Houdini Swap APY Increases to 11% as Weekly Volume Hits $22.6M

Houdini Swap APY Increases to 11% as Weekly Volume Hits $22.6M

🔥 APY Just Got Juicier

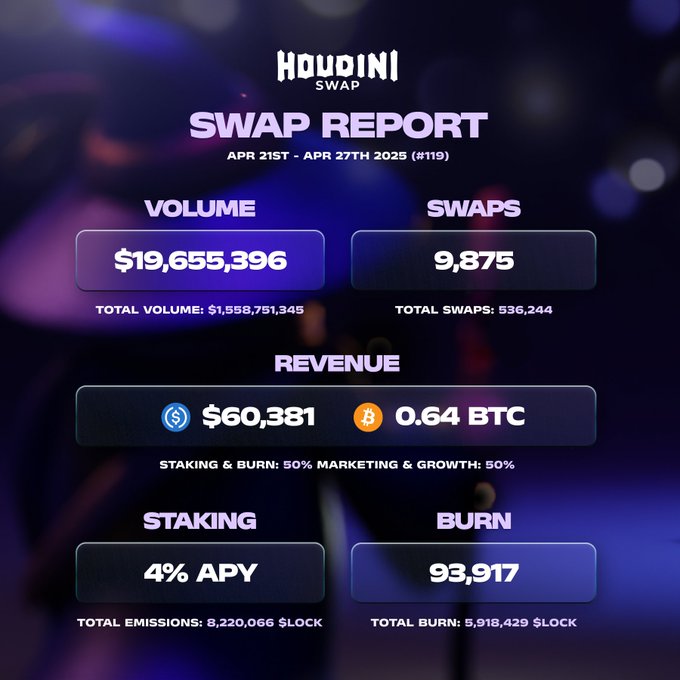

Weekly Performance Metrics:

- Volume: $22.6M

- Total Swaps: 9,629

- Revenue: $71.7K USDC / 0.65 BTC

- LOCK Tokens Burned: 212,987

Cumulative Statistics:

- Total Volume: $1.65B

- Total Swaps: 574,279

- Total LOCK Burned: 6.63M

Notable Changes:

- APY increased from 9% to 11% this week

- Volume decreased 27% from previous week ($30.9M)

- Burn rate increased by 19% (from 179,241 LOCK)

Stake your LOCK tokens to earn 11% APY.

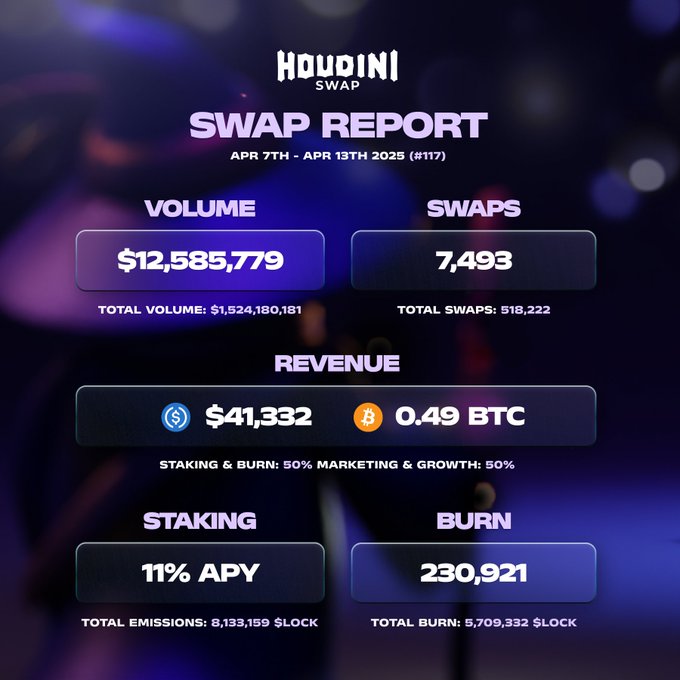

Another 230,921 $LOCK burned and gone for good. 🔥 TX: 0xca5acecf879e65c398a630255cdbea3e3227d7fb28dbb29626ebc3dae25140d5 Track all burn stats and more on our Dune dashboard 👇 dune.com/whale_hunter/h…

