Lumerin Staking Pool Gains Traction

Lumerin Staking Pool Gains Traction

🚀 LMR Staking Frenzy

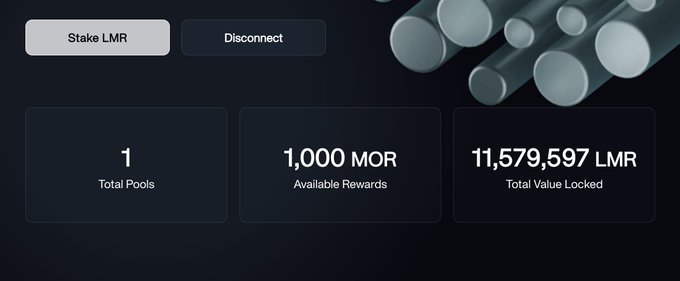

Lumerin's first staking pool has seen significant adoption in its initial days:

- 11.5M LMR staked within 24 hours of launch

- Total staked amount increased to over 17M LMR in two weeks

The staking pool, accessible at staking.mor.lumerin.io, offers community members an opportunity to participate in the Lumerin ecosystem.

Key Points:

- Rapid adoption indicates strong community interest

- Staking pool launched successfully

- Opportunity still available for those who haven't staked yet

To participate in the staking pool, visit staking.mor.lumerin.io

Less than 24h in and 11.5M LMR has already been staked 👀 ➡️ staking.mor.lumerin.io

Lumerin Launches First Decentralized Hashpower Futures Marketplace

Lumerin has launched the world's first decentralized futures marketplace for Bitcoin hashpower, enabling traders to position on mining economics independently of Bitcoin price movements. **Key Features:** - Trade future hashpower value based on predictable Bitcoin difficulty adjustments - Isolate mining profitability signals from BTC price volatility - Access on-chain futures contracts through Web3 wallets - Capitalize on mechanical protocol shifts before they occur The platform addresses a gap in crypto derivatives markets, which previously couldn't isolate mining-specific conditions. Bitcoin difficulty adjustments—one of crypto's most predictable events—directly impact miner revenue (hashprice), yet traders lacked direct exposure to this dynamic. Hashpower futures allow market participants to take precise positions on future mining economics, treating difficulty as a tradeable signal. This creates new opportunities for both miners seeking revenue predictability and traders looking to capitalize on protocol mechanics. The beta marketplace is now live at [lumerin.io/futures](https://www.lumerin.io/futures), offering what Lumerin describes as a "new edge" in mining economics through decentralized, trustless contracts.

🏭 Texas Approves 7.65 GW AI Power Campus: Energy Competition Intensifies for Bitcoin Miners

**Texas regulators approved a massive 7.65 GW air permit for Pacifico Energy's AI Power Campus**, marking a significant escalation in industrial energy demand across the state. **Key implications for Bitcoin miners:** - New AI facilities will compete directly for grid capacity, potentially tightening energy availability - Rising operational costs expected as energy competition intensifies - **Downward pressure on hashprice** anticipated as miner expenses increase - Follows recent ERCOT overhaul mandating costs and disconnects for loads over 75MW This development compounds existing challenges from ERCOT's grid transformation, which projects peak power demand to **double by 2031**. Fixed-location miners face mounting pressure from both regulatory changes and new industrial competitors. **Miners may need to explore flexible hashpower solutions** to navigate the evolving Texas energy landscape and maintain profitability amid rising costs.

⚡ Winter Storms Disrupt US Bitcoin Mining Operations

**Recent winter storms have significantly disrupted Bitcoin mining operations across the United States, with new production data confirming substantial impacts on network hashrate.** **Key Impacts:** - Production data shows severe disruption for US-based mining operations - Network hashrate experienced measurable decline during storm period - Multiple mining facilities affected by power grid strain **Market Implications:** The temporary reduction in active hashrate creates a brief opportunity for miners who maintained operations. With fewer miners competing for block rewards during the disruption, operational facilities may see improved returns per terahash. This event highlights the vulnerability of mining operations to weather-related infrastructure challenges. The hashrate drop, while temporary, demonstrates how regional power grid dependencies can create sudden shifts in mining economics. For miners seeking stability, flexible hashpower arrangements can help navigate such disruptions by providing alternatives when local operations face downtime.

⚖️ Luxor Sues Giga Energy Over Alleged Client Poaching and Trade Secret Theft

**Legal Dispute Erupts in Bitcoin Mining Sector** Luxor has filed a lawsuit against Giga Energy and a former employee, alleging: - Client poaching and theft - Contract breaches - Misappropriation of trade secrets **What This Means** The lawsuit highlights the **intense competition** for mining services in the current market. Companies are fighting aggressively to retain clients and protect their business relationships. **Market Impact** Hashprice is expected to remain **neutral**, as this legal battle doesn't affect Bitcoin network fundamentals or mining difficulty. The dispute centers on business practices rather than technical operations. **Operational Risks** This case underscores the operational challenges miners face beyond just hardware and electricity costs. Contractual disputes and employee mobility can create significant business uncertainty in the mining services sector.

Bitcoin Merchant Adoption Hits 40% as Solana Activity Surges 115%

**Market adoption accelerates across multiple chains** - 40% of merchants now accept Bitcoin payments, marking significant real-world utility growth - Solana network sees 115% increase in active addresses, signaling broader ecosystem expansion - Growing BTC utility creates upward pressure on hashprice **Mining implications** Increased Bitcoin demand strengthens the economic case for mining operations. As merchant adoption drives utility, miners face improved conditions for capitalizing on hashrate opportunities through direct marketplace transactions.