KimberliteToken Emphasizes Ethical Diamond Sourcing Through Kimberley Process

KimberliteToken Emphasizes Ethical Diamond Sourcing Through Kimberley Process

💎 Conflict-free diamonds only

KimberliteToken reinforces its commitment to ethical investing by highlighting the Kimberley Process certification for its $KIMBER token.

Key Points:

- All diamonds backing $KIMBER tokens are 100% conflict-free

- Kimberley Process provides UN-backed certification ensuring ethical sourcing

- Positions itself as a transparent RWA (Real World Asset) investment option

- Continues building on diamond tokenization platform launched earlier

Background Context: This follows KimberliteToken's ongoing campaign to tokenize real diamonds through blockchain technology. The platform allows investors to own tokenized rough diamonds with 3D scans, GIA reports, and secure storage.

The emphasis on ethical sourcing differentiates KimberliteToken in the growing RWA space, where transparency and real-world backing are crucial for investor confidence.

Ready to explore conflict-free diamond investing? Learn more about $KIMBER's ethical approach to RWA tokenization.

💎Unlock the diamond market with @KimberliteToken! Own real-world diamonds as digital assets, redeemable anytime. $KIMBER powers a transparent, innovative ecosystem. Join the RWA revolution! 🚀 🌐 kimbertoken.io #Tokenization #RWA #TokenizedAssets #Crypto

$KIMBER is redefining crypto with ethics! Kimberley Process Certificates (KPCs) guarantee conflict-free diamonds, backed by the UN. Invest in transparency with @KimberliteToken ! #Crypto #Blockchain #RWA #DeFiTokens

Diamonds meet #Web3! With #KimberliteToken, you can own tokenized rough diamonds from BSR Global. 3D scans, GIA-approved reports, and secure storage in NY banks. Buy real gems as digital tokens on the blockchain. Ready to shine? 💎 $KIMBER #Blockchain

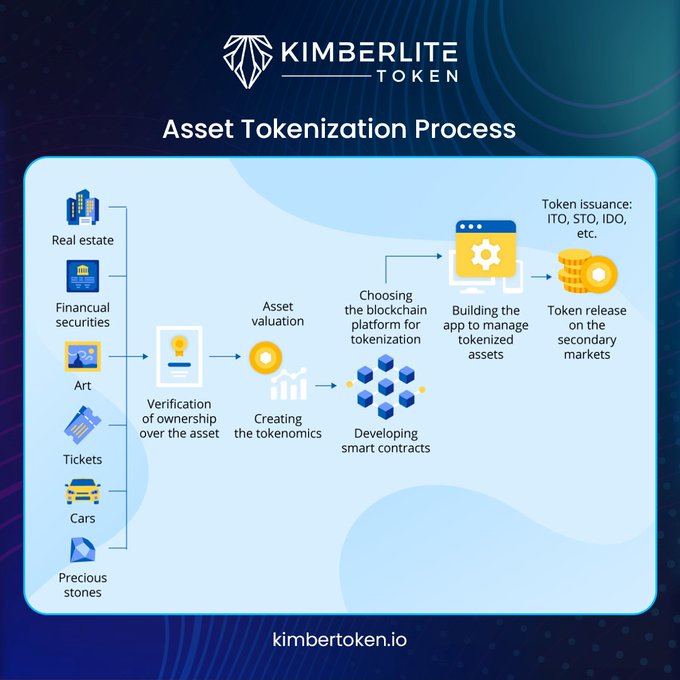

Curious about asset #Tokenization ? Discover how @KimberliteToken makes it simple and powerful! Unlock real-world assets on the blockchain. #KimberliteToken #RWA #Tokenization $KIMBER

Tokenized RWAs are changing the game for crypto investors: ✅Global access, no borders ✅ 24/7 trading, always open ✅Seamless integration with #DeFi protocols Ready to dive into the future of finance? 🚀 #Tokenization #RWA #Crypto @KimberliteToken

Diamonds meet crypto! 💎 @KimberliteToken shares 11.5% of platform profits with investors. Join the future of wealth creation. Learn more 👇 kimbertoken.io #KimberliteToken #CryptoInvesting #CryptoRewards #RWA

#KimberliteToken is revolutionizing finance by tokenizing diamonds! What’s #RWA? It’s owning real assets via blockchain—secure, transparent, & accessible. With $KIMBER, you can own a piece of the diamond market. Join the future of investing! #Crypto #Tokenization

Ever dream of owning diamonds? The diamond industry used to be an elite club. #KimberliteToken changes that, letting YOU invest in real diamonds through tokenization. Discover why this matters 👇 $KIMBER #RWA #TokenizedAssets

