Ondo Finance Expands from Stablecoins to Tokenized Securities

Ondo Finance Expands from Stablecoins to Tokenized Securities

🔮 Stablecoins Were Just Practice

Ondo Finance CEO Nathan Allman outlines the company's vision to bring US equities, ETFs, and bonds on-chain through Ondo Global Markets. The platform aims to replicate stablecoins' success in making dollars globally accessible, but for traditional securities.

Key developments:

- OUSG (tokenized US Treasuries) has reached $690M TVL

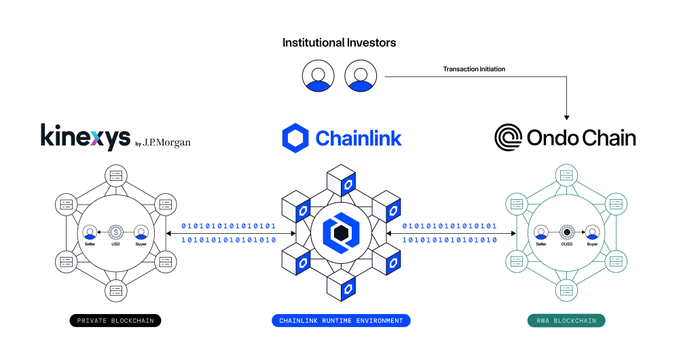

- Partnership with JPMorgan and Chainlink for bank payment integration

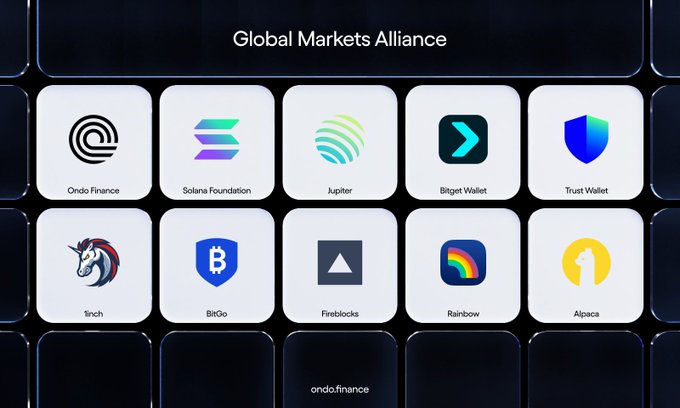

- Launch of Global Markets Alliance with Trust Wallet, Bitget, Fireblocks

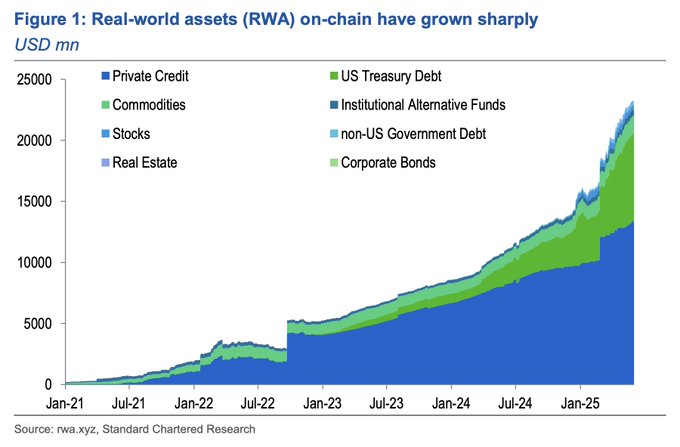

The initiative comes amid growing institutional adoption of tokenized assets, with the US Treasury market seeing $4.7B growth (+544.8%) in 2024.

From tokenized stocks to stablecoins and treasuries, the past week has seen a flurry of headlines that reflect the rapid institutional embrace of crypto and tokenized finance. Here are the key recent developments you need to know. 👇

Yesterday, Circle—issuer of USDC—went public. It’s a milestone not just for one company, but for the stablecoin category writ large. It affirms what many in crypto already believe: that blockchain-based digital dollars are becoming core financial infrastructure. Stablecoins

The internet transformed media, commerce, and communication. Ondo Finance is doing the same for capital markets.

