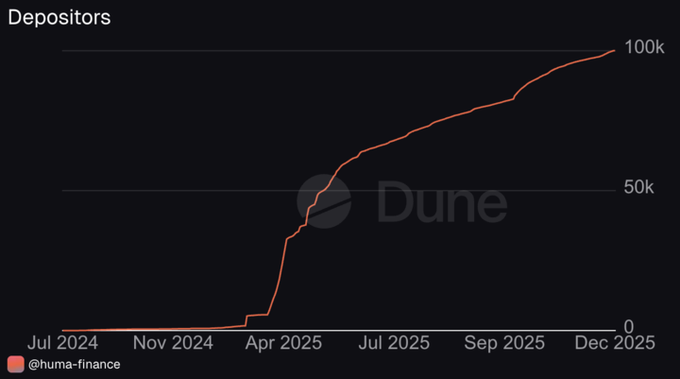

Huma Finance has reached 100,000 depositors on its PayFi platform, marking a significant milestone for the protocol.

The platform continues delivering sustainable USDC yield on Solana, backed by real-world payment flows between financial institutions.

Key metrics:

- 100K+ depositors ("PayFi believers")

- $8B+ in total transaction volume

- 19x growth since Huma 2.0 launch in April

- Institutional-grade yield regardless of market conditions

Huma's PayFi network accelerates cross-border payments, merchant payouts, and card settlements by connecting payments with on-chain liquidity.

The protocol emphasizes that its yield comes from real-world transactions, not speculative trading, providing sustainable returns during both bull and bear markets.

Yield, privacy, and (still) stablecoins remain some of the hottest topics right now. At PayFi Summit, @GillianDarko from @yellowcard_app unpacked how stablecoins are solving real-world challenges in Africa: - Hedging against currency and market volatility - Reducing high

Trillions move daily, yet it still takes day to settle. PayFi isn't just a concept, it's live with $7.7B+ transactions. Huma's yield is backed by real-world payment flows between financial institutions. Real Yield Szn

$8B in PayFi transactions! Huma is scaling fast 🚀 $8B+ in total transaction volume 👤 97K+ depositors 💧 Institutional liquidity. Institutional yield On @solana.

Huma Finance Announces New Yield Structure with 8% USDC APY

Huma Finance has revealed its updated yield breakdown for users: **Key Rates:** - Institutional-grade USDC APY: **8%** - Defensive looping APY: **5-7%** (applies to all current Prime positions, subject to periodic adjustment) - Additional Huma rewards available based on OG status, Vanguard multipliers, and staked $HUMA The defensive looping rate applies to existing Prime positions and may be adjusted periodically. Variable rewards are available for users with special badges and staked tokens. This represents a shift from the previous Classic base APY of 9% announced in October 2025, which offered up to 25.9% total APY with maximum multipliers. [View announcement](https://x.com/humafinance/status/2008135356114505730?s=20)

🎯 Huma Hits $10B in PayFi Transactions, Opens Prime Vault to Public

Huma Finance has reached $10 billion in PayFi transaction volume on Solana, marking 3.4x year-over-year growth from $2.9B. The milestone comes with zero defaults across all transactions. **Key Developments:** - **Huma Prime** vault now open for public deposits, offering up to 26% APY through a Defensive Looping strategy - Yields backed by real-world payment flows via PayFi Strategy Token ($PST) - Partnerships with Jupiter and Kamino for liquidity deployment **2026 Goals:** - Scale to $25B+ total transaction volume - Reach $500M+ in total active liquidity - Embed PayFi into major payment networks - Expand into trade finance The protocol has grown from 5K to 97K depositors since launching Huma 2.0 in April. Major payment companies including PayPal, Western Union, Revolut, and Fiserv are building on Solana's PayFi infrastructure, which has seen 755% YoY growth in total payments volume.

Stablecoin Volume Hits $10T as Huma Powers USDC Infrastructure

**Stablecoin transaction volume reached $10T in January 2026**, with USDC processing over $8T of that total. **Huma's three-year journey with USDC:** - 2023: Partnered with Circle to deliver USDC liquidity solutions - 2024: Scaled partners like ARF and Raincards, achieving $1B in total transaction volume - 2025: Advocated for the GENIUS Act and became the first embedded credit solution for Circle's payments network Huma's on-demand liquidity infrastructure has grown alongside institutional adoption of stablecoins. The platform now serves as a **liquidity engine for real-world USDC applications** including: - Cross-border payments - Card programs - Merchant payouts - Trade finance

Huma Announces $10B PayFi Milestone and New Product Launches at Catlumpurr

At Catlumpurr Day 3, Huma co-founder Erbil outlined the company's roadmap toward $10 billion in PayFi transactions and announced several product developments. **Key Announcements:** - New ODL (on-demand liquidity) product launching - Embedded PayFi infrastructure for scaling user onboarding - Strategic focus on rare earth minerals financing - PST/JupUSD lending caps reached capacity within minutes of opening - JupSOL integration coming to Huma Reserve - Partnership with Jupiter Global for everyday payment solutions The presentation addressed current inefficiencies in traditional money movement systems and positioned PayFi as an alternative infrastructure for financial transactions.

PayFi Momentum Expands from U.S. to Middle East as Institutional Demand Surges

**PayFi adoption accelerates globally** as institutional and payment sector demand grows significantly following recent regulatory developments. Key developments from Binance Blockchain Week: - **Genius Act** unlocked major institutional interest in PayFi solutions - **Geographic expansion** from U.S. markets into Middle East regions - **T+0 settlements** positioned as the future standard for payment processing The momentum represents a shift toward **instant settlement infrastructure** that could reshape traditional payment financing systems.