Klima Protocol Featured in GBB Council's Blockchain Handbook

Klima Protocol Featured in GBB Council's Blockchain Handbook

🌿 Carbon Goes Mainstream

Klima Protocol has been featured in the Global Blockchain Business Council's '101 Real-World Blockchain Use Cases Handbook (2025)'. The protocol is highlighted as an example of how blockchain technology can enhance transparency and accessibility in carbon markets.

This recognition follows recent coverage in Forbes, where Klima 2.0 was spotlighted for its innovative approach to tokenizing carbon credits. The protocol is building infrastructure that enables:

- Transparent carbon asset ownership

- Automated yield distribution

- Verifiable offset tracking

- Decentralized credit validation

The handbook feature (pages 25-28) demonstrates growing institutional recognition of blockchain's role in scaling climate finance solutions.

🌍 “Blockchain-based carbon accounting is becoming a foundational layer for global climate action.” — Teknetics, May 2025 At Klima Protocol, we’re proud to be named among the leading platforms bringing transparency, accessibility & trust to the carbon markets. 📊 Tokenized

In Klima 2.0, every action providing liquidity feeds a self-balancing structure 🏞️ Think of it as #DeFi and Climate Finance on autopilot, managing a portfolio of real carbon assets based purely on participants' input 💱 #ClimateFinance

Klima Protocol Office Hours are starting. Jump in to learn more about what changes are coming with Klima 2.0 Launch and what happens post-launch. discord.com/events/8413903…

Unvetted carbon credits? Not with Klima 2.0 🙅 Protocol won't purchase a credit type unless $KLIMA holders have 'skin in the game' by staking toward it 🔐 This decentralized signal ensures only community-approved credits enter the portfolio—aligning incentives and protecting

How does Klima 2.0 turn carbon credits into rewards and offsets? 1/ Let's follow a carbon credit through Klima 2.0’s autonomous system 👇

Blockchain is reshaping industries—faster than most realize. At Klima Protocol, we’ve been building since 2021 with a mission to scale climate finance through transparent, decentralized infrastructure. 🌍 Because the future of climate action needs the power of technology. Let’s

Blockchain technology will transform and empower every industry, much sooner than most realize. It’s time for us to step up.

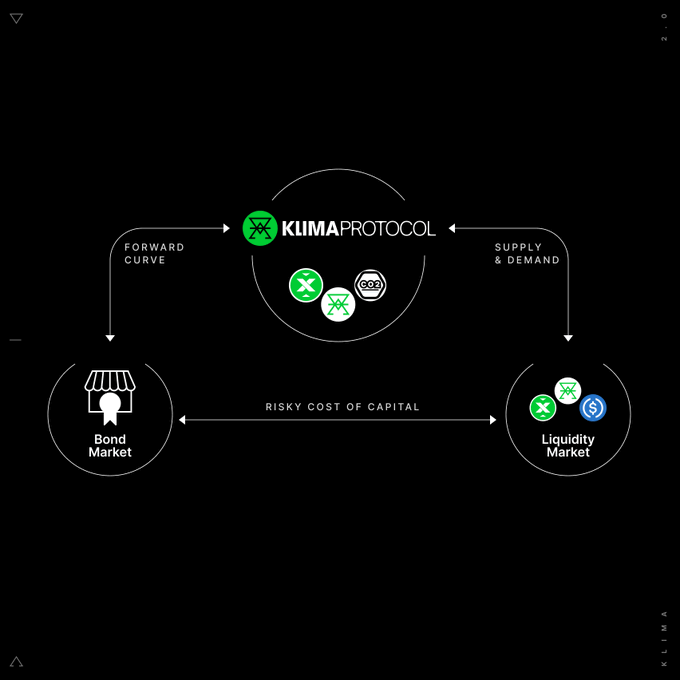

What makes Klima 2.0 tick? 🤔 3️⃣ core components work in sync, forming a self-sustaining system for carbon assets 1/ Here’s a quick breakdown 🧵

