GMX V2 offers deep on-chain liquidity for trading assets like Chainlink's LINK and Solana's SOL

GMX V2 offers deep on-chain liquidity for trading assets like Chainlink's LINK and Solana's SOL

GMX V2 provides liquidity pools for trading assets like Chainlink's LINK and Solana's SOL. The SOL/USDC pool has a TVL of $16.2 million and the LINK/USDC pool has close to $10 million of liquidity. The liquidity providers in GMX V2 are well-compensated for the risks they take. GMX also offers synthetic pools for assets like DOGE, LTC, and XRP. The GMX V2 markets for SOL and LINK are resilient and scalable due to their reliance on non-synthetic assets.

GMX will take part in #ArbitrumFrontier 🧑🚀💙, to encourage users to get familiar with various useful DeFi protocols on the high-speed @Arbitrum layer-2 blockchain. With $ARB incentives from the DAO's STIP Grants being distributed, now is the ideal time to explore Arbitrum...

GMX V2 offers deep on-chain liquidity to trade assets like @Chainlink's $LINK and #Solana's $SOL. The SOL/USDC GM pool on @Arbitrum has 16,2 million USD in TVL, while the LINK/USDC pool offers close to 10m USD of liquidity. 🔹View the GM pools at: app.gmx.io/#/earn 1/5

The total value locked in the $GM pools of GMX V2 is soaring, crossing 220 million today on #Arbitrum. Thanks go out to all the liquidity providers supporting the GMX protocol. Trade with this deep on-chain liquidity, and low trading fees, at: 🔹 app.gmx.io

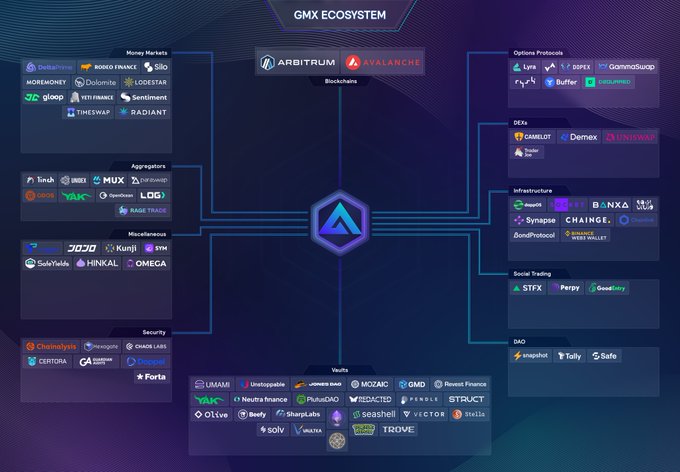

The GMX ecosystem is steadily expanding. With its deep liquidity, the protocol functions as a base layer for #DeFi on the @Arbitrum and @Avalanche blockchains. A sincere thanks to everyone building added-value instruments on top of the $GM Pools, $GLP, and GMX's trading system.

Epoch 6 of GMX's @Arbitrum Incentives starts, with: 🔹 VIP-level fees for all GMX V2 traders Traders enjoy a rebate of up to 75% of all open & close fees, for an effective fee of just ~0.015%. 🔹Liquidity Incentives on all GM pools Trade or LP at: app.gmx.io 1/5

Epoch 5 of GMX's @Arbitrum STIP Incentives has started. This week, all GMX users benefit from: 🔹 Low trading fees, equal to the VIP tiers of centralised exchanges 🔹 Boosted APRs on all the GM liquidity pools of GMX V2 🔹 Incentives to move GLP liquidity to the GM pools 1/4

GMX Labs Leadership Update Proposal Goes to Vote

GMX has launched a new governance proposal on Snapshot titled **"GMX Labs Leadership Update"** for tokenholder voting. This follows a series of recent governance activities: - A **GMX Labs Funding Proposal (2026-2027)** advanced to Phase 4 on Tally - Proposals addressing CEX supply concerns and price discovery mechanisms - Dynamic BBD adjustment proposals for APR capping - Marketing and trader incentive programs Tokenholders can cast their votes at [Snapshot](https://snapshot.box/#/s:gmx.eth/)

GMX Launches Gold Trading with Bitcoin Collateral Across Six Chains

GMX has introduced a new **XAUT/USD perpetual market** for trading Tether Gold with up to **25x leverage**. **Key Features:** - Available across **six blockchains**: Arbitrum, Ethereum, Base, BNB Chain, Solana, and Avalanche - Backed by **BTC-USDC liquidity**, allowing traders to use Bitcoin as collateral - Enables simultaneous exposure to both gold and Bitcoin price movements This synthetic perpetual contract expands GMX's asset offerings beyond traditional crypto markets. The cross-chain functionality allows users to trade from their preferred network while settling on Avalanche. The market uses XAUT, Tether's gold-backed token where each token represents physical gold reserves. Two liquidity pools support trading: a single-asset XAUT pool and a dual-asset XAUT-USDT pool. Traders can now access precious metals exposure while maintaining crypto collateral positions.

GMX Q3 Report Released by TokenTerminal on Binance Square

**GMX Q3 financial report** now available on Binance Square, published by data analytics platform TokenTerminal. The report provides insights into the **decentralized exchange protocol's performance** during the third quarter. - GMX operates on Arbitrum and Avalanche networks - Offers yield opportunities for token holders - Report accessible through [Binance Square](https://www.binance.com/en/square/post/33454137963122) TokenTerminal specializes in **crypto project analytics** and financial data compilation. Check the full report for detailed metrics and performance analysis.

🚀 GMX Expands Multichain

**GMX accelerates multichain expansion** in Q4, bringing its decentralized trading infrastructure to major networks including: - Base - BNB Chain - Ethereum Mainnet - Additional EVM chains The protocol maintains its **core value proposition**: - Decentralized infrastructure - Oracle-based pricing reliability - Transparent, fair markets **Key improvements** include UX optimizations and horizontal scaling without liquidity fragmentation. With over **$330 billion in trading volume** from 728,000+ users, GMX's expansion preserves decentralization while scaling sustainably across the ecosystem.

GMX Buyback Program Continues with 34,500 Tokens Repurchased

**GMX maintains steady token buybacks** under its Buyback & Distribute model, repurchasing over 34,500 GMX tokens in the past week. The program directly **rewards GMX stakers** through token distribution, though staking APR has declined from 31.52% to 22.14% compared to the previous week. - Current staking APR: **22.14%** - Weekly buyback: **34,500+ GMX tokens** - Previous week's buyback: 41,700 tokens The consistent buyback activity demonstrates GMX's commitment to **returning value to token holders** through its systematic reward mechanism.