GHO/USDC Boosted Pool Gains Traction on Base

GHO/USDC Boosted Pool Gains Traction on Base

🚀 This Pool Just Hit Different

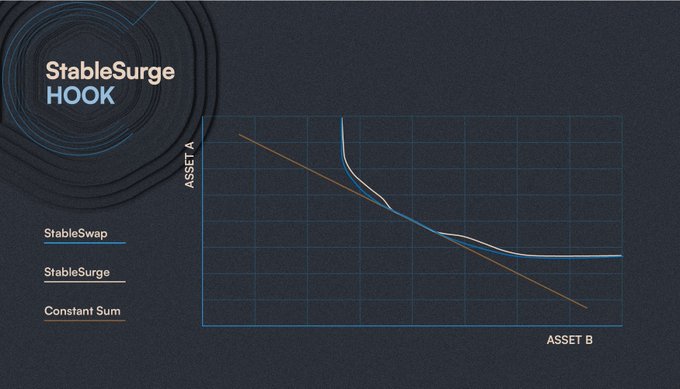

The GHO/USDC 100% Boosted pool on Base has seen strong adoption with renewed incentives offering 13% sustainable yield. The pool features triple yield sources: Aave lending fees, Balancer swap fees, and LP incentives. All liquidity is rehypothecated through Aave. The StableSurge Hook provides peg protection through dynamic swap fees during volatility periods, benefiting LPs with higher revenue and MEV protection. The deep GHO liquidity helps strengthen Aave's lending yields, creating a sustainable growth feedback loop.

Everything from the last two weeks is now in one place. Balancer Report is out: Balancer V3 Live on @avax with boosted pools, TVL jumps, fresh pools, and boosted strategies. Check it out: 🔗 medium.com/@balancer.ball…

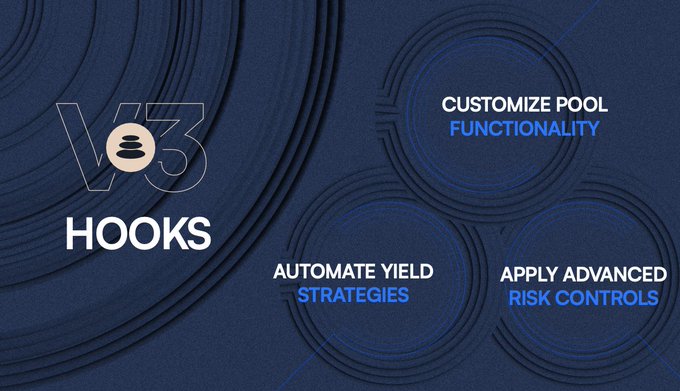

1/ Balancer v3 is now live on @Base. v3 enhances customizable AMM development, provides stable pool peg protection with the StableSurge hook, introduces capital-efficient Boosted Pools, and channels MEV profits directly to LPs for real yield. Here’s how it works 🧵⬇️

Internalizing MEV: The Priority Fee Hook v3 on @Base introduces a novel way to capture value from MEV transactions and redistribute it to liquidity providers. Instead of MEV profits going to searchers or sequencers, they flow back to LPs as rewards. x.com/Balancer/statu…

1/ Balancer v3 is now live on @Base. v3 enhances customizable AMM development, provides stable pool peg protection with the StableSurge hook, introduces capital-efficient Boosted Pools, and channels MEV profits directly to LPs for real yield. Here’s how it works 🧵⬇️

1/ Why limit yourself to swap fees when you could BOOST rewards further with exposure to lending market rewards? Powered by @MorphoLabs, DeFi users just unlocked a major yield-generation upgrade. ⬇️ 🧵

A new proposal to deploy Balancer V3 is live on our governance forum and snapshot. 👀

The proposal to deploy Balancer V3 on Avalanche is live. If passed, this would introduce advanced liquidity tooling and new trading strategies to Avalanche DeFi. Here’s what’s at stake🧵👇

Balancer is making moves across multiple ecosystems. Want to stay ahead? 👀 From @Optimism to @base, @avax & @arbitrum liquidity is expanding, pools are growing, and rewards are stacking up. Here’s a look at the latest news. 🧵👇 medium.com/@balancer.ball…

🔹 The largest sUSDS/USDC pool on Base has surpassed $600K in TVL. @SeamlessFi's boosted v3 pool, powered by @MorphoLabs and curated by @gauntlet_xyz, offers LPs up to 15% in rewards. This pool ranks among the top three on @Balancer by volume. Start now:

From MEV internalization with priority fees to L2 expansions on @Base and @Arbitrum, Balancer v3 continues to push boundaries in AMM innovation. Check out the latest updates in this week’s Balancer Report. medium.com/balancer-proto…