GM Crypto Crew! 💎 Rough diamonds aren’t just clear—they shine in yellow, brown, green, and more! Trace elements create these vibrant hues, boosting value and rarity. Ready to mine the potential with @KimberliteToken ? 🚀 #RWA $KIMBER

Diamonds with a story worth telling. 💎 The Kimberley Process ensures your $KIMBER is 100% conflict-free, backing ethical sourcing with real value. Join the future of RWA investing! #KimberleyProcess #KimberliteToken #RWA #Crypto

Discover @KimberliteToken's curated #eDiamonds! We handpick top-tier stones from BSR Global—VVS1-VS2 clarity, D-H color, 5+ carats. Get in on brilliant, fancy-colored gems and rare flawless diamonds. Invest in real value with #KimberLite 💎 #crypto #RWA #Tokenization

Discover #KimberliteToken: a utility token tied to real-world diamond value, not Bitcoin’s volatility. 💎 Swap $KIMBER for tokenized rough diamonds for stability in any market. Join the future of #Web3! 💪 #cryptocurrency #RWA #tokenisation

🔄 RWAs Shift From Yield Promises to Pure Ownership

**The RWA narrative is changing.** Instead of chasing returns, the focus is shifting to a fundamental question: *what do you actually own?* **Ownership-based design prioritizes:** - Clear rights to real assets - Verifiable custody and records - Ability to hold, transfer, or redeem independently This matters because **real assets don't need constant incentives**—they already have intrinsic value. The infrastructure just needs to enable safe, transparent movement. RWAs are evolving toward designs built on **clear structure and ownership**, not speculative yield promises.

Why Polished Diamonds Fail On-Chain Tokenization

Polished diamonds face three critical challenges for blockchain tokenization: **Subjective Valuation** Cut quality, branding, and market trends create pricing inconsistencies. Two stones with identical specifications can trade at vastly different prices, making reliable on-chain pricing difficult to establish. **Replacement Risk** Polished stones are easier to swap without obvious visual differences, weakening custody guarantees and complicating long-term verification processes. **Marketing Distortion** Retail markups, brand premiums, and resale spreads dominate pricing structures. Tokens end up reflecting market narratives rather than the underlying asset's intrinsic value. Rough diamonds offer a more viable alternative for on-chain models. Their value derives from measurable characteristics—size, structure, and origin—without design premiums or subjective aesthetics. This creates clearer pricing anchors and stronger verification frameworks for blockchain applications.

Bitcoin Drops 35% as KimberLite Offers Diamond-Backed Alternative

Bitcoin has fallen sharply in early 2026, dropping from $120,000+ to around $78,000-$81,000—a 35-40% decline from its October 2025 peak. The correction triggered over $1.7 billion in liquidations in a single day. **Key factors driving the downturn:** - Geopolitical tensions in the Middle East and U.S. political risks - Federal Reserve policy shifts under Kevin Warsh's nomination - Spot Bitcoin ETF outflows of $1.1-$1.3 billion - Heavy profit-taking by long-term holders **Broader market impact:** - Nasdaq fell 1.25%, S&P 500 down 0.9% - Gold dropped 5-12% from highs above $5,000/oz - Silver plunged 8-35% from $121/oz **Price outlook:** Short-term forecasts suggest potential tests of $60,000-$75,000, while long-term projections range from $75,000-$225,000 by end of 2026. Binance founder CZ predicts a "super cycle" that could push prices toward $180,000-$200,000. Amid this volatility, [KimberLite Token](https://kimbertoken.io/) offers an alternative by tokenizing rough diamonds on Ethereum. The project provides access to the $100+ billion diamond market through eDiamonds (full ownership) and eCarats (fractional shares), backed by real assets with 14.5% historical annual growth. Learn more at [kimbertoken.io](https://kimbertoken.io/)

🏗️ RWA Infrastructure Consolidates Around Key Settlement Networks

Real-world assets are clustering around specific blockchains based on use case and capital type. **By deployment volume:** - Ethereum leads in number of assets deployed - Arbitrum and Solana follow, favored for flexibility and integration ease **By capital settled:** - Ethereum still dominates total value - BNB Chain and Liquid Network rank second and third - Larger institutional capital gravitates to these networks The data reveals a clear pattern: some chains attract experimentation and builder activity, while others serve as settlement infrastructure for substantial assets. As the RWA sector matures, network selection is moving beyond trends toward strategic infrastructure decisions based on capital requirements and long-term stability.

🏛️ Compliance First

**KimberLite prioritizes regulatory compliance in tokenization** The diamond tokenization platform emphasizes that blockchain innovation must operate within existing legal frameworks for ownership, disclosure, and custody. **Core principles:** - Direct asset ownership structure - Regulated custody solutions - Complete documentation from inception KimberLite positions regulatory compliance as foundational rather than restrictive, building their tokenized diamond system around established legal requirements.