The Ledger Connect issue reported yesterday has been fixed. Balancer was not affected and the frontend is safe to use. Users are advised to stay vigilant and exercise caution with their transactions.

UPDATE: The Ledger Connect issue communicated yesterday has now been reported as fixed. Balancer was not affected and the frontend is safe to use. We continue to advise all users to stay vigilant and exercise caution with their transactions. x.com/ledger/status/…

WARNING: A potential vulnerability has been detected with Ledger Connect. We advise all users to exercise heightened caution and avoid using the Balancer frontend until further information is available. x.com/bantg/status/1…

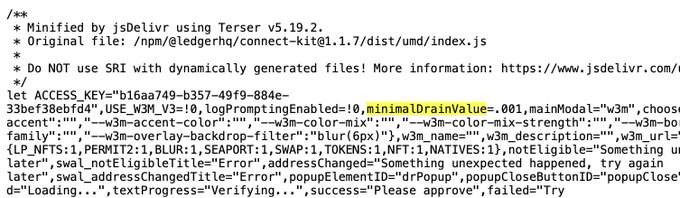

🚨 ledger library confirmed compromised and replaced with a drainer. wait out interacting with any dapps till things become clearer. cdn.jsdelivr.net/npm/@ledgerhq/…

Nerite Org Presents Decentralized Borrowing Protocol at Balancer Office Hours

Balancer is hosting its weekly office hours session featuring Nerite Org. **Key Details:** - CupOjoseph from Nerite Org will present their decentralized borrowing protocol - Focus on how they leverage Balancer pools to scale USND - USND is a stablecoin that allows users to set their own interest rates This follows last week's session with Yuzu Money, which covered their Balancer pool strategies and yzUSD stablecoin development. The office hours series provides a platform for projects building on Balancer to share their technical implementations and product roadmaps with the community.

🏗️ RockSolid Vault

**RockSolid HQ** is leveraging Balancer's AMM pools to enhance liquidity for their vault token. - Wardy Ben from RockSolid discussed their integration strategy - The team is utilizing Balancer's pool infrastructure for improved token liquidity - This follows a broader trend of projects building on Balancer as a base layer for AMM innovation Balancer has become increasingly popular among DeFi protocols, with **11% of volume** flowing through Gyroscope's E-CLP pools and CoW AMM capturing MEV to protect liquidity providers.

StakeDAO Explains VE Tokenomics Model in Office Hours Session

StakeDAO's Hubert recently hosted an office hours session breaking down the VE (vote-escrowed) tokenomics model. The presentation covered: - What the VE model actually is - The core purpose behind this tokenomics approach - How it functions in practice The VE model has become a popular tokenomics framework in DeFi, allowing token holders to lock their tokens for voting rights and governance participation. The session aimed to demystify this mechanism for the community. A recording of the office hours is available for those interested in understanding this tokenomics structure.

Hidden Hand Launches New Voting Incentives Market with StakeDAO

Two new platforms are now available for claiming voting incentives in DeFi: - **[Hidden Hand](https://hiddenhand.finance/)** allows users to claim unclaimed incentives from previous voting rounds - **[StakeDAO's Votemarket](https://votemarket.stakedao.org/)** introduces a new marketplace for voting incentives These platforms enable protocols to offer rewards to governance token holders who vote in their favor, creating a market for protocol influence. Users who participated in previous voting rounds should check for any unclaimed rewards. The voting incentives model has gained traction as protocols compete for governance votes across DeFi platforms like Balancer, Curve, and others.

Hidden Hand Incentives Deadline: Claim by June 30, 2026

**Action Required: Claim Your Hidden Hand Incentives** Balancer users have until **June 30, 2026** to claim their Hidden Hand incentives. Any unclaimed rewards after this date will be permanently forfeited. **Key Details:** - Deadline: June 30, 2026 - Unclaimed incentives will be lost after the deadline - Users should check their accounts and claim earned rewards **What to Do:** Visit your Hidden Hand dashboard to review and claim any pending incentives before the deadline passes.