Offering more efficient passive exposure with concentrated swap fees on a concentrated range liquidity, @GyroStable had been a launch partner for Balancer V3 and bringing all their expertise to V3 LP's. Explore more Gyro E-CLP's here: @Balancer: balancer.fi/pools?poolType…

Put your stables to work and join ~$14m in one of the most efficient stablecoin pools in DeFi. • Continuous exposure to $GHO | $USDC | $USDT swap fees. • Enhanced rewards with 100% exposure to @aave interest rates. • Additional $BAL and $GHO rewards. x.com/Balancer/statu…

The @Aave Boosted 3 Pool is now live with rewards on Balancer v3, optimizing stablecoin liquidity & enhancing capital efficiency. This fully yield-bearing LP is designed to deepen markets for $GHO, while routing 100% of assets to Aave's lending markets—all in one position. 🧵👇

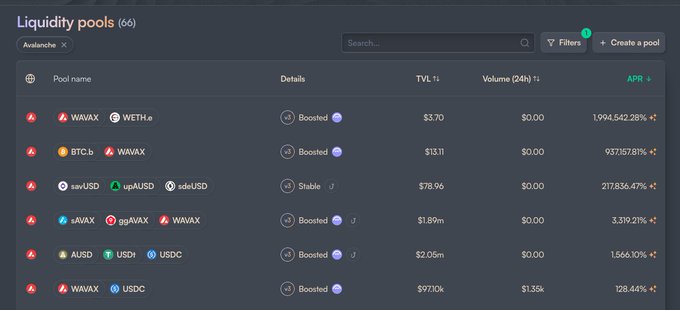

Psst... hey... Liquidity Providers 👀🔺 Balancer V3 Incentives are live on @avax with capital efficiency, programmable hooks, and deeper capital use. Incentives are on, starting with key stable and AVAX-native pools.🔥 If you’re managing liquidity, you'll want to take this into

1/ Introducing a new era of liquidity on @Arbitrum. Balancer v3 is live, offering 100% Boosted Pools, Hooks, and Custom AMMs. Built on a revamped tech stack, v3 maximizes real yield with enhanced composability on one of DeFi’s most scalable ecosystems. Here’s what’s new. 👇

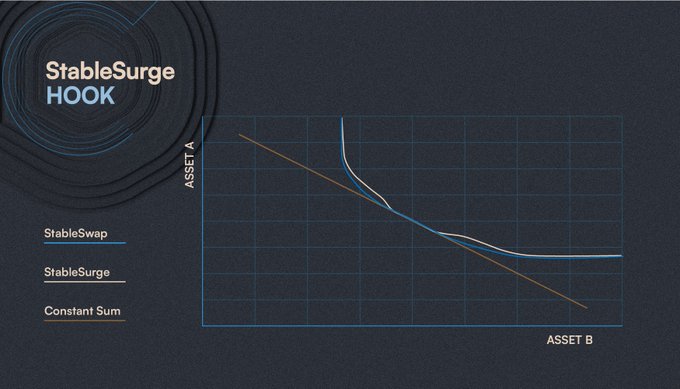

Stable Surge Hook working its magic out in the wild. Balancer V3, providing simplicity & flexibility with various hooks for different conditions , such as Stable Surge. Protecting the range, getting rewarded while doing so. Simple? Interested? Check the pools with Stable

The new StableSurge hook pools from @Balancer V3 are a truly innovative way of protecting a Stablecoin or LRT peg AND rewarding LPs while doing it. By activating a dynamic surge fee when volatility hits, LPs receive boosted swap fee revenue AND MEV protection. Bullish AF.

The next billion starts now! 🔥 In 3 short months, @Balancer V3 have surpassed the 1B volume mark. And ready for many more. Balancer V3's refined experience, powerful Hooks & Boosted Pools we are already driving deeper liquidity and better capital efficiency. 🔗

Coming to an L2 near you. Priority Fee Taxes: turning MEV into LP rewards. Catch it in action with Balancer v3 on @Base soon!

