Major Financial Institutions Embrace Digital Assets

Major Financial Institutions Embrace Digital Assets

🏦 Wall Street Goes Crypto

A transformative week for digital asset adoption marked by significant institutional moves. The CFTC launched Crypto Sprint, providing clarity on spot crypto contracts. President Trump signed an Executive Order expanding 401k crypto access. BBVA partnered with Binance for institutional custody using US Treasuries as collateral. JPMorgan, HQLA-X, and Ownera's cross-ledger repo solution traded $5B in its first month. These developments signal accelerating adoption of blockchain infrastructure across traditional finance, with major institutions integrating digital assets into core operations.

From tokenized stocks to stablecoins and treasuries, the past week has seen a flurry of headlines that reflect the rapid institutional embrace of crypto and tokenized finance. Here are the key recent developments you need to know. 👇

The U.S. is choosing to lead the world in financial innovation. Through the tokenization of U.S. stocks and Treasuries, Ondo is building the infrastructure that will strengthen and modernize capital markets.

We will make sure the next chapter of financial innovation is written right here in America. Watch highlights from my speech launching Project Crypto at @A1Policy.

Tokenization, simplified. Ondo Finance's Ian De Bode walks through how traditional assets become blockchain-native tokens on @TheStreet's Roundtable Network (@rtb_io). The straightforward breakdown everyone needs.

Yesterday, Circle—issuer of USDC—went public. It’s a milestone not just for one company, but for the stablecoin category writ large. It affirms what many in crypto already believe: that blockchain-based digital dollars are becoming core financial infrastructure. Stablecoins

The internet transformed media, commerce, and communication. Ondo Finance is doing the same for capital markets.

Today, SEC Chair Paul Atkins announced Project Crypto in a landmark speech, a bold initiative to modernize U.S. securities regulation for the blockchain era. His vision charts a clear path forward, one that embraces tokenized securities, stablecoins, and crypto-native

The future of capital markets has no borders. “Anyone with a stablecoin is going to essentially be able to buy any U.S. stock or ETF that they want... we really want to break open the barriers that currently still exist for a global user base.” - Ondo Finance's @iandebode on

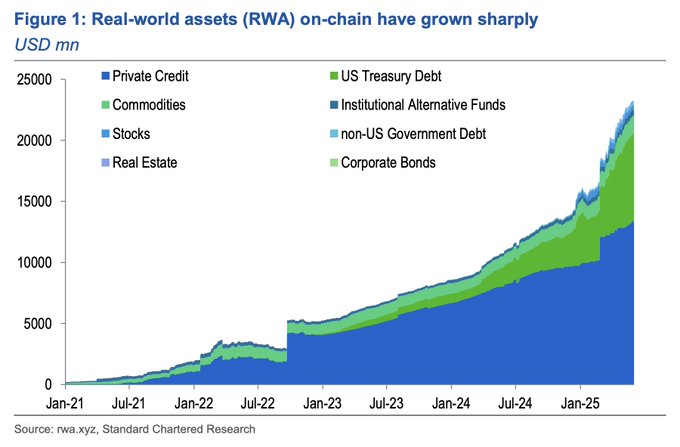

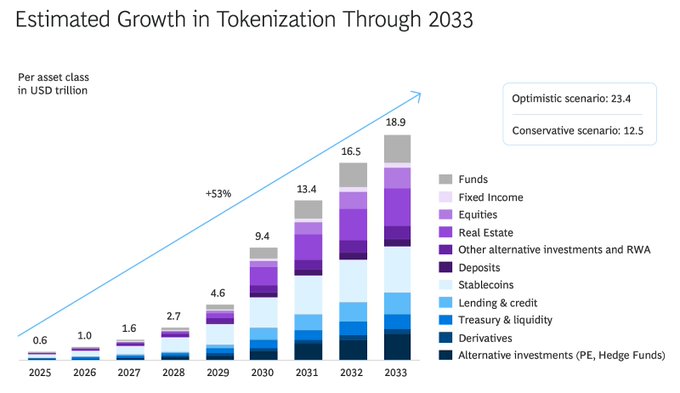

“Gradually, then suddenly.” A newly released report by analysts at @StanChart highlights a fundamental truth: Tokenized assets need “to be cheaper, quicker to settle, and/or create access for more investors than [their] offchain equivalent; or need to solve an onchain need,

