Hong Kong Stablecoin Regulation Set for August 2025

Hong Kong Stablecoin Regulation Set for August 2025

🇭🇰 HK's Crypto Plot Thickens

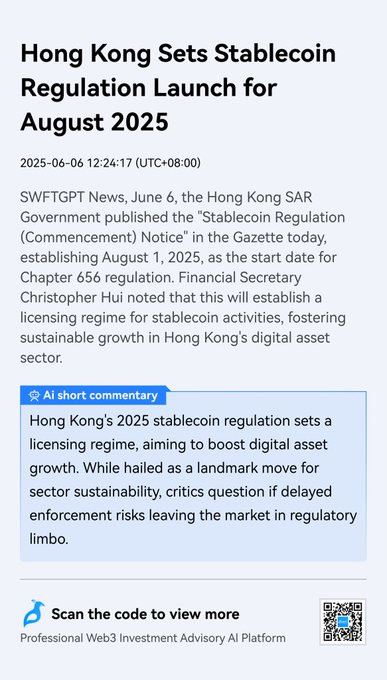

Hong Kong is implementing comprehensive stablecoin regulations through Chapter 656, scheduled to take effect in August 2025. The initiative, which has been in development since 2023, introduces a new licensing framework aimed at fostering digital asset market growth.

Key points:

- New regulatory framework under Chapter 656

- Implementation date: August 2025

- Focus on stablecoin oversight and market development

- Part of ongoing crypto regulatory efforts since 2023

This marks a significant step in Hong Kong's push to become a major digital asset hub.

🚨 Hong Kong sets the stage for stablecoin regulation starting Aug 2025! 📜 Chapter 656 introduces a licensing regime to boost digital asset growth.

Major Crypto Updates: Circle's L1, BitMine's ETH Plans, Chainlink Surge, and Do Kwon Plea

**Circle** launches Arc, a stablecoin-focused L1 blockchain using USDC as native gas. Testnet launches this fall, mainnet in 2026. **BitMine Immersion** receives SEC approval for $20B ETH purchase plan. Currently holds 1.15M ETH, targeting 5% of supply. Backed by major firms including Thiel's Founders Fund. **Chainlink** experiences significant growth (+42% weekly) following ICE partnership for forex/metals pricing and new buyback program. **Do Kwon** pleads guilty in TerraUSD collapse case, forfeiting $19.3M in assets. Faces up to 12 years; sentencing scheduled for December 11.

AI Compute Emerges as New Revenue Stream for Crypto Miners

TeraWulf's partnership with Fluidstack signals a significant shift in mining revenue models, potentially generating up to $8.7B through AI compute services. Google has strengthened this trend with a $1.8B investment deal, securing an option for 8% stake in TeraWulf. Key developments: - TeraWulf x Fluidstack partnership targets AI compute market - Google's $1.8B backstop deal shows tech giants' growing interest - Traditional miners diversifying beyond crypto mining This marks a strategic pivot for mining companies seeking sustainable revenue streams while maintaining their core operations.

Daily Web3 Community Update - August 14, 2025

The web3 community continues its daily tradition of morning greetings. Today's gm features a sun with face emoji (:sun_with_face:), marking a slight variation from the usual sunny emoji pattern seen in recent weeks. This is the third appearance of the sun with face emoji in the past few months, previously seen on July 14 and June 9, 2025. - Pattern shows consistent community engagement - Regular daily greetings maintain since February 2025 - Mix of gm/gm and gm frens variations - Predominantly sunny weather emojis

SWFTC Token Listed and Searched on Coinbase

The SWFTC token has been generating attention on Coinbase, with multiple listing-related events spanning from October 2024 to August 2025. - Initial Coinbase listing confirmed in November 2024 - Subsequent trading activity noted in August 2025 - Token appears to maintain active presence on the exchange SWFTC is the native token of SWFT AllChain Bridge, a cross-chain swap platform enabling one-click token and NFT exchanges across multiple blockchains.

Circle Announces Arc: A New Layer 1 Blockchain for Stablecoins

Circle, the company behind USDC, has announced plans to launch Arc - a dedicated Layer 1 blockchain specifically designed for stablecoin operations. The new blockchain aims to enhance transaction speeds and privacy features in stablecoin transfers, potentially accelerating mainstream adoption. Key features: - Purpose-built for stablecoin transactions - Enhanced privacy capabilities - Improved transaction speeds - Focus on trust-minimized operations This development could significantly impact global financial infrastructure by streamlining stablecoin operations.