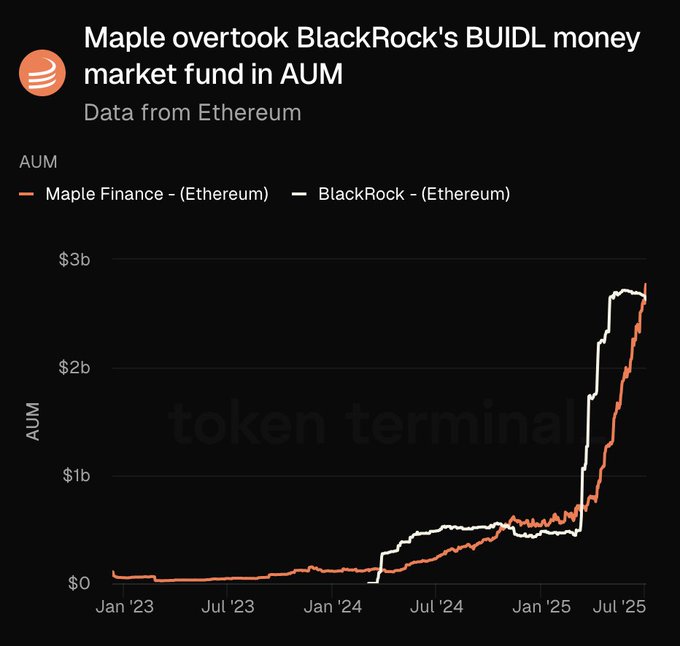

Maple Finance continues its remarkable growth trajectory in onchain asset management:

- Reaches $3 billion in Assets Under Management

- Achieves 300% growth in just 3 months

- Previously hit $2B milestone in June 2025

- Maintains position as largest onchain asset manager

The platform's consistent growth from rebuilding phase to market leadership demonstrates increasing institutional adoption of decentralized finance solutions.

ICYMI, Maple is now the largest onchain asset manager. Wake up and smell the 🥞

Maple's syrupUSDC Ranks Top 10 in Onchain Yield Assets

Maple's syrupUSDC has secured a position in the **top 10 onchain yield assets** according to DefiLlama data. **Key Achievement:** - Among three dollar assets in the top 10, syrupUSDC delivers the **highest yield** - Follows rapid growth after launching on Aave's Base network in late January **Recent Milestones:** - Initial $50M deposit cap on Aave Base was quickly filled - Maple's institutional-grade asset management infrastructure now accessible to millions of Base users - Both syrupUSDC and syrupUSDT consistently rank among highest-yielding dollar assets Maple continues expanding its flagship dollar yield products across the Aave ecosystem, demonstrating strong performance across market conditions.

Maple Handles 18 Margin Calls in Under 2 Hours During Market Volatility

Maple Finance demonstrated operational resilience during recent market turbulence, successfully managing 18 margin calls with an average resolution time under 2 hours. **Key Performance Metrics:** - All 18 margin calls were cured quickly - Borrowers proactively deposited over $60M in additional collateral - Previous week saw $100M in new loan originations - Standard loan funding time remains at 24 hours **Risk Management:** Maple's core products—syrupUSDC, syrupUSDT, and Maple Institutional Secured Lending—remain overcollateralized, protecting lender capital throughout the volatility period. The platform continues to demonstrate why it's considered a leading standard in onchain asset management, combining rapid response times with institutional-grade risk controls.

Plasma Partners with Maple Finance for Onchain Asset Management

Maple Finance has announced a partnership with Plasma, marking a significant development in onchain asset management infrastructure. This collaboration follows Maple's recent expansion to Base and their 2025 Data Review, which highlighted last year as a turning point for the platform. The partnership aims to enhance Maple's scaling capabilities in 2026. **Key Context:** - Maple recently published their 2025 Data Review showing strong growth - The platform expanded to Base network in January 2026 - Maple offers cash management, RWA lending, and digital asset lending for accredited investors The Plasma integration represents another step in Maple's strategy to scale onchain asset management solutions this year. [Read the full announcement](https://maple.finance/insights/plasma-x-maple)

Maple Partners with Plasma to Deliver Transparent Yields for Neobanks

Maple has integrated with **Plasma**, providing its partners with access to sustainable and transparent yield products. The collaboration targets neobanks and fintech applications seeking competitive advantages in the expanding digital finance market. Key aspects of the partnership: - Delivers transparent yield opportunities through Maple's infrastructure - Enables fintech apps to offer differentiated products to their users - Case study documentation demonstrates successful implementation The integration aligns with Maple's focus on increasing access, security, and transparency in digital finance. Neobanks can now leverage these yield products to enhance their service offerings and compete more effectively in the market.

Maple Finance Crosses $4B in Cross-Chain Bridge Volume

Maple Finance has reached a milestone of over $4 billion in total bridge volume as part of its ongoing multichain expansion. **Key Details:** - Bridge infrastructure powered by [Chainlink](https://chain.link) - Follows previous growth of syrupUSDC to $3.4B+ in assets under management - Cross-chain volume previously exceeded $500M in October 2025 **Technical Foundation:** The expansion utilizes Chainlink's Cross-Chain Token (CCT) standard and Price Feeds, enabling: - Zero-slippage transfers across chains - Self-serve token deployment - Unified interoperability Maple continues scaling its presence across multiple blockchain networks, with particular focus on Solana integration for institutional capital markets.