Harvest Finance's wETH Autopilot Sees $1M Inflow as Performance Data Shows Success

Harvest Finance's wETH Autopilot Sees $1M Inflow as Performance Data Shows Success

🤖 Autopilot Just Got Richer

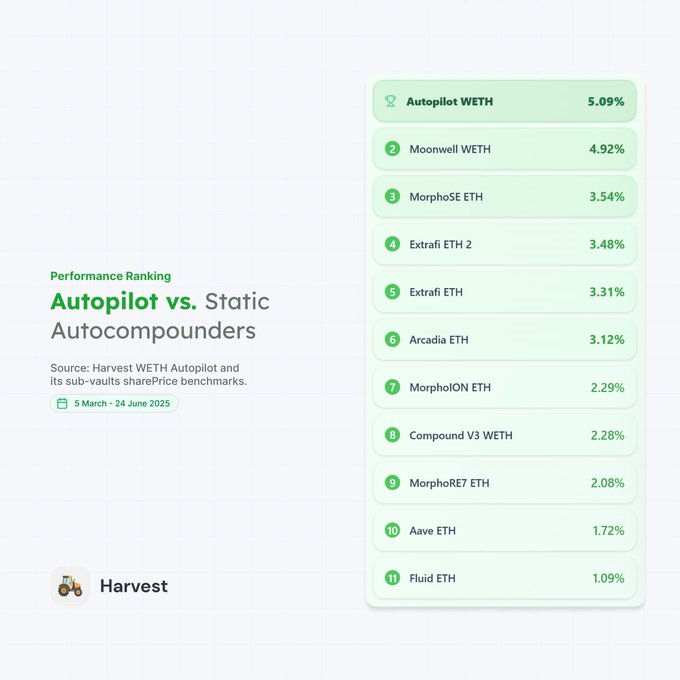

Harvest Finance's wETH Autopilot received a significant boost with a 455 ETH (approximately $1M) inflow this morning. The platform's automated rebalancing system has demonstrated superior performance compared to static yield sources.

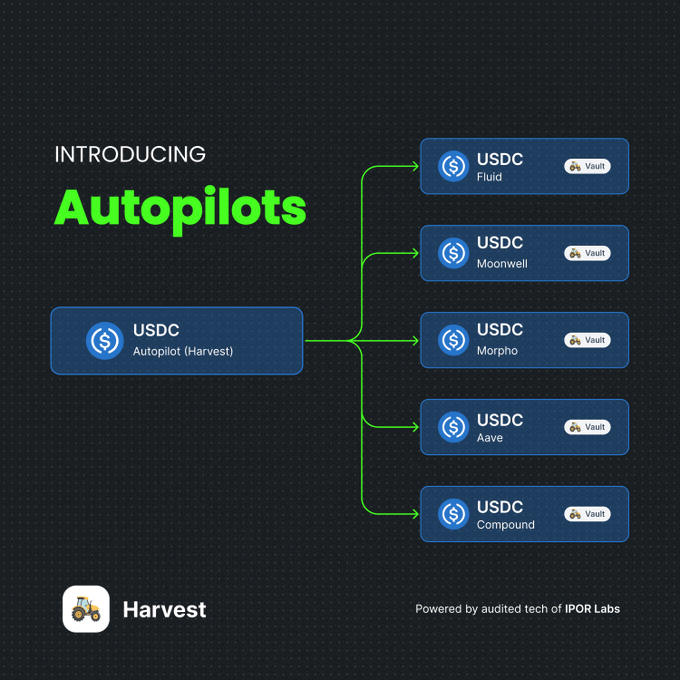

The Autopilot product line, launched in April 2025, has grown to $2.6M TVL and attracted over 400 wallets in 50 days. It leverages @ipor_io's rebalancing engine and Harvest's proven infrastructure to automatically optimize yield across multiple sources including:

- Aave

- MorphoLabs

- Euler Finance

- Moonwell

- Compound

- 0xfluid

- ExtraFi

- Arcadia

- 40acres Finance

The system is fully permissionless and open for integration by any project or platform.

