Market Analysis: Traders Face First Loss-Taking Since October 2024

Market Analysis: Traders Face First Loss-Taking Since October 2024

📉 Traders Finally Break

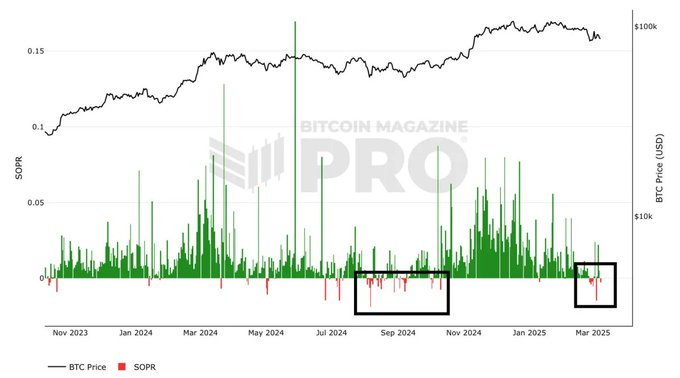

Recent onchain data shows crypto traders are selling at a loss for the first time in 5 months, marking a potential shift in market sentiment. This follows a period of significant volatility, with $3B in options expiring last week.

Key points:

- First instance of widespread loss-taking since October 2024

- Major market swings coinciding with large options expiration

- Uncertain whether this indicates a market bottom or further decline ahead

The timing aligns with broader market uncertainty, coming after February's worst performance since 2014 and recent recovery sparked by Trump's Crypto Reserve announcement.

#Bitcoin momentum surges! 🔹 @MicroStrategy adds 10,107 BTC, now holding 158,400 BTC 📈 🔹 @Metaplanet_JP raises $745M to expand its Bitcoin reserves ⚡ 🔹 @Tether_to integrates $USDt into Bitcoin’s Lightning Network, boosting payment utility 💡 More info in Bitfinex Alpha!

Tweet not found

The embedded tweet could not be found…

Markets have gone moribund according to Bitfinex Alpha 👀 Bitcoin has been range-bound between $91K and $102K for over 90 days. Volatility surged on Feb 21st after the @Bybit_Official hack and an S&P 500 options expiry sell-off, causing a 4.7% drop to ~$95K before it recovered 🚨

Bitfinex Alpha takes a look at the wild market swings, $3B in options expiring last week, and major market moves - get the full breakdown. 📉📈 🎥 Watch our review for full insights!

Access every week our comprehensive weekly reports on the Bitcoin market, emerging opportunities, and key industry developments. Enhance your investment strategies with in-depth analysis and stay informed every week with Bitfinex Alpha! Sign up here: go.bitfinex.com/AlphaSignUpPage

Stay ahead in the evolving cryptocurrency market with Bitfinex Alpha! Gain access to comprehensive weekly reports packed with expert insights on market trends, opportunities, and shifts 📊 Empower your investment strategies with our in-depth analysis: go.bitfinex.com/AlphaSignUpPage

👀 Bitfinex Alpha: The UK Treasury exempts crypto staking from Collective Investment Scheme regulations, fuelling innovation and reinforcing a more crypto-friendly stance from the UK.

"We're seeing the possible commencement of a new type of market environment where altcoins are going through entire cycles while BTC continues to be macro-correlated and shows more maturity as a risk asset." - Bitfinex Alpha @Crypto_Potato @Mandy5Williams cryptopotato.com/bitfinex-warns…

Stay at the forefront of the crypto market with BITFINEX ALPHA! Unlock expert insights, available for free anytime. With detailed analysis, you'll have the tools you need to make more informed decisions and fine-tune your strategy for 2025. Sign up now: go.bitfinex.com/AlphaSignUpPage

This week we saw @MicroStrategy add 7,633 $BTC to its portfolio, pushing its total to 478,740 BTC! @saylor stays firm in his "buy and hold" strategy, reinforcing confidence in Bitcoin’s long-term value 🌟 More insights in Bitfinex Alpha 👀

From worst February since 2014 to a 20% rebound after Trump's Crypto Reserve announcement. This chart tells the story of Bitcoin's 28.3% correction and recovery. Get the full analysis here: blog.bitfinex.com/bitfinex-alpha…

As we start a new month, Bitcoin faces a volatile crossroads! Bitcoin closed February down 17.39%, its worst Feb since 2014. It plunged 18.4% to $78.6K amid record ETF outflows. However, March is kicking off with a bang 💥

81 days and counting... Bitfinex Alpha @pelimatos @cryptoslate cryptoslate.com/bitcoin-comple…

Bitfinex Alpha takes you through the mix of bullish momentum and risk in the crypto markets ✅ @MicroStrategy has launched another $2B convertible offering to fund Bitcoin acquisitions What's next?

Onchain data reveals traders selling at a loss for the first time since Oct 2024. Is this a bottom or more pain ahead? Get the full analysis in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

$BTC dropped below $100K amid tariff hikes, mirroring broader market trends. Despite a 10% January gain, it's consolidating within a 15% range for the past 65 days. Volatility is cooling, but is a market-wide correction coming? 👀 More in Bitfinex Alpha!

