Fraxtal Mainnet Bridge Goes Live with Incentives and Airdrop

Fraxtal Mainnet Bridge Goes Live with Incentives and Airdrop

🚀 Fraxtal Mainnet Ignition

Frax Finance has announced the launch of the Fraxtal Mainnet Bridge, allowing users to bridge tokens like ETH, FRAX, and frxETH to the Fraxtal Layer 2 network. Starting March 13th, Flox incentives will go live, rewarding users and contracts with $FXTL points for using Fraxtal. Additionally, there will be a significant airdrop of $FXTL points to veFXS stakers based on their balance as of March 6th. Various projects, including Curve Finance, Convex Finance, and LayerZero, will offer liquidity providing opportunities with incentives powered by Frax. The Fraxtal era has officially begun, marking a new phase for the Frax ecosystem.

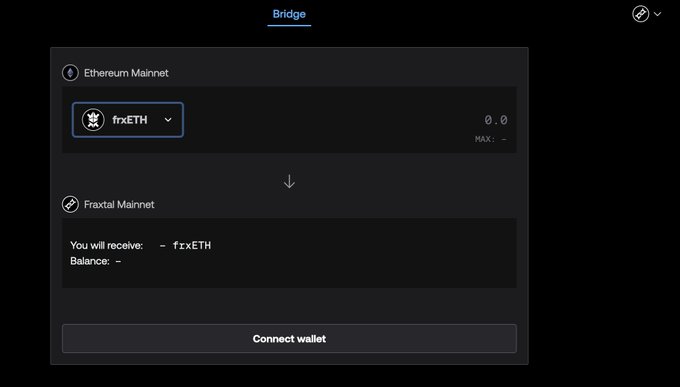

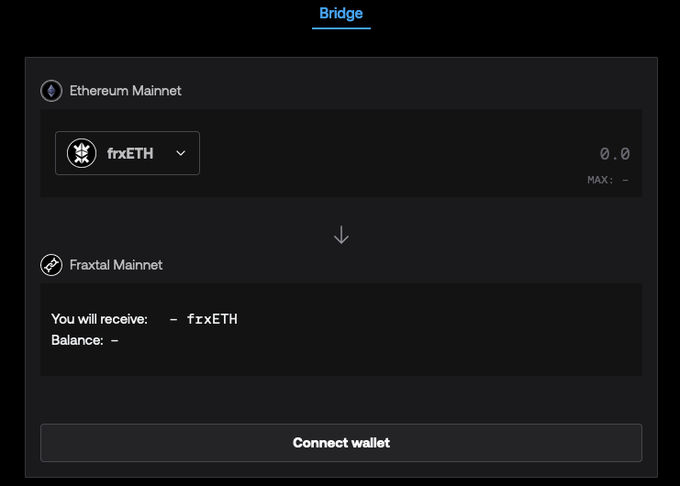

FRAXTAL Bridge NOW LIVE 👀 You can now bridge ETH, FRAX, frxETH + More over to Fraxtal!!! All chains lead to Fraxtal ⛓️ @fraxfinance

The moment has arrived. LPs - #Fraxtal bridge is now LIVE. Ready yourselves. Pools on RA go live this week 🙌 and it pays to be early. @fraxfinance

FRAXTAL Bridge NOW LIVE 👀 You can now bridge ETH, FRAX, frxETH + More over to Fraxtal!!! All chains lead to Fraxtal ⛓️ @fraxfinance

~13k $sfrxETH deposited through Kelp! 🧜♀️ That's more than 57% of all $sfrxETH deposits on @eigencloud so far. LST caps are set to pause on 09 Feb, 12 PM PT. Before that, let's talk about everything $rsETH can unlock for $sfrxETH restakers. 🌱 🌊👇

Congrats to the @fraxfinance team! 🚨Fraxtal Mainnet Bridge is LIVE.

1/ Fraxtal Mainnet Bridge is now open to all public users & teams! Head over to bridge any token below: mainnet.frax.com/tools/bridge/d… Fraxtal ferry, Fraxswap, & other Frax apps as well as a slew of partner projects have already launched! 🚀

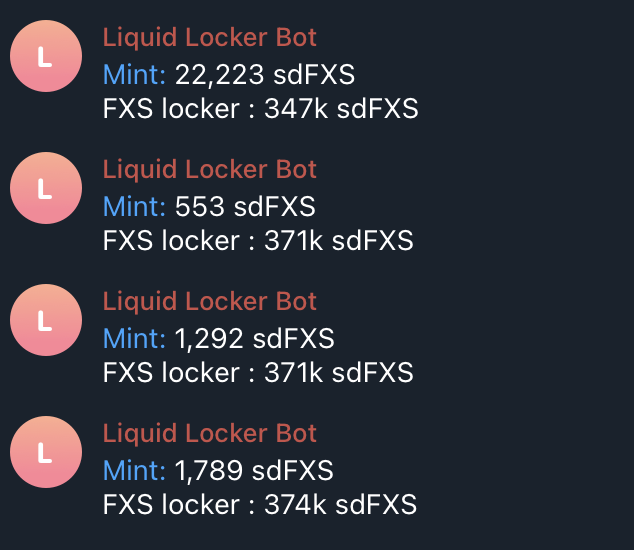

The $FXTL points snapshot is planned for March 6. Make sure you have some $FXS locked as veFXS or stake some $CVXFXS / $sdFXS. People do not realise yet how big Fraxtal will become. @fraxfinance always builds top tier tech. BET MORE. 🌚

After months of development, @fraxfinance is finally launching Fraxtal. Here's a deep dive into Fraxtal, how they incentivize users to build on their L2, and the role of $FXS within this new ecosystem.