1/ We’re excited to share that OKX Wallet (@wallet) is joining the Ondo Global Markets Alliance and that OKX users will be able to access Ondo’s tokenized stocks, ETFs, and more when we launch later this summer.

Early tokenized stock models reveal deep structural issues: limited liquidity, wide spreads, and persistent price dislocations. Ondo’s tokenized stocks and ETFs take a different approach, inheriting liquidity from public markets rather than trying to recreate it. In our latest

Hear from Nelli Zaltsman, Head of Platform Settlement Solutions at Kinexys by @JPMorgan, on our recent collaboration, and the future of tokenization. 👇 “The test transaction between Ondo Finance, J.P. Morgan and Chainlink was very exciting for our organization. I think it

"Providers like Chainlink play an important role because interoperability is not necessarily something a single institution can achieve by itself." @Nzaltsman of Kinexys by @jpmorgan joins Chainlink’s Future Is On series to discuss the institutional adoption of blockchain

Excited to welcome @MercadoBitcoin to the Global Markets Alliance. With a long-standing presence in LATAM’s digital asset markets, Mercado Bitcoin helps strengthen the Alliance’s global footprint and supports its mission to align infrastructure and standards for tokenized

Some launch on Solana. Some launch on Ethereum. This summer, Ondo tokenized stocks, funds, and more will launch on both. Because global means everywhere.

We are excited to announce that Ondo Finance has acquired @strangelovelabs to accelerate our full-stack RWA platform development. This acquisition significantly expands Ondo’s engineering and product capabilities to develop infrastructure for bringing RWAs onchain, at scale.

A new chapter in compliant infrastructure for tokenized assets. Last week, we announced our agreement to acquire Oasis Pro, including its SEC-registered broker-dealer, ATS, and transfer agent. This lays the groundwork for Ondo to develop a regulated tokenized securities

The Global Markets Alliance expands its footprint in Latin America. Welcome, @RipioApp With over a decade of experience driving crypto adoption in Latam, Ripio brings regional leadership to the global effort to standardize tokenized markets.

Capital markets are coming onchain, and they’re not turning back.

The golden age of finance begins. The SEC’s Project Crypto makes tokenization part of America's economic blueprint 🇺🇸

.@SECPaulSAtkins gave remarks at @A1Policy today on Project Crypto, an SEC Commission-wide initiative to modernize the securities rules and regulations to enable America’s financial markets to move on-chain. sec.gov/newsroom/speec…

Ondo is bringing global markets onchain. Flipping the switch to a more open, modern financial system.

“Tokenizing treasuries, stocks, and other assets is now the second hottest sector in crypto as the regulatory environment eases.” — @axios This growing wave of tokenization is what inspired Catalyst: a $250 million initiative supported by @PanteraCapital to back projects

USDY is now available on @IcrypexGlobal—a prominent digital asset platform. ICRYPEX’s users can now gain exposure to daily yield collateralized by US Treasuries, furthering Ondo Finance’s mission to make institutional-grade financial products and services available to everyone.

A new chapter for capital markets begins this summer. Get ready. Ondo Stocks are coming.

