SiloFinance on Ethereum mainnet allows users to use LUSD as collateral and borrow at 85% LTV. ZeroLendXYZ on zksync now enables users to borrow or supply LUSD and earn yield on it.

✅ You can now borrow or supply LUSD on @zksync with @zerolendxyz 🎉 Users can get yield on their deposited LUSD, along with being able to use it as collateral to borrow other assets. 👉 Learn more here: app.zerolend.xyz/reserve-overvi…

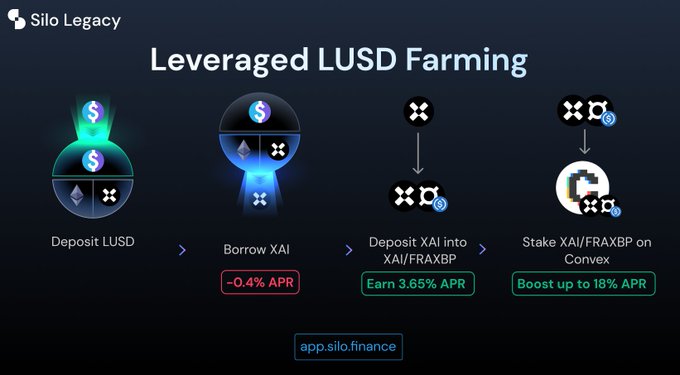

LUSD as collateral 🔵 Did you know that you could use $LUSD as collateral on @SiloFinance, and borrow at 85% LTV? On @ethereum mainnet, it is one of the most capital efficient venues to borrow against $LUSD. Check out their thread on some use cases one could use👇

As prime collateral on Silo, you can borrow against $LUSD at up to 85% LTV from the LUSD-ETH-XAI silo. Not sure why this is interesting? Check out this stable farming strategy on $XAI that yields up to 18% APR 👇

🪂 Enosys Airdrop Now Live for BOLD Liquidity Providers

The first portion of the **Enosys airdrop** (52.5 APS tokens) is now claimable for Liquity V2 users. This marks the beginning of a **40-week incentive program** distributing 412.5 APS tokens (2.75% of supply) worth approximately **$850,000** to $BOLD liquidity providers. **Key Details:** - APS valued at ~$2,000 per token (~$32m FDV) - Adds roughly **3% APR** on top of existing yields (6.5-8.5% across Uniswap, Curve, and Yearn) - **10+ additional airdrops** planned throughout 2026 - Rewards split 50/50 between retroactive users and ongoing activity **What You Can Do with APS:** - Stake in Enosys Governance to earn protocol fees - Provide liquidity on Enosys DEX v3 Claims available on the [Enosys Protocol frontend](https://loans.enosys.global/incentives) on Flare Network. Bridge via [Stargate Finance](https://stargate.finance/). Continue providing liquidity with $BOLD on Ethereum Mainnet to qualify for future weekly distributions of 9 APS (~$18k).

Liquity V2 Ecosystem Dashboard Now Live on Dune Analytics

Liquity has launched a comprehensive ecosystem dashboard on Dune Analytics, providing users with a centralized view of eligible venues for their V2 protocol. **Key Features:** - Access to all eligible venues in one location - Real-time ecosystem metrics and analytics - Complements the existing BOLD yield dashboard (15+ venues) **What This Means:** Users can now easily track and compare different venues within the Liquity V2 ecosystem, making it simpler to identify opportunities and monitor protocol activity. View the dashboard: [Liquity V2 Ecosystem](https://dune.com/liquity/liquity-v2-ecosystem)

🎁 Enosys Airdrop Goes Live Tomorrow for Liquity V2 Users

**Liquity V2 users can claim their Enosys airdrop starting January 21, 2026.** The airdrop is part of a **40-week incentive program** split evenly between: - **50% retroactive rewards** for existing users - **50% ongoing activity rewards** starting tomorrow **Additional Benefits for BOLD Liquidity Providers:** - Roughly **3% APR boost** from Enosys rewards - Stacks on top of existing yields: - 8.5% on [Uniswap](https://uniswap.org) - 7.5% on [Yearn](https://yearn.fi) yBOLD - 6.5% on [Curve Finance](https://curve.fi) Claims will be available through the Enosys frontend. This is the first of **10+ airdrops planned for 2026**. **Action:** Stay active and continue providing liquidity on Ethereum to maximize rewards. Full details: [Liquity Blog](https://www.liquity.org/blog/enosys-airdrop-for-liquity-v2-users)

Liquity Launches Dual Reward Program with $108k Retro Claim and Weekly Incentives

Liquity has introduced a two-part reward structure for its community: **Retro Bucket (1.375%)** - One-time claim of 52.5 APS (~$108k) available for users on the [Liquity leaderboard](https://dune.com/liquity/v2-leaderboard) - Eligible users continue receiving 3.85 APS weekly (~$8k/week) on a pro-rata basis **Ongoing Bucket (1.375%)** - Rewards new Mainnet Liquity activity starting January 21 - Distributed at 5.15 APS/week (~$11k/week) - Same leaderboard criteria apply, including: - Liquidity provision on Stability Pools - LP positions on Curve - LP positions on Uniswap The program allocates a total of 2.75% of rewards split between retroactive recognition and ongoing participation incentives. Users can check their eligibility and track rankings through the Dune Analytics dashboard. Both reward streams run concurrently, allowing active participants to earn from multiple sources simultaneously.

🎁 Fork Season Incoming

Yearn Finance's yBOLD token, which represents deposits in Liquity's Stability Pool, currently offers 8.7% APR - described as the highest risk-adjusted yield in DeFi. **Key Details:** - Current benchmark APR: 8.7% - Potential boost: ~3% APR increase expected next week - "Fork rewards season" announcement suggests additional incentives coming **Background:** Liquity's Stability Pools have historically averaged ~7.5% APR since inception. Users deposit BOLD stablecoin to earn 75% of protocol borrow fees while acquiring liquidated ETH and liquid staking tokens at discounted prices.