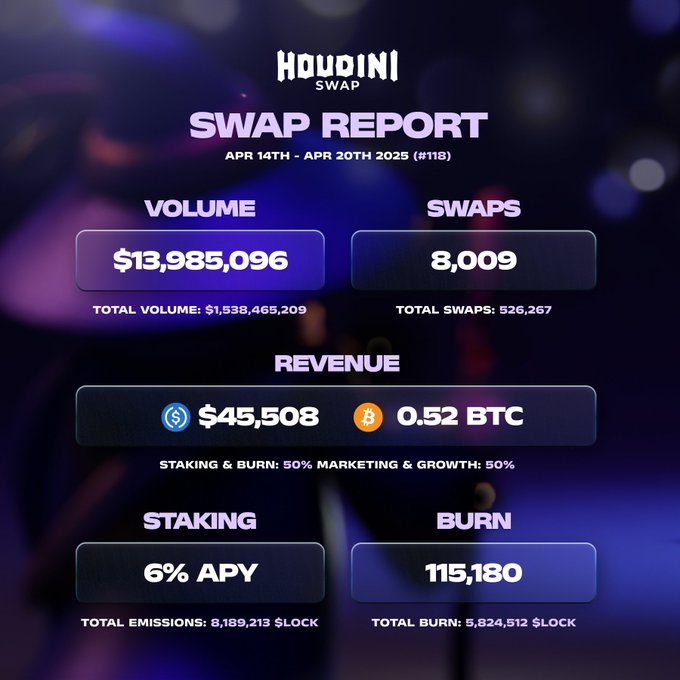

🔥 Weekly Burn 🔥 Another 115,180 $LOCK sent to the void. TX: 0xb5e274a6028c6b7ae7c708b5e107eb62194aebf127346529d9acb2932701f54d Follow the full burn trail on our Dune dashboard 👇 dune.com/whale_hunter/h… 🧙♂️🔥

✨ Weekly Swap Report #122✨ • Volume: $30,960,875 • Swaps: 10,069 • Revenue: $94,369 USDC / 0.91 BTC • Burn: 179,241 LOCK 📈 Total Vol: $1,630,365,952 📈 Total Swaps: 564,737 Stake $LOCK for 9% APY 🧙♂️ houdiniswap.com/staking-dashbo…

✨ Monthly Swap Report ✨ Monthly Stats: 🔵 Volume: $76,006,475 🔵 Swaps: 39,873 🔵 Revenue: $291,289 Weekly Stats: 🟣 Volume: $15,484,348 🟣 Swaps: 8,221 🟣 Revenue: 0.61 BTC / $50,572 🔥 Burn: 77,093 $LOCK Totals: 📈 Swap Volume: $1,512,262,349 📈 Swap Count: 510,899 🔒

