanced the GENIUS Act for stablecoin regulation . •Trump hosted a dinner for $TRUMP meme coin buyers . •Coinbase joined the S&P 500 despite a probe . •A new

SWFTGPT Daily – May 21, 2025 BTC Hits $106.5K | ETF Inflows Continue | SEC Sues Unicoin | South Korea to Lift Crypto Ban Top Headlines: • James Wynn expands 40x BTC long to $832M, unrealized gains hit $16.5M • Bitcoin ETFs net $329M, led by IBIT’s $287M inflow • SEC charges

📊 Crypto Market Update – June 4, 2025 Market Cap Dips, Volume Climbs | $SUIA +61% | BTC & ETH Dominate 70% of the Market 📰 Crypto News Highlights: 🪪 TRUMP coin partners with Magic Eden to launch official Trump Crypto Wallet 🗳️ South Korea’s election: Democratic candidate Lee

📉 SWFT GPT Daily – May 29, 2025 Crypto Market Dips | SocialFi Pops | FCA Drafts Stablecoin Rules | Ooki +232% 🚀 🧠 Key Headlines: 🔹 UK FCA proposes stablecoin rules: Reserve transparency & custody protection. 🔹 Fed Policy: Stable rates expected till Q3; trade tension clouds

Bridgers Clarifies Its Role as Non-Custodial Router

Bridgers has issued a key clarification about its service model: It is not a DEX and does not hold user funds or match orders directly. Instead, Bridgers functions as a routing protocol that securely connects users to aggregated liquidity across DEXs and bridges through smart contracts. Users maintain full control of their assets throughout the process, only authorizing transactions that Bridgers routes optimally. **Key Points:** - Non-custodial by design - Routes transactions via smart contracts - Aggregates existing DEX/bridge liquidity - User maintains asset control

U.S. Senate Advances GENIUS Act for Stablecoin Regulation

The U.S. Senate has made significant progress on stablecoin regulation, passing the GENIUS Act with a decisive 68-30 vote. Key provisions of the bill include: - Mandatory 100% USD backing for stablecoins - Annual auditing requirements for major issuers - New regulatory framework for foreign stablecoin providers This marks a historic step toward establishing the first comprehensive stablecoin legislation in the United States. The bill aims to enhance transparency and security in the digital asset market. Want to learn more about how this affects your digital assets? Visit [U.S. Senate Committee on Banking](https://www.banking.senate.gov)

Daily GM Streak Continues with Sunny Greetings

The web3 community maintains its daily greeting tradition with consistent *GM* messages accompanied by sunny emojis. A notable pattern shows alternating use of *gm gm* and *gm frens* across months, with occasional coffee emojis appearing. The consistency spans from February through June 2025, demonstrating the community's commitment to daily engagement and positive culture-building. - Primary greeting variations: *gm gm* and *gm frens* - Most common emoji: :sunny: - Occasional variations: :coffee:, :sun_with_face: - Continuous streak since February 2025

SEC Signals Potential Solana ETF Approval with Filing Request

The SEC has requested updated filings for a potential Solana spot ETF, suggesting possible approval within 24 months. This development follows Nasdaq's recent application to include $SOL alongside $XRP, $ADA, and $XLM in their crypto index ETF. Key points: - $SOL price increased 4% following the news - Polymarket indicates 78% probability of Solana ETF approval this year - Move could expand US crypto ETF exposure beyond Bitcoin and Ethereum This regulatory shift may signal broader acceptance of digital assets in traditional finance markets.