Gyroscopic, a project focused on developing a unique stablecoin design, has announced a collaboration with Arbitrum and received a grant from Balancer. The project aims to create passive elliptical concentrated liquidity pools and an all-weather resilient stablecoin. This partnership and funding will support the development of Gyroscopic's innovative stablecoin solution built on the Balancer protocol.

Passive elliptical concentrated liquidity pools + Unique all-weather resilient stablecoin design + $ARB grant. @GyroStable 🤝 @arbitrum #BuiltOnBalancer

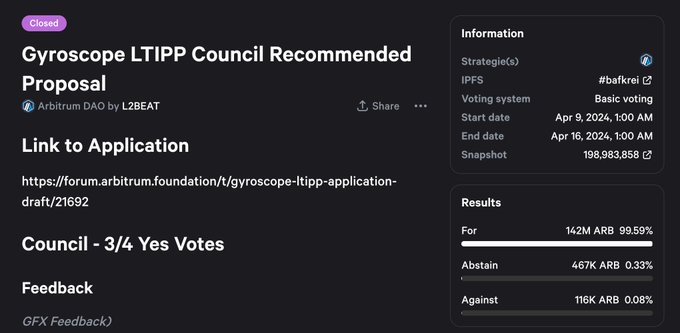

Gyroscope's LTIPP proposal passed @arbitrum governance with 142m ARB voting in favor. 100k ARB tokens will incentivize the growth of GYD and E-CLPs on Arbitrum. Gyroscope is excited to contribute its unique mix of resilience, liquidity, and capital efficiency to Arbitrum DeFi.

Balancer V3 Launches Three-Token Stablecoin Pool on Monad

Balancer V3 has deployed a three-token stablecoin pool on Monad, combining AUSD, USDC, and USDT0 in a single liquidity pool. **Key Features:** - First three-stablecoin pool enabled by Balancer V3 technology - Provides deep liquidity for AUSD stablecoin - Combines swap fees with lending yield for liquidity providers - Operates as both a stable and boosted pool The pool is now live and accessible at [balancer.fi](https://balancer.fi/pools/monad/v3/0x2daa146dfb7eaef0038f9f15b2ec1e4de003f72b). This deployment showcases V3's capability to handle multi-token stable pools, offering traders tighter spreads and liquidity providers additional yield opportunities beyond traditional two-token pairs.

Monad Enables Scalable Multi-Token Pools with Sub-Second Finality

**Monad's infrastructure breakthrough enables complex DeFi operations at scale.** The platform delivers: - **Sub-second finality** for near-instant transaction confirmation - **Parallel execution** allowing multiple operations simultaneously - **Cost-efficient multi-token pools** that remain practical at scale This technical foundation removes the latency and cost barriers that previously made complex pool operations inefficient on other chains. The infrastructure is purpose-built to support ambitious DeFi protocols requiring high throughput and low costs. Monad's approach addresses a core challenge in decentralized finance: maintaining performance as complexity increases.

Neverland Money Enables Dual-Yield Stablecoin Pool with Active Lending Deployment

A new liquidity pool integrates wrapped tokens from Neverland Money, allowing stablecoins to simultaneously generate lending yields while remaining available for trading. **How it works:** - Deposited stablecoins are actively deployed to lending protocols - Assets remain liquid and available for swaps at all times - When trades occur, the pool withdraws necessary amounts and redeploys excess capital **Yield sources:** - Swap fees from trading activity - Lending yields across all three pool assets This approach addresses a common DeFi tradeoff by enabling liquidity providers to earn from both trading fees and lending markets without sacrificing capital efficiency.

Stable Pools Optimize Trading for Assets Near Parity

**Stable Pools** are designed specifically for assets that trade close to equal value, like stablecoins pegged to the same dollar amount. **How it works:** - StableSwap math concentrates liquidity where trading actually occurs - Three stablecoins tracking the same value can trade with minimal slippage - Handles correlated assets (stablecoins and liquid staking tokens) with tight spreads **The advantage:** Assets that should trade near parity get the liquidity depth they need, without gas costs limiting activity. This represents genuine capital efficiency - liquidity is positioned exactly where it's most useful for traders. The approach benefits both liquidity providers and traders by reducing wasted capital on price ranges that rarely see activity.

🪙 Agora's AUSD Stablecoin Joins Major Stable Pool

**AUSD enters multi-stablecoin pool** Agora's AUSD stablecoin, with a $200M market cap and reserves managed by VanEck, has been combined into a stable pool alongside USDC and USDT. - AUSD: Fully-backed stablecoin by Agora - USDC: Backed by Circle - USDT: Backed by Tether The three major stablecoins are now pooled together, creating a unified liquidity solution. This follows AUSD's previous expansion across multiple blockchain networks including Plasma, Berachain, Citrea, Initia, and Sei Network.