The GMX decentralized exchange protocol operates on both the Arbitrum and Avalanche blockchains. On Arbitrum, the GMX token generates an annual percentage rate (APR) of 13% for users, while on Avalanche, the GLP token offers an APR of around 21%. Additionally, GMX provides an API for developers to integrate with its infrastructure.

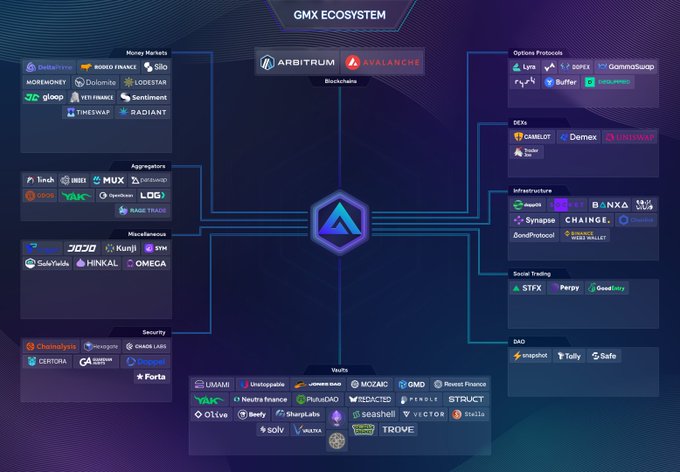

All the news from around the vast GMX finance ecosystem, on @arbitrum and @avax, curated for you by the community: #DeFi

We are already in April ! Stay up to date with this week‘s news around GMX as the 113th Pulse is out ! 🫐📷🤠 🔹GMX’s weekly revenues 🔹GMX Development and Governance 🔹GMX Main News 🔹GBC News 🔹GMX Events 🔹Ecosystem News medium.com/@BlueberryPuls…

GMX Labs Leadership Update Proposal Goes to Vote

GMX has launched a new governance proposal on Snapshot titled **"GMX Labs Leadership Update"** for tokenholder voting. This follows a series of recent governance activities: - A **GMX Labs Funding Proposal (2026-2027)** advanced to Phase 4 on Tally - Proposals addressing CEX supply concerns and price discovery mechanisms - Dynamic BBD adjustment proposals for APR capping - Marketing and trader incentive programs Tokenholders can cast their votes at [Snapshot](https://snapshot.box/#/s:gmx.eth/)

GMX Launches Gold Trading with Bitcoin Collateral Across Six Chains

GMX has introduced a new **XAUT/USD perpetual market** for trading Tether Gold with up to **25x leverage**. **Key Features:** - Available across **six blockchains**: Arbitrum, Ethereum, Base, BNB Chain, Solana, and Avalanche - Backed by **BTC-USDC liquidity**, allowing traders to use Bitcoin as collateral - Enables simultaneous exposure to both gold and Bitcoin price movements This synthetic perpetual contract expands GMX's asset offerings beyond traditional crypto markets. The cross-chain functionality allows users to trade from their preferred network while settling on Avalanche. The market uses XAUT, Tether's gold-backed token where each token represents physical gold reserves. Two liquidity pools support trading: a single-asset XAUT pool and a dual-asset XAUT-USDT pool. Traders can now access precious metals exposure while maintaining crypto collateral positions.

GMX Q3 Report Released by TokenTerminal on Binance Square

**GMX Q3 financial report** now available on Binance Square, published by data analytics platform TokenTerminal. The report provides insights into the **decentralized exchange protocol's performance** during the third quarter. - GMX operates on Arbitrum and Avalanche networks - Offers yield opportunities for token holders - Report accessible through [Binance Square](https://www.binance.com/en/square/post/33454137963122) TokenTerminal specializes in **crypto project analytics** and financial data compilation. Check the full report for detailed metrics and performance analysis.

🚀 GMX Expands Multichain

**GMX accelerates multichain expansion** in Q4, bringing its decentralized trading infrastructure to major networks including: - Base - BNB Chain - Ethereum Mainnet - Additional EVM chains The protocol maintains its **core value proposition**: - Decentralized infrastructure - Oracle-based pricing reliability - Transparent, fair markets **Key improvements** include UX optimizations and horizontal scaling without liquidity fragmentation. With over **$330 billion in trading volume** from 728,000+ users, GMX's expansion preserves decentralization while scaling sustainably across the ecosystem.

GMX Buyback Program Continues with 34,500 Tokens Repurchased

**GMX maintains steady token buybacks** under its Buyback & Distribute model, repurchasing over 34,500 GMX tokens in the past week. The program directly **rewards GMX stakers** through token distribution, though staking APR has declined from 31.52% to 22.14% compared to the previous week. - Current staking APR: **22.14%** - Weekly buyback: **34,500+ GMX tokens** - Previous week's buyback: 41,700 tokens The consistent buyback activity demonstrates GMX's commitment to **returning value to token holders** through its systematic reward mechanism.