Landmark Moment: U.S. Stablecoin Bill, the GENIUS Act, Passes the U.S. Senate. In a historic milestone for digital assets, the U.S. Senate has passed the GENIUS Act, the first comprehensive stablecoin legislation, with strong bipartisan support. Stablecoins are the first killer

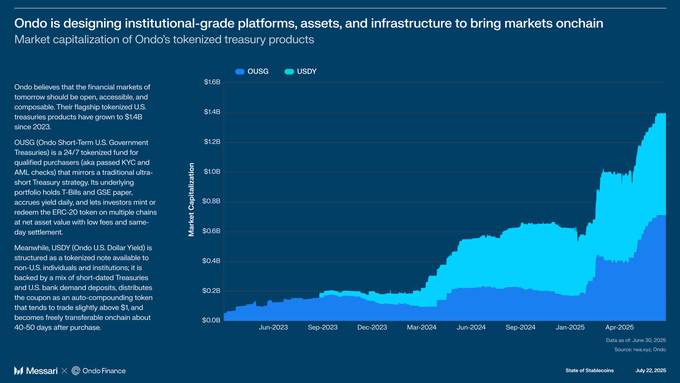

As detailed in @MessariCrypto’s latest report, the tokenization of financial assets is no longer theoretical. Ondo’s tokenized US Treasuries products alone have surpassed $1.4 billion since launching in 2023. This growth is confirmation of a structural shift. As the report

Ten years. Zero downtime. Hundreds of billions secured. Ethereum has redefined financial infrastructure. From trustless settlement to composable applications, it’s driven financial innovation at a historic pace, enabling DeFi, stablecoins, and now tokenized real-world assets.

Stablecoins made the US dollar globally accessible, instantly tradable and fully composable. Ondo Global Markets will unlock the same upgrades for US securities. US Treasuries and equities represent $28T and $62T in market value, respectively. Learn more about Ondo Global

Ondo Catalyst, a $250M strategic investing initiative, is attracting visionary founders and teams advancing the future of capital markets. Are you building tokenized financial products, DeFi protocols, or financial infrastructure? Apply today: forms.gle/akQfJaSamHrwDq…

1/ We’re excited to announce the launch of the quarter-billion dollar Ondo Catalyst initiative, one of the largest dedicated commitments to support the tokenization of real-world assets with support from @PanteraCapital.

U.S. regulators mobilize behind President Trump's vision to make America the “crypto capital of the world” Following SEC Chairman Paul Atkins' “Project Crypto” initiative to modernize U.S. securities rules, the Commodity Futures Trading Commission is launching “Crypto Sprint” to

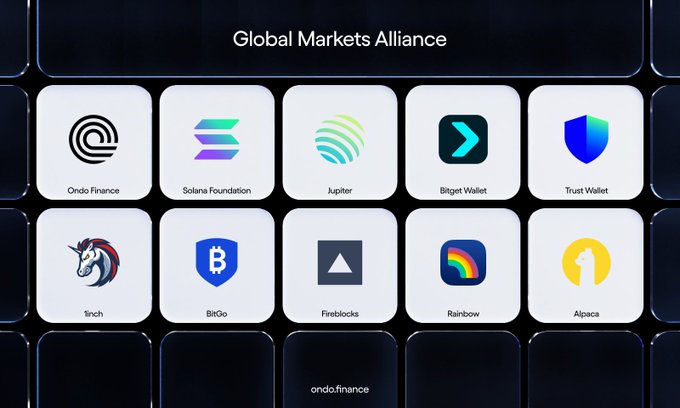

Here’s what leaders from Ondo Finance, Trust Wallet, Bitget Wallet, Jupiter, Fireblocks, and BitGo had to say about yesterday’s Global Markets Alliance announcement. 👇 “Access to US capital markets has historically been gated and inefficient and standardization is essential to

1/ Today we're announcing the Global Markets Alliance, a historic alliance of leading wallets, exchanges, and custodians to bring capital markets onchain and set standards for the interoperability of onchain stocks. This alliance includes: • @SolanaFndn • @BitgetWallet •

High-quality tokenized assets are a step toward upgrading the financial system—deeper transformation is enabled at the infrastructure level. Ondo Finance Vice Chairman @PatrickMcHenry joined @APompliano's latest podcast to discuss the latest in legislation and tokenization. “A

Excited to share that @bitgetglobal is joining the Global Markets Alliance and that Bitget users will be able to access Ondo’s 100+ tokenized stocks, ETFs, and more this summer. Capital markets are coming onchain.