“Gradually, then suddenly.” A newly released report by analysts at @StanChart highlights a fundamental truth: Tokenized assets need “to be cheaper, quicker to settle, and/or create access for more investors than [their] offchain equivalent; or need to solve an onchain need,

Hear from Nelli Zaltsman, Head of Platform Settlement Solutions at Kinexys by @JPMorgan, on our recent collaboration, and the future of tokenization. 👇 “The test transaction between Ondo Finance, J.P. Morgan and Chainlink was very exciting for our organization. I think it

"Providers like Chainlink play an important role because interoperability is not necessarily something a single institution can achieve by itself." @Nzaltsman of Kinexys by @jpmorgan joins Chainlink’s Future Is On series to discuss the institutional adoption of blockchain

Capital markets are coming onchain, and they’re not turning back.

USDY is now available on @IcrypexGlobal—a prominent digital asset platform. ICRYPEX’s users can now gain exposure to daily yield collateralized by US Treasuries, furthering Ondo Finance’s mission to make institutional-grade financial products and services available to everyone.

Landmark Moment: U.S. Stablecoin Bill, the GENIUS Act, Passes the U.S. Senate. In a historic milestone for digital assets, the U.S. Senate has passed the GENIUS Act, the first comprehensive stablecoin legislation, with strong bipartisan support. Stablecoins are the first killer

Stablecoins made the US dollar globally accessible, instantly tradable and fully composable. Ondo Global Markets will unlock the same upgrades for US securities. US Treasuries and equities represent $28T and $62T in market value, respectively. Learn more about Ondo Global

Here’s what leaders from Ondo Finance, Trust Wallet, Bitget Wallet, Jupiter, Fireblocks, and BitGo had to say about yesterday’s Global Markets Alliance announcement. 👇 “Access to US capital markets has historically been gated and inefficient and standardization is essential to

1/ Today we're announcing the Global Markets Alliance, a historic alliance of leading wallets, exchanges, and custodians to bring capital markets onchain and set standards for the interoperability of onchain stocks. This alliance includes: • @SolanaFndn • @BitgetWallet •

High-quality tokenized assets are a step toward upgrading the financial system—deeper transformation is enabled at the infrastructure level. Ondo Finance Vice Chairman @PatrickMcHenry joined @APompliano's latest podcast to discuss the latest in legislation and tokenization. “A

The latest @artemis report covers the evolution of onchain stablecoin yields and institutional adoption, and highlights Ondo Finance's role in this transformation. “The trend for onchain finance is clear: global markets are moving onchain. And we are building the products, rails

The on-chain yield landscape is maturing, as institutions and users seek more sophisticated opportunities on-chain. We partnered with @vaultsfyi to dive into the world of on-chain yield — here’s what we found 🧵

Ondo Finance CEO @nathanlallman discusses the GENIUS Act's impact on institutional participation with @TheStreet: “This legislation provides long-awaited clarity around the treatment of digital assets, laying the foundation for increased institutional participation.” Sustained

From tokenized stocks to stablecoins and US Treasuries, the past week has delivered a number of headlines that show how fast the institutional embrace of tokenized finance is racing ahead. Here are the key recent developments you need to know. 👇

Tokenization is already scaling. “You’re starting to see that inflection point and hockey stick moment. First in cash. Now in treasuries. And the big question is: what’s next? We believe that the assets that make most sense to tokenize is stuff that people really want and is

Gradually, then suddenly. Have we already reached the inflection point for tokenization? 📶 @OndoFinance’s Ian De Bode says yes and joined @MonicaLongSF on the XRPL mainstage at Apex 2025 to unpack what's next as markets move onchain.

What stablecoins did for the dollar, Ondo is doing for capital markets. Speaking with @thestreet, @nathanlallman explained, “the financial system wasn’t designed for the world we live in—it was stitched together over centuries.” Just as stablecoins brought accessibility and

NEW: What stablecoins did for the dollar, @OndoFinance is doing to capital markets. thestreet.com/crypto/innovat…

ICYMI: Ondo Finance, @Chainlink, and Kinexys by @JPMorgan teamed up to connect bank settlement infrastructure to Ondo Chain.