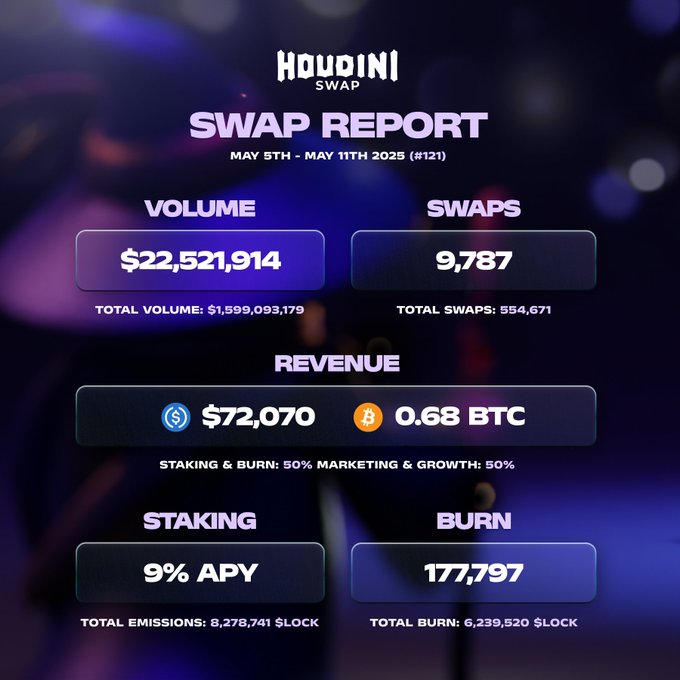

✨ Weekly Swap Report #123 ✨ • Volume: $22,649,101 • Swaps: 9,629 • Revenue: $71,707 USDC / 0.65 BTC • Burn: 212,987 LOCK 📈 Total Vol: $1,652,601,878 📈 Total Swaps: 574,279 🔥 Total Burn: 6,631,762 Stake your $LOCK for 11% APY this week 🧙♂️

SOL Reclaims Top Position in Weekly Token Rankings

**Solana (SOL) has returned to the #1 spot** in last week's top-performing tokens rankings. The blockchain's native token regained its leading position after previously losing ground to other cryptocurrencies. This marks a significant comeback for SOL in the weekly performance metrics. - SOL demonstrates renewed market strength - Weekly token rankings show shifting dynamics - Solana ecosystem continues to attract attention The return to the top position suggests **renewed investor confidence** in the Solana network and its capabilities.

Houdini Swap Erases 0.3% of Token Supply in Single Week Through Buybacks

**Houdini Swap executed massive buybacks**, removing nearly 0.3% of total token supply in just one week. This follows a pattern of aggressive supply reduction: - **October**: 2.42% of circulating supply bought back in one week - **December**: 0.3% of entire supply eliminated **Supply reduction at this scale** suggests strong revenue generation and commitment to tokenomics. The consistent buyback program indicates sustainable business operations. The phrase *"See the writing on the wall?"* hints at significant developments ahead for the privacy-focused protocol.

🎭 Houdini Pay Launches Private Payments on Polkadot

**Houdini Pay has launched private payment functionality on Polkadot**, addressing wallet privacy concerns in crypto transactions. **Key features:** - Create payment links without exposing wallet addresses - Recipients can accept payments without doxxing their wallets - Payers can settle using any asset of their choice - Zero wallet exposure for both parties The service eliminates the need for burner wallets or address exposure during crypto payments. Users can generate payment links at [houdiniswap.com/pay](http://houdiniswap.com/pay) and share them with clients or customers. **Real-world usage** has already been demonstrated with a $5K invoice payment, where both sender and receiver maintained complete wallet privacy while transacting across different blockchain networks. This launch represents a step toward more private and user-friendly crypto payment solutions.

Houdini Swap Reports $99.7M Monthly Volume with 51,585 Swaps

**Monthly Performance** - Volume: $99,747,913 - Swaps: 51,585 - Revenue: $296,654 **Weekly Highlights** - Volume: $15,744,380 - Swaps: 7,343 - Revenue: $47,079 USDC / 0.54 BTC **Token Burns & Milestones** - Weekly burn: 276,819 LOCK tokens - **Total platform volume**: $2.31 billion - **Total swaps**: 855,336 - Total burns: 15.6 million LOCK **Community Winner** @Cherrypoppie7 won this week's contest and will receive $LOCK tokens.

Magic Monday #150 to Cover Privacy Tools for Mass Crypto Adoption

**Magic Monday #150** is scheduled to discuss privacy tools essential for cryptocurrency mass adoption alongside the regular monthly report. The event offers participants a chance to **win 300 $LOCK tokens** by liking, retweeting, and attending the session. - Focus on privacy infrastructure needed for broader crypto acceptance - Monthly updates and community discussions included - Interactive format with token rewards for engagement The session continues the series' tradition of exploring privacy-focused blockchain solutions and their role in mainstream adoption.