💚Klima Protocol is featured in @GBBCouncil’s 101 Real-World Blockchain Use Cases Handbook (2025)! We’re proud to represent how Web3 can unlock transparency, liquidity & access in carbon markets 🌍📊

🌍 Big news: Klima Protocol is featured in @Forbes as a key example of how tokenization can drive social & environmental impact. 1/Yes, Klima 2.0 is getting noticed — and the world is starting to pay attention. 🧵

🚨 Big updates from Klima Protocol’s latest Office Hours: 1/ Klima 2.0 is taking shape — new token design, protocol buildout, veAERO realignment, and a strategic rebrand toward institutional adoption. Here’s everything you need to know 🧵

Carbon onchain is becoming the next #RWA narrative—and Klima is already years ahead, turning capital flows into measurable climate action. 🌍

Yield farming is cool — but staking into real-world assets? That’s Klima 2.0. 🌍 In Klima 2.0, bond staking returns come from carbon-backed yield and $KLIMA emissions. 📦 Real carbon. 🔁 Onchain rewards. All automated by the protocol.

🌱 Real-world assets aren’t a theory — they’re happening onchain. Klima Protocol is proud to be building the rails for programmable, transparent carbon credit markets. Tokenized impact is no longer niche — it’s the future. 🎥 Great conversation at @onchainsummit with @0xy_moron

Don’t tokenise everything. But do get serious about what’s working in RWA. From carbon markets to tokenised treasuries to onchain equities, real-world adoption is happening. 📹 Panel with @jeremyng777 @0xy_moron @rrah622, Nikhil Joshi, and @LCV_KL youtube.com/watch?v=N-cPft…

Klima Protocol Announces Office Hours for 2.0 Launch

Klima Protocol is hosting Office Hours on May 21st at 6PM UTC to discuss the upcoming Klima 2.0 Fair Launch. The team will cover: - Key changes in Klima 2.0 - Post-launch developments - Community Q&A session The event welcomes both veteran Klimates and newcomers, providing an opportunity to understand the protocol's evolution and contribute to its future direction. Join via [Discord Stage](https://discord.com/events/841390338324824096/1372976571664830617)

KlimaDAO Partners with Universal Carbon Registry, Announces Webinar on Carbon Integration

**KlimaDAO announces two major developments:** - Partnership with Universal Carbon Registry (UCR) to integrate carbon credits into their ecosystem, enhancing transparency and compliance in tokenized carbon markets - Upcoming webinar on January 28, 2025 (8:00 AM EST) featuring: * Success story of TrueMoney's carbon offsetting initiative (1,500+ tons offset) * Insights on Carbonmark API implementation * Speakers from Ascend Bit Corp and Carbonmark Recent research from University of Alcalá validates KlimaDAO's approach to enhancing liquidity and transparency in voluntary carbon markets through tokenization.

New Carbon Capital Podcast Episode with Marcus Levine

The latest Carbon Capital podcast features Marcus Levine from KlimaDAO, discussing his transition from data science to climate action. Key topics include: - Stoicism and climate resilience - Forward carbon credits and KlimaDAO's evolution - Blockchain's role in climate solutions The episode offers insights into Klima 2.0 and the future of carbon markets. Listeners can expect to gain valuable knowledge about the intersection of blockchain technology and climate action. **Listen to the podcast**: http://klima.fyi/carboncapital

KlimaDAO's Perpetual Futures on SynFutures Gains Traction

KlimaDAO's perpetual futures listing on SynFutures has reached the front page, offering 500x points for participants. This development signals growing engagement and liquidity in carbon markets. Key points: - $KLIMA trading now available on SynFutures - Up to 10x leverage for KLIMA/ETH perpetual market - Opportunity to add liquidity to the market This listing marks a significant step towards increasing liquidity for on-chain carbon markets. As engagement grows, it could potentially impact the broader carbon credit ecosystem. For more information, visit klimadao.finance