DeFi projects like Liquity Protocol, Synthetix, and Venus Protocol are starting to embrace oracle diversity by incorporating two or even three oracle models. This is crucial for scaling DeFi as it provides fallback options in case of events that impact users.

We hate it when users of DeFi get impacted by events like today and are glad that the @SiloFinance team was able to prevent any real harm. Every oracle comes with trade-offs, which is why you shouldn’t put all of your eggs in one basket. Leading projects are starting to embrace

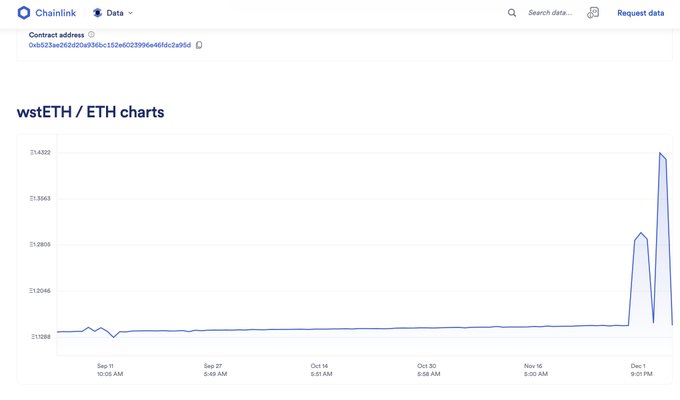

Earlier today, Chainlink wstETH/ETH price feed on Arbitrum reported an inaccurate value, resulting in the liquidation of 5 positions. Our friends at Chainlink are on it. No bad debt accrued, Silo is performing as usual ✅ 🧵

YeiFinance Launches on Injective EVM with API3 Oracle Integration

**YeiFinance has officially launched on Injective EVM**, integrating API3's first-party oracles with OEV (Oracle Extractable Value) capabilities. - Builders can now access **real-time data feeds** through API3's oracle infrastructure - The integration provides **secure and transparent** data delivery directly from source - API3 served as a **launch partner** for Injective EVM mainnet This deployment enables developers to leverage advanced oracle functionality including OEV capture mechanisms. The partnership represents API3's continued expansion across EVM-compatible networks. Developers can access the data feeds at [market.api3.org/injective](http://market.api3.org/injective).

New DeFi Infrastructure Proposes Single Entity for Chain Money Markets

A new DeFi concept is emerging that could **simplify blockchain infrastructure** by consolidating multiple services into one entity. Currently, blockchain networks must interact separately with: - Lending protocols - Oracle services - Curator networks The proposed solution would allow chains to access **complete money market functionality** through a single provider with aligned incentives. This approach aims to reduce complexity while maintaining the **"skin in the game"** principle - ensuring the service provider has financial stake in successful outcomes. The concept addresses a key pain point in current DeFi architecture where fragmented services can create operational overhead and potential failure points. *Key benefit: Streamlined access to essential DeFi services without sacrificing decentralization principles.*

Morpho's OEV-Boosted Vaults Hit $30M in Deposits

**Morpho's OEV-Boosted Vaults** have reached over **$30 million in deposits**, focusing on sustainable yield generation through blue-chip collateral. Key features: - **Blue-chip collateral only** for reduced risk - **Liquidation incentive recapture** boosts returns - **Real yield** without unsustainable mechanisms The vault emphasizes **principal protection** over high-risk yield farming strategies. Growth from $20M+ in October shows steady adoption of the conservative approach. [Access the vault](https://app.morpho.org/ethereum/vault/0x68Aea7b82Df6CcdF76235D46445Ed83f85F845A3/oev-boosted-usdc)

RLP/USD Oracle Feed Goes Live on API3

**RLP token now has live price feeds** through API3 oracles, providing transparent multi-source pricing across 40+ blockchain networks. **Key details:** - RLP serves as the risk-bearing layer for USR stablecoin - Token holders earn yield by absorbing systemic risk - Available on [API3 Market](https://market.api3.org) This follows the earlier launch of RESOLV/USD feeds in July, expanding Resolv Labs' oracle infrastructure for their DeFi ecosystem.

Morpho Labs and Yearn Finance OEV-Boosted Vault Update

Morpho Labs and Yearn Finance continue their collaboration on OEV (Maximal Extractable Value) recapture through their joint vault initiative. The OEV-Boosted USDC vault has shown significant growth since its launch, surpassing $10M in deposits. Key points: - Partnership focuses on returning value to users - Vault specifically designed for USDC deposits - Plans include expansion to additional markets and chains - Aims to provide sustainable yield opportunities Visit [Morpho's OEV-Boosted Vault](https://app.morpho.org/ethereum/vault/0x68Aea7b82Df6CcdF76235D46445Ed83f85F845A3/oev-boosted-usdc) to learn more.