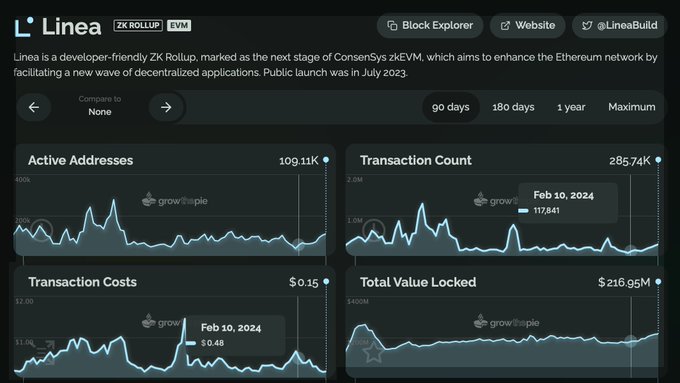

LineaBuild has successfully lowered its average transaction costs to $0.15, a significant improvement from the previous week. This reduction is attributed to the Phase 1 upgrade implemented on Linea, setting the stage for further decreases in transaction costs in the future. The upgrade aims to enhance efficiency and accessibility for DeFi operations on the Linea platform.

Tweet not found

The embedded tweet could not be found…

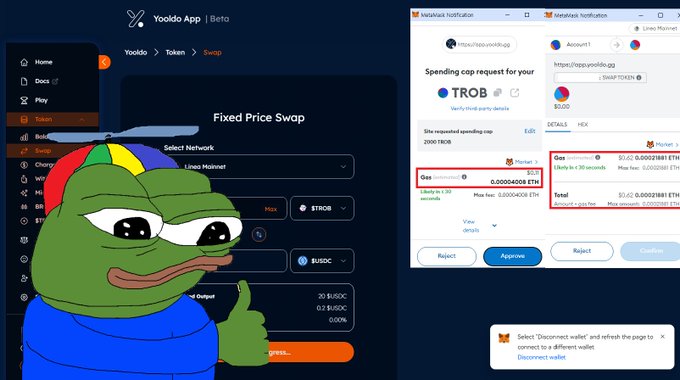

Say farewell to $2 gas fees and welcome cheaper transactions! With @LineaBuild 's V2 now live, gas fees have instantly become 3 times cheaper. We recommend our users to experience lower gas prices through Fixed Price Swap. Exciting news may be on the horizon from both Linea

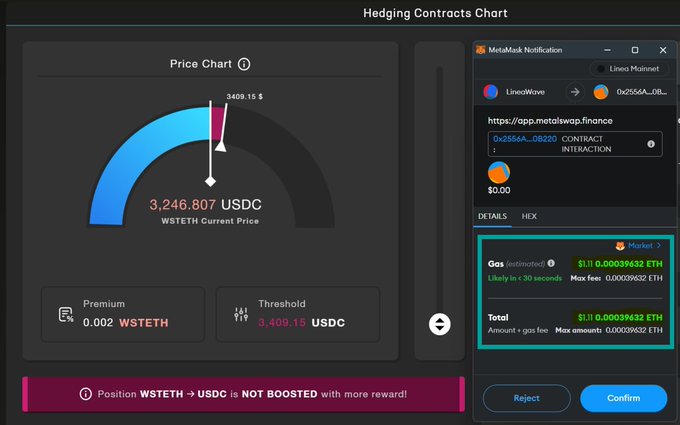

🌐 Big news from the @LineaBuild chain! With the launch of Linea's V2, we're seeing a dramatic reduction in fees - down by ~3x! This significant update marks Phase 1 in our journey to lower transaction costs on #Linea, setting the stage for even more efficient DeFi

👀 @LineaBuild has decreased its average transaction costs to 1/3 of last week's. Now at around $0.15! This is due to phase 1 of an ongoing upgrade to Linea! Looking forward to seeing a further decrease in transaction costs on Linea. 🎊

