Kelp delivered strong performance across all products in November:

Gain Vaults Performance:

- High Gain (hgETH) maintained #1 position among ETH vaults >$10M TVL with 13%+ rewards

- Airdrop Gain (agETH) achieved ~12% weekly rewards with $45M+ TVL

- Stable Gain (sbUSD) held steady at ~11% rewards with $8M+ TVL

rsETH Expansion Milestones:

- wrsETH launched on Aave v3 Avalanche with 5k supply cap

- Native rsETH minting went live on Ink blockchain

- Arbitrum TVL hit $183.9M, maxing out 60k ETH supply cap

- Market cap reached ~$175M (+450% since DRIP launch)

DRIP Epoch 7 deployed with ~2M ARB incentives for ETH strategies.

Community Updates: Co-founder spoke at NextFin NYBW about Kred's "Internet of Credit" - connecting DeFi with traditional finance through stablecoin liquidity.

All three Gain vaults consistently delivered 10%+ rewards despite market volatility, showcasing the platform's risk-adjusted strategy approach.

agETH just hit a ~12% 7-day exchange rate 🌱 Watch the agETH exchange rate climb and track the reward rate directly on the Airdrop Gain dApp page. Access institutional-grade strategies powered by @k3_capital and @august_digital’s infra - all through a simple vault deposit.

Over the last 35 days, market-wide depegs and liquidations reminded everyone of a core DeFi principle: in stress events, strategy quality determines stability. Stable Gain, powered by @ultrayieldapp, maintained consistent performance and delivered steady rewards throughout this

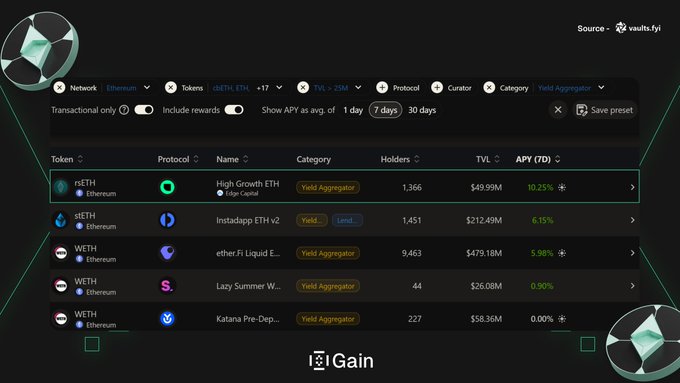

Gain vaults lead the charts - again! 🌱 In the last 7 days, High Gain and Airdrop Gain delivered some of the highest reward rates among all ETH vaults with >$25M TVL. Here's the data 🧵

ALL GREEN 🌱 This week, all three Gain vaults: High Gain, Airdrop Gain, and Stable Gain, delivered over 10% rewards. Amid the market chaos, Gain quietly kept outperforming. Let’s break it down 👇

If you’re going to Get High, you might as well Get the Best High 🍃 According to @vaultsfyi, High Gain is the #1 ETH vault by 7-day reward rate among all vaults with over $25M TVL - a spot it has held consistently for nearly two months. Powered by blue-chip strategies from

Kelp November 2025 recap 🌱 ✧ Major launches & product updates ⍛ High Gain (hgETH) held its position as the #1 ETH vault by 90-day performance rate among vaults >$10M TVL outperforming the next best vault by 50%, while delivering 13%+ rewards through market volatility. ⍛

