The GENIUS Act has officially become law, establishing the first comprehensive federal framework for payment stablecoins in the United States. This landmark legislation creates clear guidelines for digital dollar stablecoins like Frax USD and USDC.

Key impacts:

- First clear federal regulations for stablecoins

- Enhanced security and compliance standards

- Framework for mainstream financial integration

Circle and Frax are positioning their stablecoins to operate under the new regulatory framework, aiming to provide compliant digital payment solutions.

Learn more about the GENIUS Act at Circle's overview

Historic day tomorrow. Frax USD will enter a new phase post-GENIUS legislation. Legal digital dollars are about to take over all of finance!

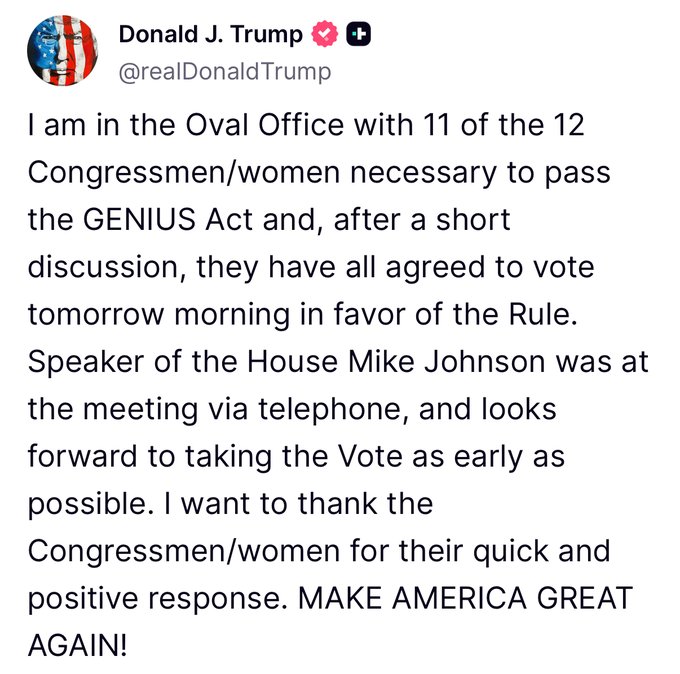

🇺🇸 JUST IN: President Trump says he met with 11 of 12 representatives needed to pass the GENIUS Act in the Oval Office, and after discussion they have all agreed to vote in favor of the stablecoin legislation.

Frax Highlights sfrxUSD's Stable Yield Performance Amid Market Volatility

Frax Finance is promoting **sfrxUSD** as a reliable yield option during volatile market conditions. **Key Points:** - sfrxUSD designed to offer optimal risk-adjusted stable yield on-chain - Consistently outperforms APY of major competing stablecoin options - Backed by team with 5-year security track record - Positioned as "set-it-and-forget-it" savings solution The protocol emphasizes sfrxUSD's performance track record as markets experience turbulence. Users can access the yield product at [frax.com/earn](http://frax.com/earn). Frax continues to differentiate its yield-bearing stablecoin in an increasingly crowded market of similar products, focusing on security and consistent returns rather than maximum APY.

Avant Protocol Integrates frxUSD as PegKeeper

Avant Protocol has selected frxUSD as their PegKeeper solution for their avUSD stablecoin. **Key Details:** - Avant's avUSD offers adaptive yield with institutional-grade security - Available across multiple blockchain networks - New liquidity pools launched on [Curve Finance](https://www.curve.finance) (Ethereum) and Etherex (Linea) This follows a recent frxUSD PegKeeper pool launch with Origin Protocol's OUSD, which benefits from dual yield incentives from both frxUSD and OUSD.

🇰🇷 Korean Won Stablecoin KRWQ Joins FraxNet for Global Settlement

**KRWQ**, the most traded Korean won stablecoin, has integrated with **FraxNet** to create an efficient KRW-USD settlement corridor. **Key developments:** - Built by IQ AI in collaboration with Frax using frxUSD infrastructure - Partners include BlackRock, Bridge, Superstate, and WisdomTree - Listed on major Korean exchanges: Upbit and Bithumb **Integration benefits:** - Unified, capital-efficient KRWUSD corridor for exchanges and DeFi platforms - New KRWQ/frxUSD liquidity pools, including first pool on Uniswap v4 - Enhanced global KRW settlement capabilities on-chain The integration leverages Frax's GENIUS-compatible network to provide deeper liquidity and streamlined cross-border settlement for Korean won transactions. [Read full press release](https://www.prnewswire.com/news-releases/krwq-the-most-traded-korean-won-stablecoin-joins-fraxnets-genius-compatible-network-302638607.html?tc=eml_cleartime)

frxUSD Joins Elite Group as DEIN Insurance Platform Launches with Only Three Supported Stablecoins

**frxUSD selected for exclusive DeFi insurance launch** DEIN.fi has chosen only **three stablecoins** for its insurance platform launch: - frxUSD - USDC - USDT This partnership positions frxUSD as **collateral** for DeFi insurance products, marking a significant step toward making decentralized finance safer for users. The collaboration aligns with Frax's mission to enhance DeFi security and demonstrates growing institutional confidence in frxUSD's stability and utility.

🔥 New liquidity pool

**New incentives launched** for the frxUSD/wBLT liquidity pool on Deli Swap by BMX DeFi. **Key benefits:** - frxUSD's revenue-sharing model offers better capital efficiency than USDC/USDT - Perfect pairing with wBLT's productive liquidity vault - Now live on Base network **Why it matters:** This combination leverages frxUSD's Treasury-backed rewards system with wBLT's yield-generating capabilities, creating a more attractive option for liquidity providers. [Start providing liquidity](https://www.deliswap.com/#/explore/pools/base/0x3779354f8c0065d70f35115508d040008ccf2e6a246d80c4db994e4684e2f72a?chain=base&from=0x4E74D4Db6c0726ccded4656d0BCE448876BB4C7A&tab=swap)