GMX's WIF and PEPE Markets Lead in Performance

GMX's WIF and PEPE Markets Lead in Performance

🚀 Meme coins making moves

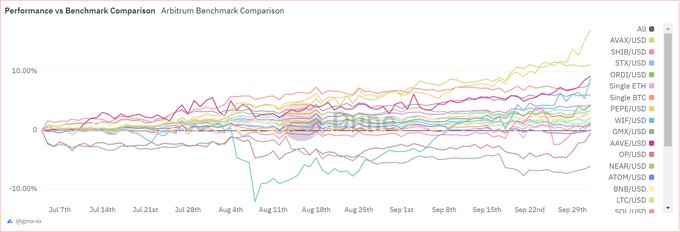

GMX's WIF and PEPE markets on Arbitrum are currently top performers for GM liquidity providers. These pools offer exceptional rewards due to high utilization.

- @pepecoineth and @dogwifcoin pools outperformed 50/50 LP positions over 3 months

- Most GM pools outperform rebalancing 50/50 counterparts

- BTC/USD [BTC] pool offers ~10% annual returns on Bitcoin

- Zero price impact on BTC/USD [BTC] and ETH/USD [WETH] pools increased volume and rewards

LP Exposure in GM pools:

- Price movements of underlying assets

- Trader PnL when market isn't 50:50 balanced

- Fees from pool at listed reward rate

Note: Returns on app.gmx.io/#/pools/ exclude price changes and trader PnL.

GMX V2's GM pools generated nearly $66 Million in revenue over 13 months.

Learn more: http://app.gmx.io

The WIF and PEPE markets on GMX on #Arbitrum have recently been the top performers for GM liquidity providers. The rewards earned in these two pools are exceptional due to their high utilisation — traders love memes. Trade PEPE or WIF permissionlessly on-chain, or provide

GMX Expands to MegaETH for Real-Time Perpetual Trading

**GMX is deploying on MegaETH**, a new blockchain designed for real-time trading with sub-10-millisecond blocks and 100,000+ TPS capacity. **Key features of the deployment:** - Full launch in early February following MegaETH mainnet - Complete suite available from day one: perpetual trading, swaps, GLV, leaderboard, and referral system - Enables previously impossible onchain strategies including HFT, CEX-level arbitrage, and institutional-grade execution **GMX's track record:** - 4+ years of operation - $350B+ in processed volume - 745,000+ traders served - 40,000+ liquidity providers MegaETH's technical infrastructure includes 10ms blocks (targeting 1ms), ultra-low latency, in-memory computation, and optimized EVM execution. The combination aims to bring institutional-grade perpetual trading onchain with real-time responsiveness and complex DeFi composability without performance degradation.

GMX Labs Seeks 2026-2027 Funding Through DAO Vote

GMX Labs has submitted a funding proposal for the 2026-2027 period, now live for voting on Snapshot. **Key Details:** - Tokenholders can cast their votes on the proposal - Vote accessible at [Snapshot](https://snapshot.box/#/s:gmx.eth/) - Follows previous governance activity, including an August 2025 proposal for GMX-Solana expansion The proposal represents a standard governance process for the decentralized exchange protocol, allowing token holders to decide on operational funding for the next two years.

🔄 IP/USD Perpetual Swap Now Live with 25x Leverage

A new perpetual swap for IP/USD is now available for trading. **Key Details:** - Trade Story Protocol's token with up to **25x leverage** - Available across **four chains**: Arbitrum, Base, BNB Chain, and Ethereum Mainnet - Traders can take long or short positions on $IP The perpetual swap enables leveraged trading of Story Protocol's native token across multiple networks, expanding access for onchain traders.

GMX Launches LIT/USD Perpetual Market with 25x Leverage Across Four Chains

GMX has introduced a new **LIT/USD perpetual trading market** available on Ethereum, Arbitrum, Base, and BNB Chain. **Key Features:** - Up to **25x leverage** trading - Fair pricing powered by [Chainlink Data Streams](http://chainlink.com) - Risk parameters optimized by Chaos Labs Edge Risk Oracle - User-provided liquidity model with **45,000+ liquidity providers** - LPs earn from three fee sources - Competitive trading fees with fast onchain execution The market leverages GMX's existing infrastructure, which includes price impact capped at 0.5%, coin-margined perpetuals, and features like TWAP orders and depth charts. Trade now at [app.gmx.io](http://app.gmx.io)

GMX Launches Gold Trading with Bitcoin Collateral Across Six Chains

GMX has introduced a new **XAUT/USD perpetual market** for trading Tether Gold with up to **25x leverage**. **Key Features:** - Available across **six blockchains**: Arbitrum, Ethereum, Base, BNB Chain, Solana, and Avalanche - Backed by **BTC-USDC liquidity**, allowing traders to use Bitcoin as collateral - Enables simultaneous exposure to both gold and Bitcoin price movements This synthetic perpetual contract expands GMX's asset offerings beyond traditional crypto markets. The cross-chain functionality allows users to trade from their preferred network while settling on Avalanche. The market uses XAUT, Tether's gold-backed token where each token represents physical gold reserves. Two liquidity pools support trading: a single-asset XAUT pool and a dual-asset XAUT-USDT pool. Traders can now access precious metals exposure while maintaining crypto collateral positions.