1/ Fraxtal Mainnet Bridge is now open to all public users & teams! Head over to bridge any token below: mainnet.frax.com/tools/bridge/d… Fraxtal ferry, Fraxswap, & other Frax apps as well as a slew of partner projects have already launched! 🚀

The Stake DAO $FXS Liquid Locker has seen nearly a 10% increase in anticipation of the @fraxfinance airdrop. Snapshot date is March 6th, there's still time to get involved. 👇

The $sfrxETH restaking limit for @KelpDAO is now 20% full. EigenLayer unpause got pushed back to Feb 5th so you still have a few days to grab a spot and earn multiple airdrops. kelpdao.xyz/restake/?utm_s…

1/ As a @fraxfinance $sfrxETH holder, I have refrained from restaking... until now. That's because @KelpDAO is the first to offer liquid sfrxETH restaking, as @eigencloud opens sfrxETH deposits Jan 29th. Here's why I'm trusting Kelp with my sfrxETH👇🧵

Flox aka Fraxtal Blockspace Incentives is designed in a way to draw activity and TVL to Fraxtal. Fraxtal WILL NOT be a one-time get-rich-quick airdrop. So for those thinking that FXS is sell the news on Fraxtal, think again. My view is Fraxtal launches -> TVL grows as dApps

"The Flox mechanism...is like a weekly airdrop & whatever dApp is the most popular gets a big amount of the points." This underscores the mechanism's goal to foster a sustainable ecosystem by rewarding SC gas usage, popularity (contract rank), & asset availability sampling.

LayerZero is live on @fraxfinance's L2 Fraxtal.

Frax Highlights sfrxUSD's Stable Yield Performance Amid Market Volatility

Frax Finance is promoting **sfrxUSD** as a reliable yield option during volatile market conditions. **Key Points:** - sfrxUSD designed to offer optimal risk-adjusted stable yield on-chain - Consistently outperforms APY of major competing stablecoin options - Backed by team with 5-year security track record - Positioned as "set-it-and-forget-it" savings solution The protocol emphasizes sfrxUSD's performance track record as markets experience turbulence. Users can access the yield product at [frax.com/earn](http://frax.com/earn). Frax continues to differentiate its yield-bearing stablecoin in an increasingly crowded market of similar products, focusing on security and consistent returns rather than maximum APY.

Avant Protocol Integrates frxUSD as PegKeeper

Avant Protocol has selected frxUSD as their PegKeeper solution for their avUSD stablecoin. **Key Details:** - Avant's avUSD offers adaptive yield with institutional-grade security - Available across multiple blockchain networks - New liquidity pools launched on [Curve Finance](https://www.curve.finance) (Ethereum) and Etherex (Linea) This follows a recent frxUSD PegKeeper pool launch with Origin Protocol's OUSD, which benefits from dual yield incentives from both frxUSD and OUSD.

🇰🇷 Korean Won Stablecoin KRWQ Joins FraxNet for Global Settlement

**KRWQ**, the most traded Korean won stablecoin, has integrated with **FraxNet** to create an efficient KRW-USD settlement corridor. **Key developments:** - Built by IQ AI in collaboration with Frax using frxUSD infrastructure - Partners include BlackRock, Bridge, Superstate, and WisdomTree - Listed on major Korean exchanges: Upbit and Bithumb **Integration benefits:** - Unified, capital-efficient KRWUSD corridor for exchanges and DeFi platforms - New KRWQ/frxUSD liquidity pools, including first pool on Uniswap v4 - Enhanced global KRW settlement capabilities on-chain The integration leverages Frax's GENIUS-compatible network to provide deeper liquidity and streamlined cross-border settlement for Korean won transactions. [Read full press release](https://www.prnewswire.com/news-releases/krwq-the-most-traded-korean-won-stablecoin-joins-fraxnets-genius-compatible-network-302638607.html?tc=eml_cleartime)

frxUSD Joins Elite Group as DEIN Insurance Platform Launches with Only Three Supported Stablecoins

**frxUSD selected for exclusive DeFi insurance launch** DEIN.fi has chosen only **three stablecoins** for its insurance platform launch: - frxUSD - USDC - USDT This partnership positions frxUSD as **collateral** for DeFi insurance products, marking a significant step toward making decentralized finance safer for users. The collaboration aligns with Frax's mission to enhance DeFi security and demonstrates growing institutional confidence in frxUSD's stability and utility.

🔥 New liquidity pool

**New incentives launched** for the frxUSD/wBLT liquidity pool on Deli Swap by BMX DeFi. **Key benefits:** - frxUSD's revenue-sharing model offers better capital efficiency than USDC/USDT - Perfect pairing with wBLT's productive liquidity vault - Now live on Base network **Why it matters:** This combination leverages frxUSD's Treasury-backed rewards system with wBLT's yield-generating capabilities, creating a more attractive option for liquidity providers. [Start providing liquidity](https://www.deliswap.com/#/explore/pools/base/0x3779354f8c0065d70f35115508d040008ccf2e6a246d80c4db994e4684e2f72a?chain=base&from=0x4E74D4Db6c0726ccded4656d0BCE448876BB4C7A&tab=swap)