Over $90 trillion in value exists in US Treasuries and US stocks, with only a fraction accessible onchain. Ondo Finance was the first to bring US Treasuries onchain at scale. Now we’re doing the same for hundreds, soon thousands, of stocks.

2025 will be the year of tokenized stocks.

The latest @artemis report covers the evolution of onchain stablecoin yields and institutional adoption, and highlights Ondo Finance's role in this transformation. “The trend for onchain finance is clear: global markets are moving onchain. And we are building the products, rails

The on-chain yield landscape is maturing, as institutions and users seek more sophisticated opportunities on-chain. We partnered with @vaultsfyi to dive into the world of on-chain yield — here’s what we found 🧵

This summer, Ondo Global Markets will redefine capital markets. “Onchain US Treasuries, led by firms like Securitize and Ondo, now exceed several billion dollars.” -@Bloomberg “Major players like BlackRock and Citigroup are actively digitizing funds,” and now, “crypto’s big

Tokenization is an innovation. “Tokenization... is the next step to have much more efficiency in the marketplace.” – SEC Chairman Paul Atkins As regulatory clarity improves, the path is clearing for tokenized assets to transform capital markets.

Traditional finance is embracing tokenization. From Goldman and BNY tokenizing money market funds to Vietnam rolling out a national blockchain, the transformation is accelerating globally. Here's the biggest headlines from the past week. 👇

.@PythNetwork is joining the Global Markets Alliance. With Ondo’s tokenized stocks, ETFs, and more set to launch soon, fast and reliable market data will play an important role. Pyth delivers real-time pricing across 100+ blockchains, contributing critical infrastructure for

Ondo Finance CEO @nathanlallman discusses the GENIUS Act's impact on institutional participation with @TheStreet: “This legislation provides long-awaited clarity around the treatment of digital assets, laying the foundation for increased institutional participation.” Sustained

From tokenized stocks to stablecoins and US Treasuries, the past week has delivered a number of headlines that show how fast the institutional embrace of tokenized finance is racing ahead. Here are the key recent developments you need to know. 👇

Tokenization is already scaling. “You’re starting to see that inflection point and hockey stick moment. First in cash. Now in treasuries. And the big question is: what’s next? We believe that the assets that make most sense to tokenize is stuff that people really want and is

Gradually, then suddenly. Have we already reached the inflection point for tokenization? 📶 @OndoFinance’s Ian De Bode says yes and joined @MonicaLongSF on the XRPL mainstage at Apex 2025 to unpack what's next as markets move onchain.

Traditional finance is embracing tokenization. JPMorgan's latest report predicts stablecoins will be “integrated with the traditional financial system, as well as more tokenization of real world assets.” This convergence is well underway, and Ondo is building the infrastructure

What stablecoins did for the dollar, Ondo is doing for capital markets. Speaking with @thestreet, @nathanlallman explained, “the financial system wasn’t designed for the world we live in—it was stitched together over centuries.” Just as stablecoins brought accessibility and

NEW: What stablecoins did for the dollar, @OndoFinance is doing to capital markets. thestreet.com/crypto/innovat…

Another landmark week for digital asset adoption. From CFTC launching crypto initiatives to JPMorgan trading $5B in cross-ledger repos, the move toward onchain infrastructure is accelerating across every level of the financial system. Here are the biggest developments from the

BNB Chain is on. @BNBCHAIN, one of the most widely used blockchain networks, will soon support Ondo's suite of tokenized assets, including over 100 US stocks, ETFs, and funds to start. As part of this collaboration, BNB Chain joins the Global Markets Alliance, a growing group