455 ETH (~$1M) inflow into wETH Autopilot this morning. Autopilot's rebalancing outperforms static yield sources over time, and we've got data to prove it ↓

Autopilots are now live on @base for USDC, wETH & cbBTC. → app.harvest.finance/autopilot Supply once - Autopilots automatically allocate to the best-performing vaults 24/7. Extra performance boost for 6 weeks! Details ↓

🚀 Harvest's USDC Autopilot Outperforms All Morpho Vaults Over 6 Months

Harvest Finance's **USDC Autopilot for Morpho** has demonstrated superior performance over the past six months, beating all individual V1 and V2 yield sources it connects to. **Key Features:** - Single entry point to the entire Morpho ecosystem (V1 & V2) - Automated 24/7 detection and routing to top-performing vaults - Integrates curated vaults from Gauntlet, Steakhouse, Anthias, Spark, Yearn, and Re7 Labs - Automatic reward claiming and compounding **How It Works:** The Autopilot continuously monitors and reallocates USDC across multiple Morpho deployments, eliminating the need for manual vault selection and monitoring. Users supply once and the system handles optimization automatically. **Performance:** Historical data shows the Autopilot (green line) consistently outperforming individual vault options, providing higher yields through intelligent rebalancing. Ideal for users seeking maximum USDC yields on Morpho without active management. [Access USDC Autopilot](http://app.harvest.finance/?asset=autopilot)

🤖 Harvest's Autopilot Strategy Goes Public After 6 Months of Testing

**Harvest Finance is launching a new automated yield strategy** that has been running privately for over six months. **Key Performance Metrics:** - Tested through volatile market conditions for 6+ months - Steady upward share price trajectory - Powered by IPOR's automation engine - Previously demonstrated 345 days of consistent operations on Base **What This Means:** The strategy automatically routes capital to highest-yielding opportunities, similar to the existing Autopilot USDC product that has served hundreds of users on Base. The share price growth indicates the automation has successfully navigated market volatility while generating returns. The product will be available to the public following its extended private testing period.

🌾 ETH Arcadia Autocompounder Tops DefiLlama Rankings

The **ETH Arcadia Autocompounder** has emerged as the top-performing ETH product on DefiLlama, attracting attention from yield farmers. **Recent Performance:** - 30-day track record shows steady growth - Jan 15, 2026: 1.01854 - Feb 13, 2026: 1.02510 The [Arcadia Finance](https://arcadia.fi) WETH Autocompounder has been gaining traction among farmers seeking consistent returns. The product's performance metrics have positioned it at the top of DefiLlama's ETH product rankings. Early adopters identified the opportunity in mid-February, with the autocompounder demonstrating reliable yield generation over the past month.

40acres Finance Autocompounder Doubles User Base to 648 Wallets in One Week

**40acres Finance** sees explosive growth as their **Autocompounder reaches 648 wallets** - a **100% increase** in just one week. The USDC-based farming tool on **Base network** has doubled from 300+ users, showing strong adoption momentum. - Platform offers **auto-harvested OP Rewards** - Built on Base blockchain for USDC farming - Growth accelerated from previous week's milestone The rapid user acquisition suggests growing interest in **automated yield farming** solutions as DeFi users seek passive income strategies.

Harvest Finance Completes Receipt Token Distribution for Silo Liquidity Crisis

**Harvest Finance has completed distributing receipt tokens** to users affected by the November 2025 liquidity crisis involving Silo, Stream Finance, and StablesLabs. **Key developments:** - Users now hold **bUSDC-127** and **Varlamore USDC Growth** tokens directly in their wallets - Tokens are visible in portfolio trackers like **DeBank** under the Silo section - Receipt tokens represent users' share of underlying USDC positions on Silo protocol **Two recovery paths available:** 1. **Direct control** - Users can manage positions directly through Silo once liquidity improves 2. **Registry inclusion** - Harvest vault contracts are listed in [Silo Labs' official registry](https://silofinance.medium.com/registry-of-lenders-impacted-by-stream-and-stable-labs-incidents-19c6b1f13a5b) If Stream Finance or Stable Labs provide restitution through the registry, **proceeds will be distributed to users** according to Harvest's [published framework](https://github.com/harvestfi/silo-share-distributions/blob/main/harvest-silo-share-distributions.pdf). **Distribution transactions** were executed in batches for both Harvest vault users and Autopilot users, with all transaction links provided for transparency. Harvest continues monitoring official communications from affected protocols and will share verified updates as they become available.