Get in-depth insights with Bitfinex Alpha! 🔹 Weekly Bitcoin Market Trends 🔹 Emerging Investment Opportunities 🔹 Key Industry Developments Enhance your investment strategies with expert analysis and stay informed every week. Sign up now: go.bitfinex.com/AlphaSignUpPage

After 90 days of $BTC consolidation, the market always moves decisively - one way or the other. Bitfinex Alpha @CryptoSlate @pelimatos cryptoslate.com/bitcoin-crash-…

Stay ahead of the curve with our weekly reports on the Bitcoin market, emerging trends, and key developments in the crypto space. Gain valuable insights to refine your investment strategies and stay updated every week with Bitfinex Alpha! Sign up now: go.bitfinex.com/AlphaSignUpPage

With volatility at historic lows, the market remains directionless as geopolitical tensions and macroeconomic uncertainty weigh on sentiment” - Bitfinex Alpha @FXstreetUpdate @cryptochhetri fxstreet.com/cryptocurrenci…

Bitcoin has been trading in a narrow range of $91,000 to $102,000 for 81 consecutive days, with historic lows in volatility. Geopolitical tensions & macroeconomic uncertainty continue to weigh on sentiment, leaving the market directionless. More in Bitfinex Alpha 👀

Don’t be phased by the volatility: “While BTC remains sensitive to macroeconomic factors, it is also exhibiting structural strength on higher timeframes… and remains in a robus trend” #Bitfinex Alpha @cointelegraph @sndr_krisztian coindesk.com/markets/2025/0…

Stay Ahead with Bitfinex Alpha! 🔹 Weekly Bitcoin Market insights 🔹 Key Industry Developments Enhance your investment strategies with expert analysis & stay informed every week! 📩 Sign up now: go.bitfinex.com/AlphaSignUpPage

Stay ahead in the crypto world with Bitfinex Alpha! With in-depth analysis that helps drive smarter decisions, you’ll have the expert knowledge you need to refine your strategy. Sign up here: go.bitfinex.com/AlphaSignUpPage

Institutional investors are actively seeking ways to bring crypto-related assets into traditional finance 🌟 Read more in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

Bitfinex Alpha analysis shows that the downturn has been exacerbated by macro-driven uncertainty, as well as Bitcoin’s increasing correlation with traditional markets. 📉 Watch our full review in the video! Read more in our full Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

SimpleBTC App Launches Interactive Bitcoin Education with Lightning Rewards

A new educational platform called SimpleBTC App aims to revolutionize Bitcoin learning through: - Interactive lessons combining theory with practical transactions - Lightning Network rewards for completing lessons - Certification system to verify knowledge - Duolingo-style approach to cryptocurrency education The platform was created by Yannick to address the knowledge gap in traditional financial education regarding Bitcoin and monetary systems. [Watch the full demonstration](https://youtu.be/Qe387JdqDoQ)

US Strategic Bitcoin Reserve Announced at White House Crypto Summit

Former President Trump has announced the creation of a US Strategic Bitcoin Reserve at the inaugural White House Crypto Summit. Key developments include: - Executive order establishing a virtual Fort Knox within US Treasury - Commitment to end regulatory crackdowns on crypto - Push for stablecoin legislation by August 2025 Market reaction showed initial price increases on anticipation, followed by a sell-the-news event after the official announcement. The initiative marks a significant shift in US digital asset policy, though immediate market impact remains uncertain. Read more: [Bitfinex Alpha Report](https://blog.bitfinex.com/bitfinex-alpha/bitfinex-alpha-market-losses-rise-as-bulls-hesitate/)

KAIA Token Now Trading on Bitfinex with Zero Maker Fees

Bitfinex has officially launched trading for $KAIA, the native token of KaiaChain. Key details: - Zero fees for maker orders - 4 basis points fee for taker orders - KaiaChain represents Asia's largest Web3 ecosystem - Created through merger of Klaytn & Finschia platforms - Integrated with LINE and Kakao Talk super apps KaiaChain aims to provide Web3 services to millions of users across Asia through established messaging platforms. The blockchain offers Ethereum-equivalent functionality as a Layer 1 solution. Learn more: [Educational Guide](https://blog.bitfinex.com/token/what-is-kaia-kaia/)

Bitfinex Integrates USDT0 for Cross-Chain Operations

Bitfinex has launched support for USDT0, an omnichain version of Tether's USDT stablecoin. Built on LayerZero's Omnichain Fungible Token standard, USDT0 enables: - Seamless transfers across multiple blockchains - No fragmented liquidity or traditional bridges - Support on networks including Ink and Arbitrum One The integration allows Bitfinex users to deposit and withdraw USDT0 across supported chains, streamlining cross-chain operations. [Learn more about USDT0](https://blog.bitfinex.com/token/what-is-usdt0/)

Ethereum's Price Struggles Amid Project Slowdown and High Fees

Ethereum's performance remains subdued due to several key factors: - High gas fees deterring new projects and builders - $1,800 identified as crucial support level to monitor - ETH ETFs showing mixed results: * Some inflows to newer products like BlackRock * Significant outflows from established funds like Grayscale The ETH/BTC ratio has reached its lowest point in over 1,200 days, with aggressive selling by major market makers like Jump Trading contributing to a 40% price decline. [Read full analysis on Cointelegraph](https://cointelegraph.com/news/ether-1-8k-correction-global-tariff-fears-eth-etf-outflows)