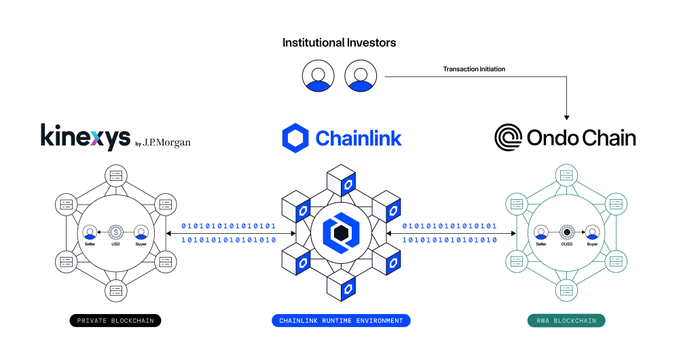

ICYMI: Ondo Finance, @Chainlink, and Kinexys by @JPMorgan teamed up to connect bank settlement infrastructure to Ondo Chain.

Chainlink is excited to be working with Kinexys by J.P. Morgan and Ondo on a groundbreaking way to utilize Kinexys Digital Payments to allow institutional clients to purchase Ondo’s tokenized treasuries. With $23B+ in tokenized RWAs on public chains, the need for secure

“Tokenization is the biggest innovation to come to capital markets in the past decade.” That’s how Robinhood CEO @vladtenev describes tokenization. He points to something powerful: the future won’t be either crypto or traditional, it will be both, working in tandem to redefine

“This surge should be expected to continue.” Today, @coingecko released a report on the real-world asset tokenization market. It notes that the “tokenized treasuries market cap climbed by $4.7B (+544.8%) since the start of 2024,” with Ondo Finance as one of the top contributors

Who said tokenized US Treasuries are only for DeFi-native users? Ondo Finance CEO @nathanlallman joined @NYSE Live to discuss our collaboration with @jpmorgan and @chainlink to integrate bank payment rails into Ondo Chain. Ondo's latest transaction with J.P. Morgan demonstrates

Stablecoins are just “the tip of the iceberg.” In a new interview with @Blockworks_, Ondo Finance CEO @nathanlallman outlines the thesis behind Ondo Global Markets, our platform for tokenized US equities, ETFs, and bonds. While stablecoins have achieved real product-market fit,

The tokenization masterclass Wall Street needed. Ondo Finance's Ian De Bode spoke with @thestreet explaining tokenization and how it will reshape finance. Ondo continues to lead the conversation on bringing capital markets onchain. Full interview.👇 thestreet.com/crypto/explain…

“What stablecoins did for the dollar, Ondo is doing for securities.” Recent coverage from @Blockworks_ explores Ondo’s recent acquisitions of @strangelovelabs and Oasis Pro, and what this signals ahead of the launch of Ondo’s tokenized stocks, ETFs, and more. “The vast, vast

Stablecoins unlocked programmable dollars. Ondo Global Markets is unlocking programmable equities. To learn more about Ondo Global Markets, visit ondo.finance/global-markets

Excited to welcome @MEXC_Official to the Global Markets Alliance. As one of the most active global exchanges, MEXC will help expand access to Ondo’s tokenized stocks, ETFs, and more, making these assets available to millions of users. Capital markets are coming onchain.

Ethereum runs 24/7/365, securing over $400B in assets. The bedrock of decentralized finance. A perfect starting point for Ondo's tokenized stocks & ETFs.

From closed systems to open protocols. Ondo Finance is accelerating one of the biggest upgrades in capital markets history.

Following up on its Crypto Sprint initiative, CFTC makes its first major move. The Commodity Futures Trading Commission will launch an initiative for trading spot crypto asset contracts that are listed on a CFTC-registered futures exchange (designated contract market or DCM).

