Market Caution as October Begins

Market Caution as October Begins

🎢 DeFi's October Rollercoaster

As October kicks off, traders are exercising caution due to potential market corrections. The DeFi sector is experiencing a decrease in Total Value Locked (TVL), coinciding with a sharp drop in Bitcoin prices.

Despite these market shifts, ApertureFinance's LP Management strategies have demonstrated resilience:

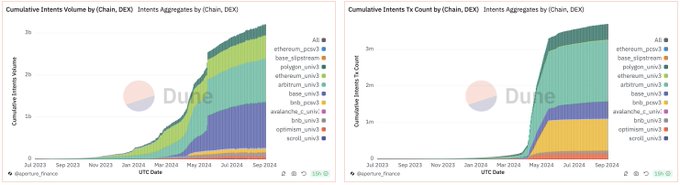

- Steady growth in user engagement across chains and LP strategies over the past week

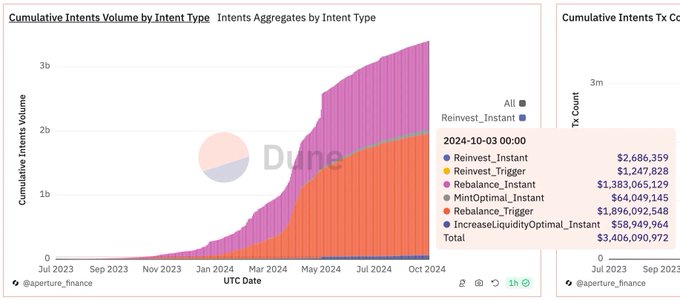

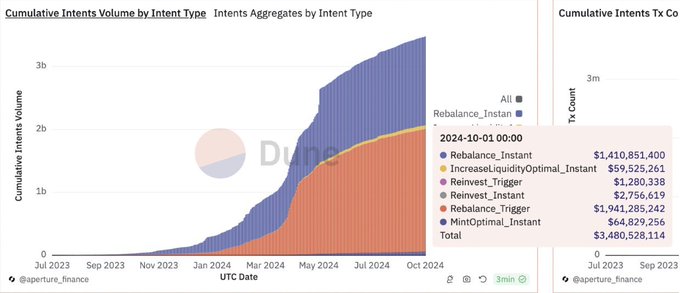

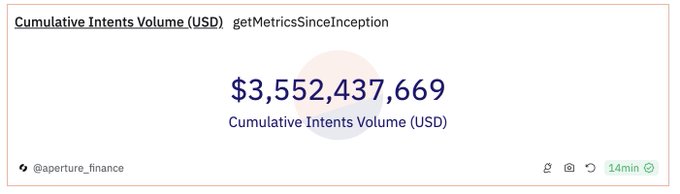

- Total intents volume remains strong at $3.4B

This performance contrasts with the broader market trends, suggesting ApertureFinance's strategies may be providing value to users during uncertain times.

Amid macroeconomic disruptions and #BTC's notable weekly fluctuations, #DeFi TVL remains resilient with a 20.68% increase. #ApertureFinance saw modest growth in intents volume, especially with the optimal instant strategy (+2.83%📈), while the rebalance trigger strategy became

Amid the current market fluctuations, Aperture Finance has achieved a cumulative #intents volume of $3.13B. Notably, our weekly trading volume has risen to $314K, up from $280K last week. We’re grateful for your continued support as we navigate these market dynamics together!

Over the past week, we saw a solid 4.7% increase in cumulative intents volume, hitting $3.55B, along with a slight uptick in transaction count. Boosted by the Fed’s recent rate cuts, which have positively influenced the #crypto markets, ApertureFinance’s robust user adoption

Aperture Finance Exploit Traced to Proxy Module Vulnerability

Aperture Finance identified the technical root cause of a recent security exploit. The attack targeted a **peripheral proxy contract** used for liquidity aggregation, not the core system. **Key Details:** - Attacker exploited an input validation bypass - Malicious calldata was injected through the vulnerability - The breach was **isolated to the proxy module only** - Core liquidity management engine remains secure and unaffected This contrasts with earlier speculation from November 2024 that suggested oracle price manipulation as the attack vector. The actual exploit proved to be a more targeted vulnerability in the aggregation proxy layer. The isolation of the vulnerability to a peripheral component suggests the platform's core architecture maintained its security integrity during the incident.

Aperture Finance Disables Web App After Security Incident, Launches Fund Recovery Effort

**Aperture Finance has taken immediate action following a security incident:** - All affected web application functionalities have been **completely disabled** to contain the situation - The team is collaborating with **top-tier forensic security firms** to investigate the breach - **Law enforcement coordination** is underway to trace the movement of affected funds - Recovery channels are being established to **negotiate the return of funds** The platform remains in containment mode while the investigation continues.

🚨 Aperture Finance Security Breach Requires Immediate User Action

**Aperture Finance has confirmed a security exploit affecting its V3/V4 contracts across multiple DeFi platforms.** **Immediate Actions Required:** - Users who utilized Instant Liquidity features on Uniswap V3/V4, PancakeSwap V3/Infinity, or Aerodrome/Velodrome through Aperture must revoke contract approvals immediately - Visit [revoke.cash](http://revoke.cash) to verify and revoke approvals - Priority revocation needed for Ethereum mainnet contract: 0xD83d960deBEC397fB149b51F8F37DD3B5CFA8913 **Platform Response:** - Core features disabled on frontend to prevent new approvals - Security partners engaged to investigate root cause - Full list of affected contract addresses provided - Post-mortem analysis pending The team is working with security experts to determine the exploit's scope and prevent further exposure.

Aperture Finance Security Alert: Instant Liquidity Management Users Must Revoke Approvals

**Security Issue Identified** Aperture Finance has identified a vulnerability affecting users who authorized approvals for "Instant Liquidity Management" features on V4-ready contracts. These features include: - Minting - Adding Liquidity - Reinvesting **Who Is Affected** Users who utilized Instant Liquidity features on: - Uniswap V3/V4 - PancakeSwap V3/Infinity - Aerodrome/Velodrome **Who Is Safe** Users of Automation Strategies are **NOT at risk**, including: - Auto-Rebalance - Prescheduled Position Close - Auto-Compound - Limit Order The core automation infrastructure operates on a separate, unaffected architecture. **Immediate Action Required** If you used the affected Instant Liquidity features: 1. Visit [revoke.cash](http://revoke.cash) immediately 2. Verify and revoke approvals for the affected contracts 3. Check the full list of affected contract addresses in the original announcement *Protect your assets by taking action now.*

🔒 Aperture Finance Security Breach Contained

Aperture Finance disclosed a **targeted security incident** on January 25, 2026, involving a vulnerability in a helper module. **Key Details:** - The exploit has been **fully contained** - Forensic analysis is currently underway - Team has released an impact scope and immediate action plan The platform is working to assess the full extent of the breach and implement necessary security measures. Users should monitor official channels for updates on the investigation and any required actions.