1/ Coming Q1 2025: Balancer v3 on @base will feature the Priority Fee Router - a new mechanism that redistributes MEV rewards to liquidity providers. ⬇️ 🧵 medium.com/@mikeisballin/…

New Balancer Report is live! 👀 A deep dive into key updates, community highlights, and the latest veBAL metrics. Don’t miss out on what’s shaping the future. 📖 Read here: medium.com/balancer-proto…

The latest Balancer Weekly Report is here.📰 Avalanche expansion moves forward, governance updates roll in, and key updates on the Balancer ecosystem. Stay tuned on the latest & greatest. 📖 Read the weekly report: medium.com/@balancer.ball…

🔺 Balancer V3 is live on @avax Programmable liquidity mechanics, strong capital efficiency, and smarter tooling for on-chain stability. Let’s break down what’s live, what’s different, and what you can do right now 🧵 balancer.fi/pools?first=20…

1/ In collaboration with @BackedFi, you can now permissionlessly swap, provide liquidity, and earn rewards on a tokenized version of the S&P500. ⬇️ 🧵

Avax pools just Beefed up 😎🔥

BAM! Balancer v3 Vault on Avalanche Autocompounding $wAVAX | $sAVAX | $ggAVAX — earns more so you can chill

Triple yield simplified. A new boosted pool appears with 1M TVL on @Balancer Ethereum Mainnet markets. With 2 new stables in it. $USDR & $USDQ 👀 Boosted by the deep liquidity and top-tier rates onchain, powered by @MorphoLabs 🔥

Balancer V3 is now live on @avax — bringing native 100% Boosted Pools, programmable Hooks, and custom pool types to one of the fastest-growing chains. With integrations like Aave already in place It's time to build smarter liquidity. Read more 👇 medium.com/balancer-proto…

1/ Protect the peg! StableSurge, a directional fee hook that adjusts swap fees dynamically to protect stable-asset pegs during volatility, is now live on Balancer. 🧵⬇️

1/ Balancer Path of the Panda community 10k $USDC content competition has officially closed. Over the past month, we’ve seen incredible creativity and dedication from the community as they highlighted the groundbreaking features of Balancer v3. Here are the winning entries. ⬇️…

Did someone say @Arbitrum?! The joint proposal to bring Balancer v3 to Arbitrum is live on Snapshot. Get ready for: • Custom Pools for limitless AMM innovation • 100% Boosted Pools for passive yield optimization • Hooks Framework for dynamic strategies Scaling DeFi on

This new boosted pool is powered by @MorphoLabs and curated by @SteakhouseFI. Finding its ultimate home on @Balancer V3.🏡 Boosted pools on Balancer, re-deposits 100% of LP liquidity into lending markets ( @MorphoLabs in this case), deepening liquidity and earning lending

The Alliance Movement Continues to Grow

A decentralized alliance of web3 builders and communities is gaining significant momentum. The movement, which started as a grassroots initiative, has been steadily expanding its reach and influence. Key developments: - Growing number of protocol integrations - Increased community participation - Enhanced cross-chain collaboration The alliance focuses on creating interoperable solutions and fostering collaboration between different blockchain ecosystems. Their approach emphasizes sustainable growth and practical implementation over rapid expansion. Community members can participate by joining working groups or contributing to ongoing initiatives.

Balancer Launches New MiCA-Compliant Stablecoin Pool with Morpho Integration

Balancer V3 introduces a new boosted pool featuring MiCA-compliant stablecoins $USDR and $USDQ, with initial TVL of 1M. Key features: - Powered by Morpho Labs and curated by Steakhouse - 100% LP liquidity redeposited into lending markets - Enhanced yields through lending incentives - Fully compliant solution for business operations The stablecoins are issued by StablR ($USDR) and Quantoz ($USDQ), designed for both on-chain and off-chain financial solutions. Learn more: - $USDQ: [Quantoz](https://quantozpay.com/eurq-usdq/) - $USDR: [StablR](https://stablr.com/usdr)

Balancer v3 Introduces Priority Fee Router on Base

Balancer v3 is launching a new Priority Fee Router on Base in Q1 2025, introducing a mechanism to redistribute MEV rewards to liquidity providers. - The system taxes high-priority transactions and shares fees with LPs - Creates new revenue stream for liquidity providers - Reduces sequencer MEV dominance The innovation draws inspiration from Paradigm's research on priority fees. Implementation aims to create a more equitable distribution of transaction fees in the DeFi ecosystem. [Read the full research](https://medium.com/@mikeisballin/mev-internalization-through-priority-fee-taxes-coming-to-balancer-v3-on-base-q1-2025-f20b3e1b7295)

Balancer and BackedFi Launch Tokenized S&P 500 Trading

Balancer has partnered with BackedFi to launch permissionless trading of tokenized S&P 500 index ($bCSPX) on Gnosis Chain. Key features: - Regulatory-compliant access to S&P 500 performance - ERC-20 token format for easy transfers - New liquidity pool pairing $bCSPX with $sDAI - Earning opportunities through swap fees and $GNO rewards The integration represents Balancer's first step into tokenized real-world assets (RWAs), with more developments planned.