Linea just launched V2 Fees are now about 3 times lower! And this is just the beginning of making @LineaBuild more affordable!👇

🔥 NEW Chain Integrated on DexCheck: @LineaBuild We're delighted to bring you the next evolution of ConsenSys zkEVM through Linea! Now on Linea: 🔍 Explore tokens & traders with ease 🧠 Track market trends and make informed decisions Explore DexCheck now for insights into

.@LineaBuild's ALPHA V2 upgrade has made transactions cheaper by ~3x ⛽️, thanks to data compression and proof aggregation. #Linea after EIP-4844 will be Legen... wait for it...dary 🔥 Bridge to #Linea with #Rango now 👇🏼 app.rango.exchange/swap/ARBITRUM.…

Exponent Competition Concludes, Winners to Be Announced

The Exponent competition has officially ended. The organizing team expressed gratitude to all participants who built, deployed, and competed in the event. **Current Status:** - Competition phase complete - Final results verification in progress - Winners will be contacted directly once verification is finished No timeline has been provided for when results will be finalized or winners announced.

Phylax Systems CEO Discusses Proactive DeFi Security

Phylax Systems CEO Odysseas will discuss the evolution from reactive to proactive security approaches in DeFi during an upcoming conversation. **Key Details:** - **Topic:** The Credible Layer and its implications for builders and DeFi security - **Date:** Thursday, January 29th - **Time:** 3:00 PM UTC - **Platform:** X and YouTube - **Hosts:** suzapolooza_eth and EricCMack Several protocols including Euler Finance, Malda, Turtle, and Denaria Finance have already integrated the Credible Layer for protocol protection. Public assertions are available at [app.phylax.systems](http://app.phylax.systems).

🛡️ DeFi protocols adopt Phylax Credible Layer security

**Four DeFi protocols now live with Credible Layer protection** Euler Finance, Malda, Turtle, and Denaria Finance have deployed Phylax's Credible Layer to protect their protocols, with more deployments coming soon. **How it works:** - Protocols define "bad outcomes" through assertions - security rules validated by the sequencer - Invalid transactions are dropped before execution - Valid transactions proceed normally - All assertions are publicly viewable at [app.phylax.systems](http://app.phylax.systems) **The shift from bug hunting to outcome prevention** Traditional security focuses on finding bugs, but some always slip through. The Credible Layer takes a different approach by preventing harmful outcomes rather than searching for vulnerabilities. Linea has integrated this technology into its sequencer, stopping exploits before they execute. This risk reduction enables institutions like SharpLink to deploy more capital into DeFi. The technology aims to make DeFi less risky for mainstream adoption. [Learn more](https://docs.phylax.systems/credible/credible-introduction?utm_source=twitter&utm_medium=social&utm_campaign=cmp-100328643-afbf08)

Linea Introduces Onchain Assertions for Transaction-Level Rule Enforcement

Linea has introduced a new feature allowing developers to write and deploy assertions directly onchain in Solidity. The sequencer enforces these rules against every transaction without requiring third parties or additional trust assumptions. **Key features:** - Assertions written in Solidity and deployed onchain - Sequencer-level enforcement on all transactions - No external dependencies or new trust models - Rules can be modified without touching production contracts This builds on Linea's recent collaboration with [Boundless](https://boundless.xyz) to support The Signal, an open-source ZK consensus client that enables trustless Ethereum state access across rollups.

Lend.xyz Launches on Linea, Enabling Fractional Real Estate Investment

**Lend.xyz has officially launched on Linea**, bringing tokenized real-world assets (RWAs) to the Layer 2 network. **Key Features:** - Enables fractional ownership of real estate properties - Makes real estate investing more accessible through tokenization - Leverages Linea's zk rollup infrastructure for scalability **Context:** Linea continues to attract RWA protocols, following LiveArt's earlier integration which brought fractionalized art and collectibles to the network. The platform allows users to buy, trade, and borrow against tokenized assets. This launch expands the range of real-world assets available on Linea beyond art and collectibles into the real estate sector.