Maple Direct's Secured Digital Asset Lending Pool Reaches $27M TVL in 3 Months

Maple Direct's Secured Digital Asset Lending Pool Reaches $27M TVL in 3 Months

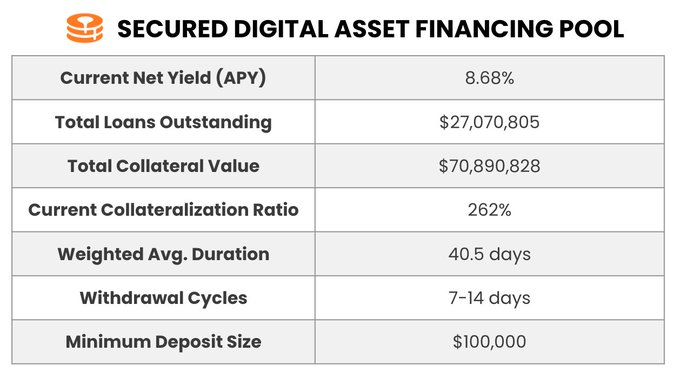

Maple Direct's Secured Digital Asset Lending Pool has achieved $27M total value locked (TVL) in just 3 months since its launch. Lenders in the pool are currently earning 8.68% net annual percentage yield (APY) on USDC deposits, which are secured by BTC, ETH, and related instruments. The team recently issued a new $10M institutional loan at 11.25% APY, backed by $25M in GBTC collateral. The pool is open to Accredited Investors who complete a quick KYC/AML onboarding process.

🥞 Latest from Maple Direct: The Secured Digital Asset Lending Pool has reached $27M TVL in its first 3 months since launch. 📰 Fact Sheet: docsend.com/view/uxsb86jfg… Lenders are currently earning 8.68% net APY on USDC deposits, secured by BTC, ETH & related instruments. 🧵 👇

Maple Finance Scales to $750M on Aave in Under Six Months

Maple Finance has grown its assets on Aave to over **$750 million in less than six months**, demonstrating strong institutional demand for onchain asset management. **Key developments:** - syrupUSDC reached top 10 onchain yield assets on DefiLlama with highest yield among dollar assets - Base deployment cap increased from 50M to 100M, now expanded to 200M due to strong inflows - Maple originated $100M in new loans last week alone **Performance through volatility:** During recent market turbulence, Maple issued 18 margin calls, all resolved in under 2 hours on average. Borrowers proactively added over $60M in additional collateral. All products remain overcollateralized, protecting lender capital. The platform provides financial apps and neobanks with sustainable yields, deep liquidity, and resilient infrastructure for competitive products. [Read the full case study](https://maple.finance/insights/aave-maple)

Maple Releases January Performance Reports for syrupUSDC and syrupUSDT Products

Maple has published January reports for its syrupUSDC and syrupUSDT products in the Maple Data Room. **Key Details:** - Reports include key metrics and monthly highlights since product inception - Data complements Maple's real-time dashboards - Provides institutional-grade transparency for investors The reports offer comprehensive performance tracking for Maple's cash management products, giving accredited investors detailed insights into product performance and operations.

Maple Protocol Hits $2.57M Monthly Revenue Record in January 2026

**Maple Finance achieved a new all-time high in monthly revenue, reaching $2.57M in January 2026.** This milestone demonstrates the protocol's ability to maintain strong performance regardless of market conditions. The achievement is attributed to Maple's sustainable and scalable protocol architecture. **Key highlights:** - New monthly revenue ATH of $2.57M - Consistent performance across varying market environments - Follows previous record of $2.159M set in October 2025 The protocol had already met its year-end targets two months early in 2025, showing continued momentum into the new year.

Maple's syrupUSDC Ranks Top 10 in Onchain Yield Assets

Maple's syrupUSDC has secured a position in the **top 10 onchain yield assets** according to DefiLlama data. **Key Achievement:** - Among three dollar assets in the top 10, syrupUSDC delivers the **highest yield** - Follows rapid growth after launching on Aave's Base network in late January **Recent Milestones:** - Initial $50M deposit cap on Aave Base was quickly filled - Maple's institutional-grade asset management infrastructure now accessible to millions of Base users - Both syrupUSDC and syrupUSDT consistently rank among highest-yielding dollar assets Maple continues expanding its flagship dollar yield products across the Aave ecosystem, demonstrating strong performance across market conditions.

Maple Handles 18 Margin Calls in Under 2 Hours During Market Volatility

Maple Finance demonstrated operational resilience during recent market turbulence, successfully managing 18 margin calls with an average resolution time under 2 hours. **Key Performance Metrics:** - All 18 margin calls were cured quickly - Borrowers proactively deposited over $60M in additional collateral - Previous week saw $100M in new loan originations - Standard loan funding time remains at 24 hours **Risk Management:** Maple's core products—syrupUSDC, syrupUSDT, and Maple Institutional Secured Lending—remain overcollateralized, protecting lender capital throughout the volatility period. The platform continues to demonstrate why it's considered a leading standard in onchain asset management, combining rapid response times with institutional-grade risk controls.