Institutional Finance Embracing Blockchain Technology

Institutional Finance Embracing Blockchain Technology

🔑 Institutional Liquidity Unlocked?

Recent developments indicate a growing interest from institutional investors in tokenizing assets and conducting transactions on blockchain networks like Polygon. Major institutions such as Sygnum, Hamilton Lane, and Apex Global Group have launched tokenized funds worth billions of dollars on Polygon's Proof-of-Stake network. This shift towards digitally native finance allows institutions to tap into global liquidity pools and a composable ecosystem of financial products. By tokenizing shares and conducting transactions on-chain, institutions aim to achieve disintermediation, accessibility, and capital and operational efficiencies. This trend suggests that institutional finance is preparing to capitalize on the potential of blockchain technology for composable and aggregated financial products in the future.

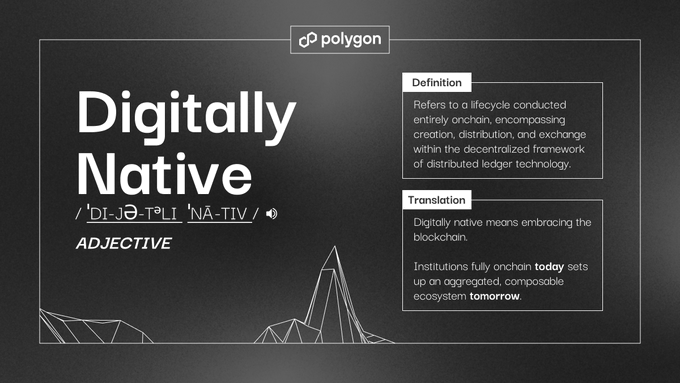

Institutions are getting busy onchain. Why -- Digitally native institutional finance today, aggregated and composable on Polygon networks tomorrow. Let's start with a recap of the institutional adoption on Polygon PoS to date. (intern out)

Tokenization offers many things. Disintermediation, accessibility, capital and operational efficiencies. But a less discussed future state might present the biggest unlock of all - billions in institutional funds becoming liquid and composable. Composable institutional finance.

Historically, institutional developments with tokenized assets have taken place primarily offchain, where a fund is tokenized onchain but the subsequent shares are issued and exchanged via a traditional digital record. But institutional interest is shifting to digitally native.

Polygon Integrates USDT0 with $1.3B Liquidity and 6M Wallets

Polygon has upgraded its canonical PoS USDT to **USDT0**, powered by LayerZero's OFT standard and backed 1:1 by USDT on Ethereum. **Key Features:** - Over $1.3B in USDT liquidity now accessible - 6M+ wallets integrated into the USDT0 ecosystem - Instant settlement with fewer intermediaries - Multihop capability across chains including Unichain, Hyperliquid, and Flare in a single transaction **Additional Development:** Polygon also launched **XAUt0**, an omnichain version of Tether Gold, enabling native gold-backed liquidity for DeFi protocols. This integration eliminates the need for wrapped tokens or traditional bridges, enabling frictionless liquidity for DeFi, P2P payments, and asset-backed finance across multiple chains.

Polygon Partners with Toku to Enable Instant Stablecoin Payroll Across 100+ Countries

Polygon is positioning itself as infrastructure for global payroll by partnering with Toku to enable stablecoin-based payments across 100+ countries. **How it works:** - Companies fund payroll in stablecoins on Polygon - Polygon provides the onchain settlement layer - Toku handles compliance, tax reporting, and employee payouts - Integration with existing HR systems like ADP, Workday, and Gusto The solution addresses friction in the $50 trillion global payroll market, which remains constrained by legacy banking infrastructure. Traditional cross-border payments involve bank fees, delays, and compliance complexity. With blockchain rails, employers can pay thousands of employees in seconds from a single wallet, eliminating intermediary costs and settlement delays. The system maintains compliance requirements while operating onchain. Polygon frames this as part of a broader vision to become "the payments solution for all payments solutions" - positioning the network as open, interoperable infrastructure for global money movement.

Polygon's Single API Simplifies Onchain Money Movement for Companies

Polygon has designed its Open Money Stack as a unified API to streamline how companies move money onchain. **Key Benefits:** - Simplifies the technical complexity of blockchain transactions - Lowers barriers for businesses adopting onchain payments - Addresses real-world financial connectivity challenges Polygon Labs CPO John Egan emphasized that the platform aims to make financial connectivity accessible globally, drawing from personal experiences with cross-border payment difficulties.

🇮🇳 Indian Cities Go Onchain

**Indian institutions are moving critical records to Polygon blockchain** - **BBD University** in Lucknow digitized degrees, ID cards, and certificates - cutting verification errors in half and eliminating fraud - **Three cities** (Amravati, Solapur, Kalyan-Dombivali) moved citizen documents onchain - birth records, permits, tax docs now verify in minutes vs months - **Maharashtra forensic labs** replaced paper trails with blockchain evidence tracking - creating tamper-proof chain of custody - **Festivals and conferences** switched from weeks-long printing processes to instant QR verification The shift creates **transparent, auditable government records** while dramatically reducing costs and processing times.

Polymarket App Returns to US Market After Previous Exit

**Polymarket has officially relaunched** its application for US users, marking a significant return to the American prediction market space. The platform's comeback follows its earlier acquisition of derivatives exchange QCEX in July, which positioned the company for re-entry into the regulated US market. - **Direct access restored** for American users to trade on prediction markets - **Regulatory compliance** achieved through strategic acquisition approach - **Market expansion** signals growing acceptance of prediction market platforms This development represents a major milestone for decentralized prediction markets in the United States, where regulatory clarity has been a persistent challenge for crypto-based platforms.