Liquity appeared on the Epicenter podcast to discuss BOLD, their crypto-native stablecoin, and how Liquity V2 enables users to operate as their own bank.

Key Features of BOLD:

- No freeze, blacklist, upgrade, or pause functions

- Permissionless minting and redemption

- Redeemable at $1 for ETH collateral anytime

- Fully decentralized with no intermediaries

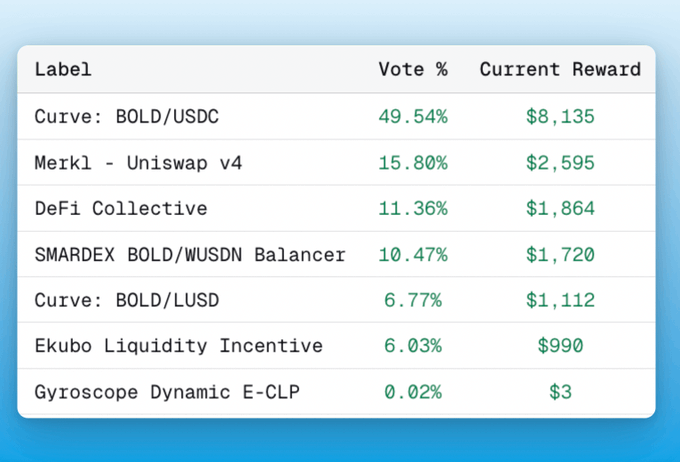

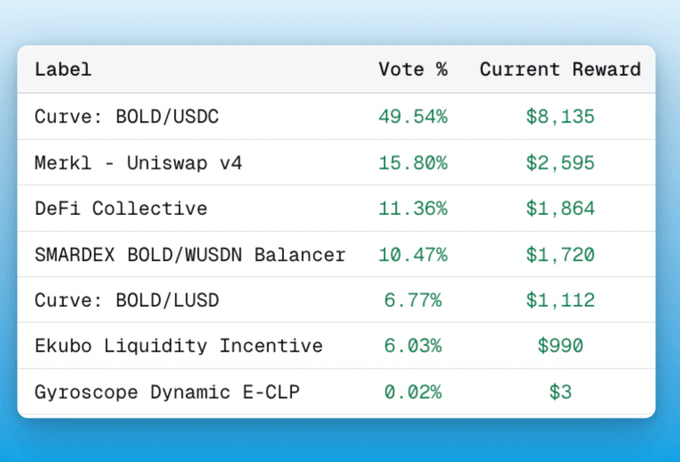

Current Yield Opportunities:

- BOLD/USDC LP pools: 11-34% APR across Curve, Uniswap, and Ekubo

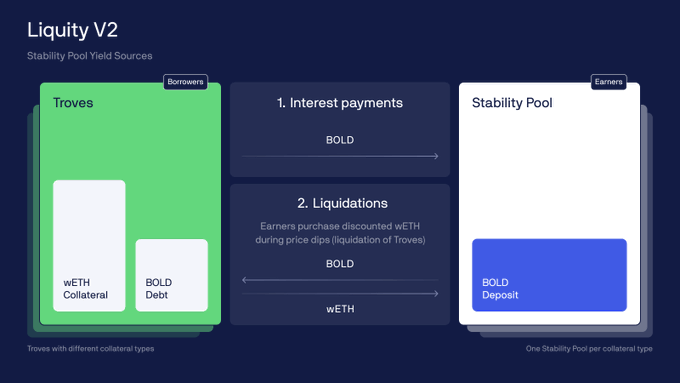

- Stability Pools: 8-192% APR from liquidations and borrower fees

- 75% of protocol revenues distributed to Stability Pool depositors

The protocol recently processed $1.1M in liquidations while BOLD maintained its $1 peg. Liquity positions BOLD as a trustless alternative in a stablecoin market increasingly divided between fully regulated options and purely decentralized protocols.

If you hold BOLD, it's yours. Period. 🔒 No freeze function or blacklist 🔒 No upgrade or pause functions 🔒 Anyone can permissionless mint/redeem in protocol 🔒 Redeem at $1 for ETH collateral anytime BOLD is your stablecoin of last resort 🛡️

volatility brings opportunity. The Liquity ecosystem is offering 20% + APR across multiple low-risk venues on @ethereum. Pick your lane: 🧠 Stable LP yield: LP BOLD/USDC on @EkuboProtocol / @CurveFinance / @Uniswap (13% +) 🧩 LP sBOLD/yBOLD: @pendle_fi / @spectra_finance

Want low-risk yield that doesn’t require monitoring every week? Here's how you can earn a steady ~8% APR without constant monitoring on Liquity V2 Liquity's Stability Pools - your DeFi savings accounts👇

Weekly Rewards Boost: 20,000 $BOLD 🤩 BOLD LPs are eating well this week. Each week, LPs below get BOLD rewards on top of swap fees. It boosts the native APRs for BOLD / USDC LPs: - @EkuboProtocol - ~18% - @CurveFinance ~11% - @Uniswap ~12% Sustainable, stablecoin rewards.

@VitalikButerin outlined in the Trustlessness Manifesto how protocols should be built: "Blockchain applications need to be trustless, credibly neutral, censorship resistant, and permissionless." BOLD is the stablecoin designed to meet this standard. Trust the code.

The stablecoin market is splitting in two: ✅ Fully regulated commodities ✅ Purely decentralized protocols Everything else - the 'trust me bro zone' of multisigs and opaque yield - gets cleared out. $BOLD is betting on decentralization winning.

