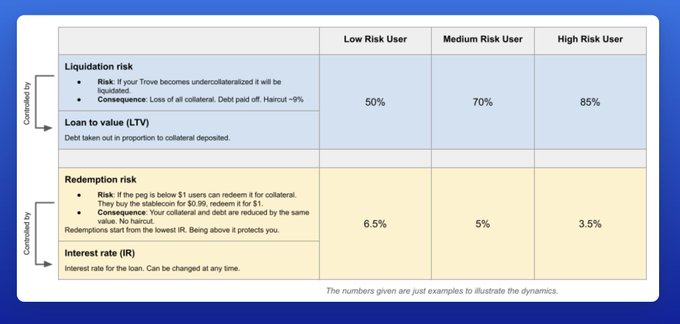

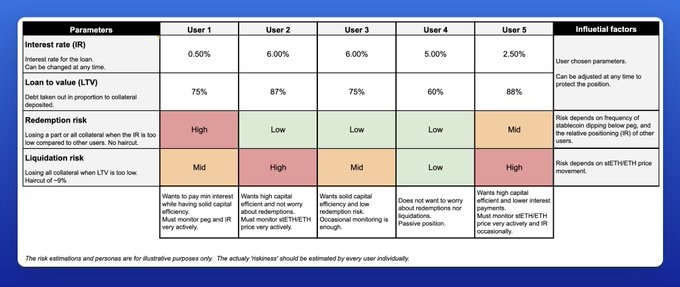

In Liquity v2, liquidation and redemption risks are split - liquidations happen when the LTV is too high and redemptions happen when the interest rate is too low. This system allows users to be capital efficient with high LTV and zero redemption risk with high IR. Users can customize their approach, adjust it as needed, and automate the process for a hands-off position.

In Liquity v2 liquidation and redemption risks are split. Liquidations happen when your LTV is too high. Redemptions happen when your interest is too low. By doing this, users can at the same time be very capital efficient (high LTV), while having zero redemption risk (high

The Trustless Force Has Arrived

A new development in decentralized systems has been announced, marking what appears to be a significant milestone in trustless technology implementation. **Key Points:** - The announcement centers on "The Trustless Force" - a concept or platform focused on removing intermediaries from financial or technical processes - This follows previous discussions on frictionless finance from September 2025 - The timing suggests a coordinated launch or major update to existing infrastructure The development represents continued progress in building systems that operate without requiring trust in centralized authorities or intermediaries. [Watch the announcement](https://x.com/i/broadcasts/1kvKpMvzXnZGE)

🔒 Pendle Launches sBOLD Pool with 6.5% Fixed APR

Pendle has launched a new sBOLD pool expiring at the end of June 2026, offering three distinct opportunities for participants: **Key Features:** - **PT holders** can lock in a fixed 6.5% APR - **YT buyers** gain exposure to potential Liquity forks airdrops - **LP providers** can supply liquidity and earn fees The pool provides structured yield options for different risk profiles while maintaining exposure to the Liquity ecosystem.

🎙️ Stablecoin Risk Deep Dive

**Liquity's BOLD stablecoin achieves A- rating and perfect 1.0 decentralization score from Bluechip** In a new podcast collaboration with Bluechip, Liquity explores the technical nuances behind stablecoin risk assessments: - **BOLD's standout metrics**: Earned an A- overall rating with a perfect 1.0 score in decentralization - a rare achievement in the stablecoin landscape - **Crypto-backed vs bank-backed**: The discussion clarifies why crypto-collateralized stablecoins can offer different risk profiles than bank-backed alternatives, even when ratings appear similar - **Technical freeze resistance**: The team explains what "can't be frozen" actually means from a technical architecture perspective The conversation provides insight into how independent rating agencies evaluate stablecoin risk factors, including collateralization methods, decentralization levels, and censorship resistance. [Watch the full podcast](https://www.youtube.com/watch?v=FSsAlqzD5bo)

🐻 Curve Finance LPs Earning 8.5%+ in Fork Airdrop Points

Curve Finance liquidity providers are currently earning over 8.5% in points from fork airdrops, according to Liquity. **Key Details:** - LPs can access additional yields through [Liquity's platform](https://www.liquity.org/earn) - Multiple forks have launched incentivized pools with double-digit APRs - Recent launches include pools from Asymmetry Finance, Felix Protocol, Bera Borrow, and Orki Finance **Market Context:** Redemptions have declined sharply as demand for BOLD increases due to fork rewards. Liquity V2 maintains its position as the cheapest borrowing option in DeFi, sitting 23% below competitors. Active incentivized pools include: - Asymmetry Finance DeFi Avengers pool with Protocol FX - Felix Protocol 3pool on Curve and Hyperliquid - Bera Borrow 3pool with NECT and HONEY on Berachain - Orki Finance increasing rewards on Swell Network Additional forks from Nerite, Ebisu Finance, and Soneta are expected to launch soon.

Podcast Explores BOLD Stablecoin's Perfect Decentralization Score

A new podcast episode with Bluechip discusses BOLD stablecoin's technical design and risk assessment. **Key Topics Covered:** - BOLD achieved perfect 1.0 scores in decentralization metrics - Comparison between bank-backed and crypto-backed stablecoins - Technical explanation of "can't be frozen" functionality - Design decisions that distinguish BOLD from other stablecoins The episode examines stablecoin risk trade-offs and why BOLD earned an A- rating despite having the same score as some competitors. The discussion provides technical insights into what makes BOLD's architecture unique in the stablecoin landscape. [Watch the full podcast](https://www.youtube.com/watch?v=FSsAlqzD5bo)