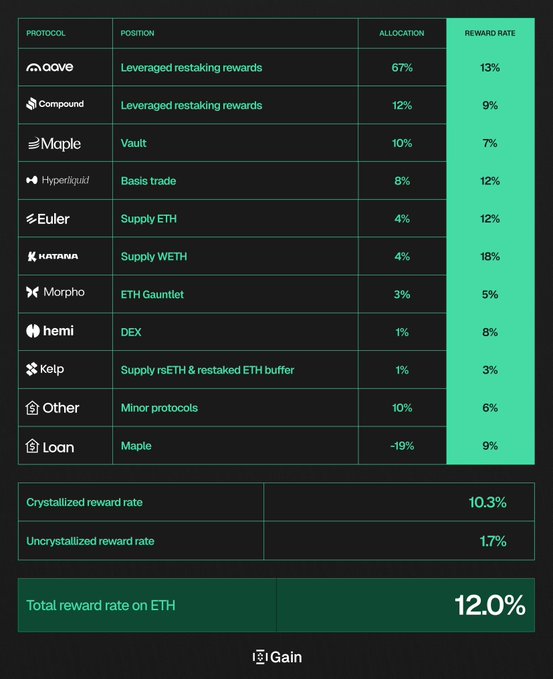

Your hgETH weekly strategy update is here! 🌱 Last week's highlights: ⍛ Portfolio reward rate climbed to 12% total on ETH ⍛ Strategic shift back to leveraged restaking as market conditions improved ⍛ @katana WETH supply delivering exceptional 18% rewards ⍛ Active

rsETH Looping Now Live on Aave v3 Core Market with E-Mode

**rsETH looping is now available on Aave v3's Core market**, offering improved capital efficiency for users. **Key features:** - E-Mode enables up to **93% LTV** for rsETH <> ETH pairs - Leverage up to **14x** possible on the Core market - Current conditions yield approximately **9% rewards** on ETH exposure - Over **$1B ETH available to borrow** in the Core market The Core market represents Aave's most conservative and liquid lending venue, designed for stability rather than experimentation. rsETH has already crossed $1B+ in supply on the platform, making it the **#8 largest asset** by supply on Aave. **E-Mode benefits:** - Tighter loops with less idle capital - Lower liquidation risk - More efficient use of the same rsETH holdings For users already looping rsETH, the Aave v3 Core market now provides the most streamlined experience. [Start looping on Aave](https://app.aave.com/reserve-overview/?underlyingAsset=0xa1290d69c65a6fe4df752f95823fae25cb99e5a7&marketName=proto_mainnet_v3)

Gain Vaults Lead ETH Performance Across Multiple Timeframes

**Airdrop Gain** has emerged as the top-performing ETH vault over the past 30 days, leading all competitors by a significant margin in short-term returns. **High Gain** maintains its position as the best-performing ETH vault on a 180-day basis among all vaults with $10M+ TVL, demonstrating six months of consistent outperformance rather than temporary gains. The Gain vault family is showing strong results across different time horizons: - **Short-term (30 days)**: Airdrop Gain leads the field - **Long-term (180 days)**: High Gain tops the charts - Both vaults maintain substantial performance gaps over competitors This dual leadership across both short and extended timeframes suggests sustained strategy effectiveness rather than market timing luck.

KelpDAO Deploys KUSD as Self-Liquidating Credit for Institutional Settlement

**Capital Deployment Model** KUSD backing capital is deployed as short-term, self-liquidating credit to verified institutions. The system operates through a straightforward cycle: - Credit is used to settle transactions - Repaid as cash flows clear - Recycled for subsequent use **How It Works** The process follows a clear loop: 1. Liquidity is minted into KUSD 2. KUSD is staked into sKUSD 3. Institutions draw liquidity for payment settlement 4. Transactions clear 5. Borrowers repay principal plus interest 6. Capital is reused The model focuses on practical settlement credit without speculation or leverage - just short-term credit facilitating real institutional transactions.

KUSD Rewards Backed by Real Payment Settlement Activity, Not Market Speculation

**KUSD rewards are generated from actual payment and settlement activity**, marking a departure from typical crypto reward mechanisms that rely on token emissions or market speculation. **Key differentiator:** - Rewards stem from real-world transaction settlement - Activity continues regardless of market conditions - Payments process consistently in both bull and bear markets **Why this matters:** The reward structure demonstrates resilience across market cycles since payment settlement occurs daily, independent of crypto market volatility. This creates a more sustainable reward model tied to genuine economic activity rather than speculative trading. The approach suggests a shift toward utility-driven tokenomics in the liquid restaking space.

KelpDAO Reaches 500,000 ETH Milestone in Liquid Restaking

**KelpDAO's rsETH has reached a significant milestone**, with total value locked (TVL) surpassing 500,000 ETH. The liquid restaking protocol, built on Eigenlayer, now serves over 20,000 rsETH holders. This growth reflects increasing adoption of liquid restaking solutions in the DeFi ecosystem. Users can mint rsETH through [KelpDAO's platform](https://kerneldao.com/kelp/restake/?utm_source=social). **Key metrics:** - 500,000+ ETH restaked - 20,000+ rsETH holders - Built on Eigenlayer infrastructure