Liquity's CEO calls the middle of the stablecoin market the "trust me bro zone." Michael Svoboda: "You're adding a multisig, a yield source, making it a hedge fund. Risk on risk on risk." Two models will survive: fully regulated commodities and purely decentralized. Everything

The “trust me bro zone” always ends with gates. Liquity V2 is the self-sovereign alternative, the ultimate freedom protocol: Ethereum-native, no intermediaries, and immutable. Borrow $BOLD against ETH on your terms Hold $BOLD to earn predictable yield. Full control, always.

BLOCKFILLS HALTS WITHDRAWALS AMID CRYPTO TURMOIL Susquehanna-backed crypto lender BlockFills has suspended client deposits and withdrawals, citing recent market volatility. The Chicago-based firm, which serves 2,000 institutional clients and handled $60 bn in 2025 trading,

You heard it first from @Bankless: "Trustless Stablecoins are back in the spotlight." Stay $BOLD. bankless.com/read/trustless…

34.55% APR on a BOLD / USDC pool in this economy? It’s real - and live on @EkuboProtocol. Ekubo is redirecting Liquity’s PIL to its new V3 'boosted' BOLD/USDC pool. Active (in-range) LPs get boosted swap fees → earn a larger share of fees. link 👇

BOLD is the ultimate freedom crypto dollar. Why settle for a “trust me bro” dollar? We jumped on the @epicenterbtc pod to discuss crypto-native stablecoins and how Liquity V2 lets you be your own bank. Check it out 👇

New Episode: Something better than USDC for your Ethereum? @svobodamichael, CEO of @LiquityProtocol, joined to explain why decentralized borrowing must remain governance-free. He discusses how Liquity V2 and user-set interest rates remove the "central bank" committees common in

Liquity V2 and $BOLD are different. It passes on 100% of protocol revenues to grow the stablecoin, with a fixed 75% going to the Stability Pools. BOLD Stability Pool = a on-chain savings account generating → Deposit BOLD → Earn from borrower interest (75% of protocol

Weekly Rewards Boost: 20,000 BOLD 🤩 BOLD LPs get those on top of swap fees. It boosts the native APRs for LPs: - @CurveFinance ~11% - @Uniswap ~12% These are continuous, sustainable stablecoin rewards. As a LQTY staker, you can direct rewards to the pools that drive V2

Liquity V2 Team Highlights BOLD's Security Track Record and Market Performance

The team behind Liquity V2 and BOLD stablecoin shared key metrics about their protocol's security and performance: **Track Record:** - Liquity V1 achieved $5B peak TVL over 4 years with zero exploits - V2 underwent 5 comprehensive audits from ChainSecurity, Dedaub, Cantina, Coinspect, and Recon **Recent Performance:** - V2 operated without issues through 9 months of varying market conditions - The protocol has been forked by over 10 teams The announcement emphasizes the team's focus on security principles and operational stability in building crypto-native stablecoins.

BOLD Stablecoin Receives A- Rating from Bluechip, Outranking USDC and DAI

**BOLD stablecoin has secured an A- rating from Bluechip**, making it the only crypto-native stablecoin to achieve an A-tier rating. This places BOLD above established competitors like USDC and DAI, which both received B+ ratings. **Key highlights:** - First crypto-native stablecoin with A-tier rating - Rated higher than USDC (B+) and DAI (B+) - Cannot be frozen, unlike centralized alternatives The rating reflects BOLD's strong fundamentals and decentralized architecture. Users can access BOLD through [Liquity's platform](https://liquity.app/borrow) or purchase it via [DeFi aggregators](https://swap.defillama.com/). View the full Bluechip rating analysis at [bluechip.org](https://bluechip.org/en/coins/bold) and read the detailed breakdown at [Liquity's blog](http://www.liquity.org/blog/bold-receives-a--rating-from-bluechip).

BOLD: A Crypto-Native Stablecoin for Ethereum Believers

**BOLD** is positioning itself as a decentralized alternative to traditional finance-backed stablecoins for Ethereum users who prioritize censorship resistance. **Key Points:** - Targets ETH holders seeking to diversify from TradFi stablecoins - Emphasizes trustlessness and decentralization - Addresses the contradiction of using censorable stablecoins in censorship-resistant DeFi - Recently received an **A- rating** for its approach The project argues that Ethereum's role as a decentralized financial settlement layer is undermined when major stablecoins can be frozen by centralized entities. BOLD aims to solve this by offering a crypto-native stablecoin that aligns with Ethereum's core values while minimizing risk for users.

Freedom Stablecoins: Code-Run, Crypto-Backed, User-Controlled

Liquity contributor Michael Svoboda introduced the concept of **'freedom stablecoins'** on The Rollup podcast, outlining a new approach to stable digital currencies. **Key characteristics:** - Run entirely by code without human intermediaries - Backed by cryptocurrency rather than traditional assets - Controlled by users, not centralized entities - Eliminates traditional finance (TradFi) risk exposure This model represents a shift from conventional stablecoins like USDC or USDT, which rely on bank deposits and regulatory frameworks. Freedom stablecoins aim to operate independently of the traditional financial system while maintaining price stability through algorithmic mechanisms and crypto collateral. The discussion comes as stablecoins continue gaining traction as crypto's most practical application for everyday transactions and value transfer. [Listen to the full explanation](https://x.com/therollupco/status/2020954117146018200)