🐱 HypurrFi Celebrates One Year Anniversary on Hyperliquid EVM Testnet

🐱 HypurrFi Celebrates One Year Anniversary on Hyperliquid EVM Testnet

🐱 HypurrFi's Big Milestone

HypurrFi marks its first anniversary on Hyperliquid's EVM testnet, celebrating a year of active lending operations.

The protocol has maintained consistent yield generation throughout its testnet phase, building a community of users and supporters.

Key highlights:

- One full year of live operations on Hyperliquid testnet

- Continued yield generation for users

- Strong community engagement including users, critics, and builders

Looking ahead, HypurrFi hints at entering the "next phase of lending on Hyperliquid," suggesting potential mainnet deployment or expanded features.

The anniversary comes as Hyperliquid's ecosystem grows, with NFT lending already available through partners like Cyan for popular collections like Hypurr NFTs.

Ready to explore decentralized lending on Hyperliquid's growing ecosystem.

Today is the one year anniversary of HypurrFi live on @HyperliquidX EVM testnet. Yield continues to purrrrrrr. Tremendous gratitude to all users, fudders, supporters, and builders who have come along so far. We hope you're ready for the next phase of lending on Hyperliquid 😻

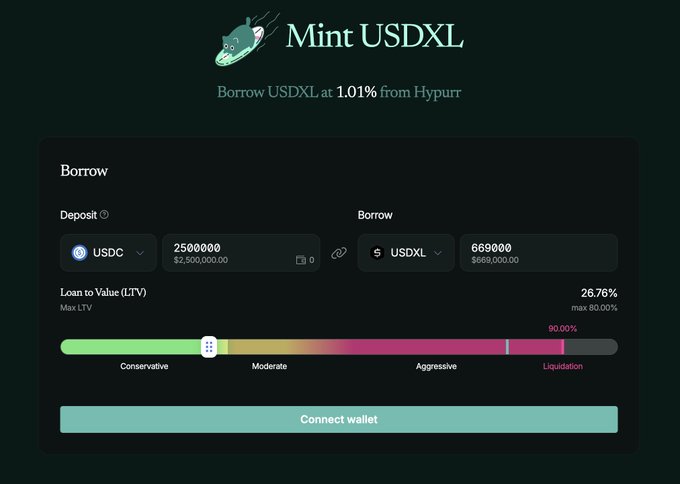

HypurrFi is live on @HyperliquidX testnet. 😺 Yield go purrrrrrrrrrrrrr. Use our gasless faucet for the HyperEVM to play with HypurrFi and $USDXL, and use the free testnet $HYPE for any other dapp on Hyper testnet. Link below ⬇️😻

HypurrFi Clarifies Collateral Standards: No Bowling Shoes Allowed

**HypurrFi has officially stated that old bowling shoes cannot be used as collateral for lending on their platform.** This announcement clarifies the platform's collateral standards and follows their previous statement that "your collateral isn't our business model." **Key Points:** - Old bowling shoes are explicitly excluded from acceptable collateral - The platform maintains specific standards for what assets can secure loans - This reinforces HypurrFi's approach to collateral management The clarification helps users understand what types of assets are acceptable when seeking loans through the protocol.

Moonwell Closes Legacy Markets to New Borrowing, Migrates to Mewler

**Major Platform Changes** - Legacy Markets are now **closed for new borrowing** - Points system removed from Legacy Markets - Existing users can still make repayments, lend, and withdraw collateral - Legacy assets will migrate to Mewler platform (timing TBA) **Moonriver Network Shutdown** Moonwell is deprecating its presence on Moonriver network following Chainlink's decision to end oracle feeds on February 1st. - All markets now have **0% collateral factor** to prevent bad debt - Users with supplied collateral can withdraw anytime - Decision prioritizes user safety For withdrawal assistance, contact [Discord support](https://discord.com/invite/moonwellfi)

HypurrFi Integrating EulerSwap Tool into Mewler Markets on Hyperliquid EVM

**HypurrFi is preparing to launch EulerSwap**, a tool from Euler Finance, within its Mewler Markets platform on Hyperliquid EVM. **Background Context:** - HypurrFi recently deployed Mewler in partnership with Euler Finance, with Earn Vault curation by Clearstar Labs - The platform offers **Mewler Classic** at [mewler.hypurr.fi](https://mewler.hypurr.fi) for users familiar with the Euler Finance interface - This integration expands Mewler's DeFi toolset on the Hyperliquid ecosystem **What This Means:** The EulerSwap addition will bring established DeFi swap functionality to Hyperliquid's EVM environment through the Mewler platform.

HypurrFi Launches Lending Protocol on Hyperliquid

**HypurrFi has launched its lending protocol on Hyperliquid**, enabling users to deposit stablecoins and other assets to earn yield. **Key features:** - Lenders deposit assets to earn returns from borrower interest - Traders can borrow funds to increase position sizes without liquidating holdings - Yield comes from actual borrower demand, not token emissions - Multiple market types available: Earn Vaults, pooled markets, and legacy isolated markets The platform allows users to lend into markets or borrow for leverage strategies while earning HypurrFi Points. Both lending and borrowing functions are now live across all supported market types.

🎯 Signal Capital Bias

HypurrFi co-founder [@androolloyd](https://x.com/androolloyd/status/1944348492198989871) introduces the concept of **signal capital bias** - a phenomenon now materializing as predicted. This builds on earlier warnings about engineered hype cycles: - Undisclosed KOL deals and OTC allocations - Whale-driven pumps disguised as organic momentum - Retail investors often arrive after insiders position **Key questions before investing:** - Why is this trending *now*? - Who actually benefits from this narrative? The pattern suggests market signals are increasingly manipulated before reaching mainstream awareness.