Today is the final day of Bitfinex's AltCoin of the Month 2 trade competition. Participants have the opportunity to win up to $250 from the $4,500 prize pool by trading $XRD, $SOL, and $SEI. Hurry and make your moves before the competition closes.

💪 Show your strength in trading $XRD, $SOL, $SEI There's still time to get your share of $4500 in the trading competition. You can earn up to $250 by showing your trading skills. Want to know more? go.bitfinex.com/AOTM2

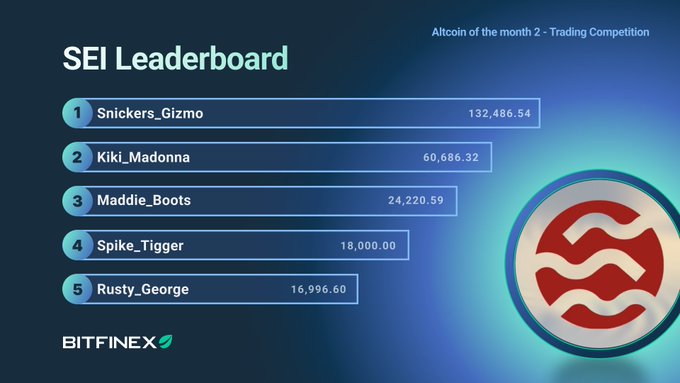

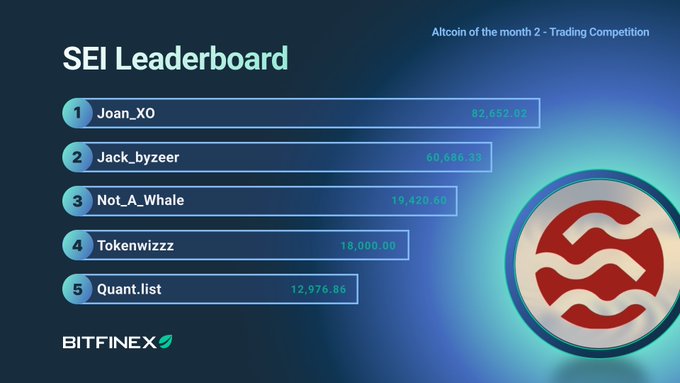

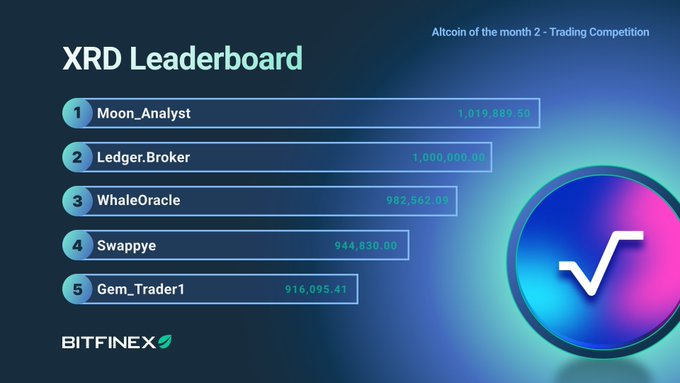

Step into the spotlight with Bitfinex's AltCoin of the Month 2 trade competition! See the leaders vying for the $4,500 prize pool. 🏆 Up to 20 winners per Altcoin, with prizes reaching $250! Your opportunity awaits - start trading today!

Step into the spotlight with Bitfinex's AltCoin of the Month 2 trade competition! See the leaders vying for the $4,500 prize pool. 🏆 Up to 20 winners per Altcoin, with prizes reaching $250! Your opportunity awaits - start trading today!

See who the leaders are in our AltCoin of the Month 2 trade competition.🥇 These are the race leaders for the $4,500 prize pool. Know that there will be 20 winners per Altcoin, with prizes of up to US$250! Start right now: support.bitfinex.com/hc/en-us/artic…

Jump into the Altcoins of the Month Trading Competition! $4,500 Prize Pool for grabs with $XRD, $SOL, & $SEI trades. Prizes up to $250 for the winners. 📅 Ends Feb 15th. Begin trading! Rules: ow.ly/II6h50QySZw

⚠️Today is the last day of our trade competition Take advantage of the last day for one last sprint and have the chance to improve your positions and increase your prize. You can win up to $250, go for it! Find out more here: go.bitfinex.com/AOTM2

Bitfinex Returns to El Salvador for Plan B Forum 2026

**Bitfinex is heading back to El Salvador** for the Plan B Forum, scheduled for January 29-31, 2026. The event brings together the cryptocurrency exchange and the global Bitcoin community to discuss: - Progress made since El Salvador adopted Bitcoin as legal tender - Current challenges facing Bitcoin adoption - Future directions for Bitcoin development The forum positions itself as a gathering point for reflection and forward planning in the world's first nation to embrace Bitcoin as official currency. More details available at [planb.sv](http://planb.sv)

Rayls Labs Launches Institutional Blockchain on Bitfinex with Zero Trading Fees

Bitfinex has listed Rayls Labs (RLS), a new Layer-1 blockchain designed specifically for banks and financial institutions. The platform aims to bridge traditional finance (TradFi) and decentralized finance (DeFi) through compliant infrastructure. **Key Features:** - Institutional-grade blockchain for compliant asset tokenization - Scalable infrastructure connecting TradFi and DeFi - Zero trading fees currently available on Bitfinex - Deposits and trading now live Rayls positions itself as purpose-built for regulated financial institutions seeking to enter the blockchain space while maintaining compliance standards. The launch represents another step in the ongoing convergence of traditional and decentralized finance. [Learn more about Rayls](https://blog.bitfinex.com/education/what-is-rayls-rls/)

Bitcoin Breaks $95K: ETF Flows to Determine Next Move

**Bitcoin surged past $95,000** to reach a 2-month high, driven by aggressive spot market buying pressure. **Key developments:** - The move follows $370M in short liquidations over 24 hours - the largest squeeze in over 6 months - BTC broke through the critical $94K resistance level after extended volatility compression - Price action now firmly established above major technical barriers **What's next:** ETF flows and market liquidity will be the deciding factors for whether this rally continues or enters a consolidation phase. The market awaits confirmation of sustained institutional demand.

🎯 Bitfinex Seeks Content Marketing Manager

Bitfinex is hiring a **Content Marketing Manager** for a fully remote position, open to candidates worldwide. **Key Responsibilities:** - Write and edit content for professional crypto audiences - Strategize content initiatives - Lead educational programs - Build Bitfinex's thought leadership presence The role offers an opportunity to shape content strategy at one of the industry's established exchanges. [Apply here](https://bitfinex.recruitee.com/o/content-marketing-manager-remote-anywhere-in-the-world-1)

Russia Legalizes Crypto Trading as ETF Inflows Hit $925M

**Major institutional and regulatory developments signal market momentum:** - Bitcoin ETFs recorded **$750M in net inflows** - Ethereum ETFs saw **$175M in positive flows** - Russia finalized legislation to **legalize crypto trading for retail investors** These three factors—regulatory clarity, institutional liquidity, and new capital access—are converging simultaneously. Russia's move opens crypto markets to millions of retail participants in a major economy, while sustained ETF inflows demonstrate continued institutional appetite for digital assets.