LiveArt Partners with Foxy on Linea to Merge Art and Memecoins

LiveArt Partners with Foxy on Linea to Merge Art and Memecoins

🦊 Art Meets Memes

LiveArt and $FOXY announce a strategic partnership on Linea blockchain to combine fine art with memecoin utility. The collaboration will bring three new masterpieces onchain, creating an innovative holding mechanism where $FOXY token amounts influence art asset evolution.

Key points:

- Integration with $10 trillion art asset class

- Dynamic asset evolution based on $FOXY holdings

- Three new onchain masterpieces planned

- First culture coin partnership on Linea

The partnership aims to transform traditional art ownership into an interactive experience, marking a significant step in merging traditional art markets with Web3 technology.

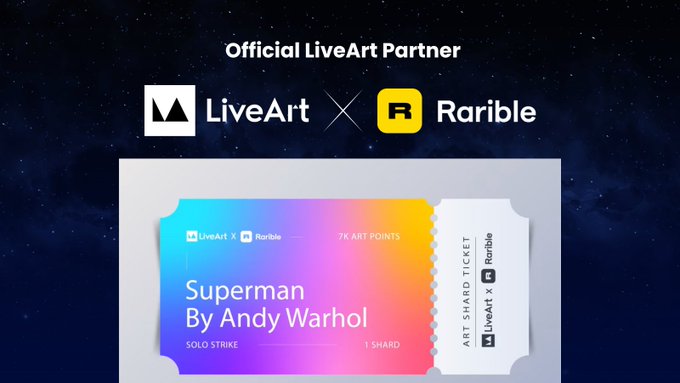

🤝 LiveArt x Rarible: AI-Powered Blue-Chip Art, On-Chain LiveArt is bringing blue-chip masterpieces to the Rarible community, making tokenized fine art accessible like never before. Powered by AI-driven insights, blockchain security, and fractionalized ownership, we’re

Utility is the essence of crypto. At LiveArt we're bringing blue chip art on-chain. Real. Tangible. Timeless. $ART

🖼️ Blue-Chip Art Goes Onchain: Picasso and Warhol Now Tokenized

**LiveArt** has launched a platform for tokenized fractional ownership of investment-grade artworks from artists like Picasso, Warhol, and Koons. - These are **real-world assets (RWAs)**, not NFTs or crypto art—actual physical artworks with decades of market history - Users can buy fractions of blue-chip pieces directly onchain with transparent custody and settlement - Payment accepted in USDT, USDC, BNB, and ART token, with settlement routing through ART - Platform focuses on proper infrastructure: custody, settlement, and liquidity rather than speculation The tokenized art pieces can be staked, lent, or used in DeFi applications. LiveArt positions itself as building real tokenization infrastructure as institutions move into tokenized markets. [Explore available tokenized artworks](https://app.liveart.io/defi)

🎨 Art's True Value Lies in Cultural Legacy, Not Hype Cycles

Art has always served as a reliable store of value, but not for the reasons many assume. The foundation of art's worth rests on: - Support from collectors and institutions - Recognition by museums - Long-term cultural demand This stands in contrast to short-term market narratives that often drive speculation. Historically significant pieces appreciate over time because they maintain cultural relevance across generations. The distinction matters: while market trends come and go, institutional backing and cultural significance provide lasting value. This principle applies whether art exists on canvas or blockchain.

Real-World Assets Show Stability While Speculative Tokens Falter

**Financial assets backed by tangible cultural and economic value are demonstrating different behavior patterns compared to purely speculative tokens.** - Tokenized real-world assets—from gold to real estate—are creating stability in the volatile crypto market by tying physical assets to blockchain technology - This divergence reveals a fundamental distinction: tokens representing actual value operate under different dynamics than those driven solely by speculation - The trend suggests that blockchain's most sustainable applications may lie in digitizing existing assets rather than creating purely digital speculative instruments The data indicates that real-world asset tokenization is maturing as a sector, offering investors exposure to tangible value while leveraging blockchain's efficiency and transparency benefits.

🏦 Nasdaq Joins NYSE in Race to Tokenize Traditional Markets

**Major exchanges are moving from tokenization pilots to production systems.** Nasdaq is seeking SEC approval for its tokenized securities platform, following the New York Stock Exchange's recent announcement of similar plans. Both exchanges are building infrastructure to support blockchain-based trading of traditional assets. **Key developments:** - Nasdaq prioritizing SEC approval for tokenization platform - NYSE actively developing tokenized securities infrastructure - Shift from experimental pilots to production-ready systems - Global exchanges and banks coordinating around shared standards This represents a fundamental change in how major financial institutions view blockchain technology - no longer as a speculative tool, but as core market infrastructure. The coordinated timing suggests industry-wide preparation for regulatory clarity. [Read more](https://cointelegraph.com/news/nasdaq-stock-exchange-tokenization-plans-sec-approval-priority)

🏛️ NYSE Building Tokenized Securities Platform

The **New York Stock Exchange** is actively developing a platform for tokenized securities, marking a significant shift from theory to practice in traditional finance. Key developments: - NYSE plans to offer **24/7 trading** and instant settlement for tokenized securities - The platform aims to bring greater efficiency, transparency, and accessibility to capital markets - This move validates the direction of the broader blockchain industry According to Lynn Martin, President of NYSE Group: "Tokenization has the potential to bring greater efficiency, transparency and accessibility to capital markets." The world's largest stock exchange embracing tokenization signals that trillions in traditional capital may follow suit. [Read the full announcement](<https://ir.theice.com/press/news-details/2026/The-New-York-Stock-Exchange-Develops-Tokenized-Securities-Platform/default.aspx>)