Chainlink is excited to be working with Kinexys by J.P. Morgan and Ondo on a groundbreaking way to utilize Kinexys Digital Payments to allow institutional clients to purchase Ondo’s tokenized treasuries. With $23B+ in tokenized RWAs on public chains, the need for secure

“This surge should be expected to continue.” Today, @coingecko released a report on the real-world asset tokenization market. It notes that the “tokenized treasuries market cap climbed by $4.7B (+544.8%) since the start of 2024,” with Ondo Finance as one of the top contributors

Who said tokenized US Treasuries are only for DeFi-native users? Ondo Finance CEO @nathanlallman joined @NYSE Live to discuss our collaboration with @jpmorgan and @chainlink to integrate bank payment rails into Ondo Chain. Ondo's latest transaction with J.P. Morgan demonstrates

Stablecoins are just “the tip of the iceberg.” In a new interview with @Blockworks_, Ondo Finance CEO @nathanlallman outlines the thesis behind Ondo Global Markets, our platform for tokenized US equities, ETFs, and bonds. While stablecoins have achieved real product-market fit,

Stablecoins unlocked programmable dollars. Ondo Global Markets is unlocking programmable equities. To learn more about Ondo Global Markets, visit ondo.finance/global-markets

From closed systems to open protocols. Ondo Finance is accelerating one of the biggest upgrades in capital markets history.

“The race to mainstream onchain stock trading is clearly underway.” “Ondo Finance...a leader in tokenizing US treasuries, and Coinbase, the largest US crypto exchange, are staking early claims in what many regard as the next big trend of Web3 finance: onchain stock trading,”

Industry Leaders to Discuss Future of Tokenization at Permissionless Conference

Key industry figures will gather at the Permissionless conference to explore the future of global financial systems and tokenization. **Panel Participants:** - Nathan Allman (Ondo Finance CEO) - Christine Moy (Apollo Global) - David Schwartz (Ripple) - Joe Cutler (Perkins Coie LLP) - Ben Strack (Blockworks) The session, titled *Rebooting the Global Financial System*, will focus on how tokenization is transforming capital markets. Ondo Finance's Head of Ecosystem, Armand Khatri, will also be present for networking and discussions about tokenized assets.

Institutional Adoption and Regulatory Clarity Signal Web3 Maturity

Key figures in the blockchain space indicate that institutional adoption and technological readiness have reached a critical point. Nathan Lallman of Ondo Finance and Chainlink's Sergey Nazarov emphasize that regulatory clarity is the final piece needed for widespread US adoption. Ondo's Ian De Bode highlighted on Nasdaq TradeTalks that major banks and asset managers are positioning themselves as regulatory clarity emerges. He noted: - Large institutions actively seeking blockchain infrastructure - Growing demand for onchain financial services - Ondo's expanding infrastructure network supporting institutional needs The convergence of institutional interest, technological maturity, and pending regulatory framework suggests a significant shift in the financial landscape.

Artemis Report Highlights Growth in Onchain Stablecoin Yields

A new Artemis report examines the evolution of onchain stablecoin yields and increasing institutional adoption, with Ondo Finance playing a key role. The analysis points to a clear trend of global markets transitioning to blockchain infrastructure. Key developments: - Growing adoption of tokenized treasuries - Expanding institutional participation - Launch of Ondo Global Markets and Ondo Chain upcoming Traditional finance players are expected to take greater notice as demand increases for tokenized securities.

U.S. Senate Passes GENIUS Act: First Comprehensive Stablecoin Legislation

The U.S. Senate has approved the GENIUS Act with bipartisan support, marking a watershed moment for digital asset regulation. This first comprehensive stablecoin legislation aims to establish clear regulatory frameworks for blockchain-based dollar alternatives. Key points: - First major stablecoin regulation in U.S. history - Strong bipartisan backing in Senate - Positions U.S. as innovation-friendly jurisdiction - Supports 24/7 permissionless access to USD The bill's passage signals U.S. commitment to fostering domestic digital innovation rather than pushing development offshore.