A defining week for digital assets just concluded. The White House published its Digital Asset Report, the SEC launched Project Crypto, and major financial entities announced tokenization initiatives. The foundation for America's tokenized economy is being built. Here's what

From upgrading financial plumbing to enabling faster payment, the past week has delivered a number of headlines that show the strong momentum of institutional embrace of crypto and digital assets. Here are the key recent developments you need to know.👇

“The race to mainstream onchain stock trading is clearly underway.” “Ondo Finance...a leader in tokenizing US treasuries, and Coinbase, the largest US crypto exchange, are staking early claims in what many regard as the next big trend of Web3 finance: onchain stock trading,”

RWA.xyz Joins Global Markets Alliance to Advance Tokenized Asset Standards

RWA.xyz, a leading analytics platform for tokenized real-world assets, has joined the Global Markets Alliance. The platform specializes in tracking growth and infrastructure in the tokenized asset sector. This addition follows recent memberships of notable organizations: - Morpho Labs (DeFi lending protocol) - Gauntlet (vault curator) - Drift Protocol (Solana-based perp DEX) - Loopscale Labs (orderbook lending) - LCX (regulated exchange) The Alliance has grown to over 25 members, all working to establish standards for onchain movement of tokenized securities including stocks and ETFs. *The coalition continues to expand its expertise across analytics, trading, and infrastructure providers.*

Ondo Chain Debuts Cross-Chain Settlement with JP Morgan's Kinexys

Ondo Chain, a new EVM L1 blockchain, has achieved a significant milestone in connecting traditional and decentralized finance. Key developments: - First cross-chain atomic Delivery vs Payment settlement of tokenized assets completed on testnet - Integration between JP Morgan's Kinexys Digital Payments blockchain and a public L1 network - Powered by Chainlink's Runtime Environment The platform aims to serve as an institutional-grade hub for real-world assets, joining a wave of enterprise EVM initiatives from Circle, Stripe, DTCC, and J.P. Morgan. Learn more: [Ondo Chain Introduction](https://blog.ondo.finance/introducing-ondo-chain/)

Ondo Finance to Present at NextFin Summit During Ethereum NYC

Matt Blumberg, Head of DeFi at Ondo Finance, will present at the NextFin Summit during Ethereum NYC on Real World Assets and Retail Users. The presentation explores how **tokenization** and **DeFi infrastructure** create new global opportunities. The one-day summit features: - Financial institutions - Regulators - Crypto innovators - Leading projects including Ethereum Foundation, Wormhole, Kraken, and Optimism Event Details: - Date: August 12, 2025 - Time: 1:55 PM - 2:20 PM ET - Location: NextFin Summit, Ethereum NYC - [Event Registration](https://lu.ma/ozlqxrph)

Traditional Finance Moving Onchain: A Market Evolution

Major financial institutions are beginning to integrate blockchain technology into their core operations. This shift represents a significant evolution in how traditional markets operate. Key developments: - Large companies exploring blockchain integration for market operations - Traditional finance infrastructure being upgraded for digital asset compatibility - Improved market access mechanisms being developed This transition indicates a measured but meaningful change in how financial markets will function. The move suggests a gradual evolution rather than a sudden revolution in market structure. *Note: These changes are expected to roll out over several years as infrastructure and regulations develop.*

Ondo Finance GC to Join SEC Commissioner for Regulatory Discussion

Mark Janoff, General Counsel at Ondo Finance, will engage in a one-on-one conversation with SEC Commissioner Hester Peirce at CoinDesk's upcoming Policy & Regulation event. The discussion will focus on the evolving regulatory landscape for cryptocurrencies, building on Ondo's previous engagement with the SEC Crypto Task Force in April 2025. **Event Details:** - Date: Wednesday, September 10th - Time: 9:15 AM EDT - Location: Washington D.C. - Format: 1:1 conversation The event brings together public officials and industry leaders in legal, policy, and compliance roles to shape the future of crypto regulation.