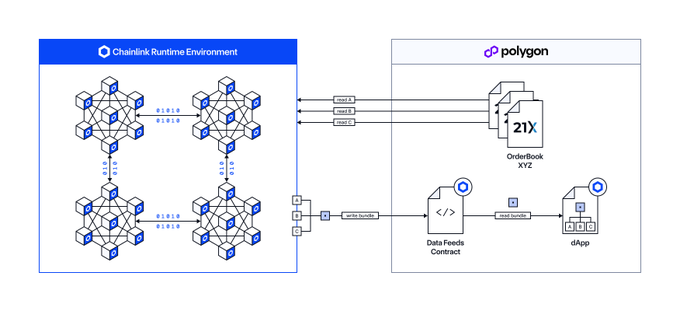

21X, the first EU-regulated onchain exchange for tokenized securities, has integrated Chainlink's data standard to deliver real-time market data directly on Polygon blockchain.

Key Features:

- Live post-trade data including last traded prices and bid-ask offers

- Enables tokenized equities, debt securities, and funds as collateral in lending protocols

- Black Manta Capital Partners USMO (backed by UBS USD Money Market Fund) is first security using Chainlink data

Regulatory Compliance: Operating under BaFin supervision, 21X provides institutions the transparency and auditability needed for onchain adoption while maintaining full regulatory compliance.

Future Expansion: 21X plans to expand Chainlink integration to include:

- Pre-trade data

- Deeper analytics

- Additional asset classes

This partnership represents a significant step toward bridging traditional capital markets with blockchain technology, potentially opening institutional capital flows onchain.

Europe’s first regulated tokenized securities platform 21X: “The work that Chainlink is doing ... with the involvement of the largest financial institutions in the world ... could not be more at the forefront.” Discover how tokenization is reshaping capital markets and why

ICYMI: @SergeyNazarov joined @CoinDesk Spotlight to talk early Chainlink, his entry into crypto, the future of tokenization, his legacy, & more ↓ x.com/CoinDesk/statu…

🎥SPOTLIGHT: @Chainlink co-founder @SergeyNazarov says Bitcoin could reach $1M if global capital allocates just 5% to crypto including central banks adding reserves.SPOTLIGHT: 00:36 Is Sergey Nazarov Satoshi? 02:22 The Role of Oracles in Blockchain 06:14 Early Days of Chainlink

Chainlink has just reached a new all-time high in Total Value Secured (TVS) ✅ $100B today. Trillions next. Accelerate.

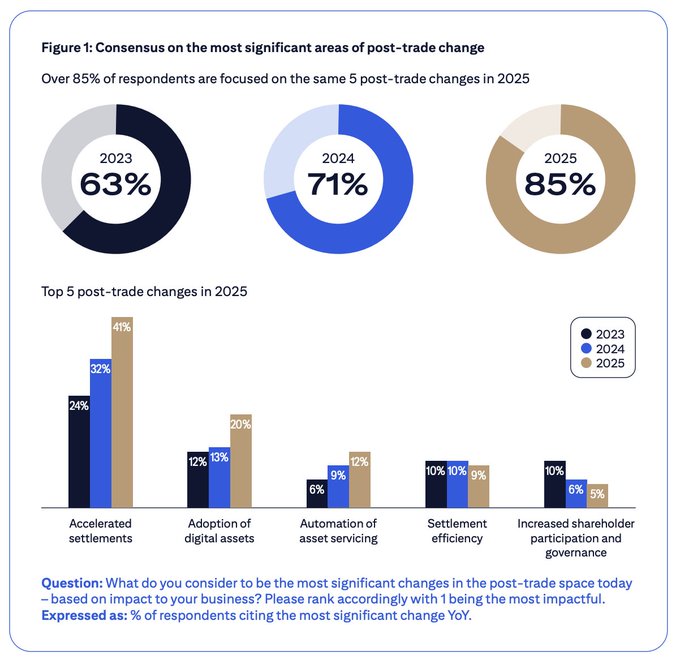

Chainlink is highlighted in @Citi’s new Securities Services Evolution 2025 report for “advancing standards enabling interoperability across public and private blockchain networks.” citibank.com/icg/docs/secur… In the report, @SergeyNazarov noted how fragmentation is one of the

We’re excited to announce that the first EU-regulated onchain exchange for tokenized securities, 21X (@tradeon21x), has adopted the Chainlink data standard. prnewswire.com/news-releases/… Live-in-production and powered by the Chainlink Runtime Environment (CRE), Chainlink enables

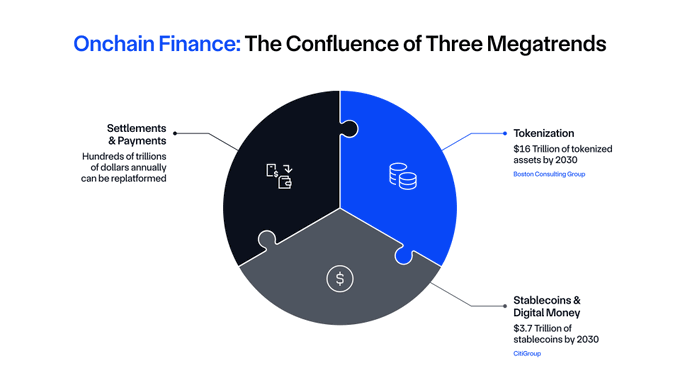

Chainlink is at the center of a $100T+ financial transformation.

DeFi is the hub of financial innovation. Capital markets represent hundreds of trillions in value. Chainlink is powering their convergence into a single Internet of Contracts.

Policy momentum, infrastructure advances, and institutional demand are all aligning. Colin Cunningham (@ctcunning), Head of Tokenization & Alliances at @chainlinklabs, explains why this is a pivotal moment for convergence in global finance. blog.chain.link/the-convergenc…

Nasdaq’s recent move to embrace tokenized stocks and exchange-traded products is part of a global transformation to move all the world’s assets onchain, with Chainlink at the center of this generational paradigm shift. Last week, Chainlink Co-Founder @SergeyNazarov met with U.S.

Today, Chainlink Co-Founder @SergeyNazarov met with U.S. SEC Chairman Paul Atkins and key policymakers at the White House to discuss how the U.S. stays at the forefront of blockchain innovation. Sergey joined @CNBC to share insights from these discussions: • Growing the U.S.

Proud to partner with @OndoFinance on its newly launched Ondo Global Markets—an initiative bringing 100+ tokenized U.S. stocks and ETFs onchain. By adopting Chainlink as its official oracle platform for trusted asset price data, Ondo is driving enhanced DeFi composability and

1/ Wall Street 2.0 is here. Ondo Global Markets is now live, providing one of the largest-ever selections of tokenized U.S. stocks & ETFs onchain with the liquidity of traditional finance, starting on @Ethereum. 100+ assets now live, with hundreds more on the way.

NEW: Today @SergeyNazarov joined @CNBCTV18News, one of the largest news outlets in India, to discuss Chainlink's groundbreaking work in Washington D.C., the tokenization of the entire global financial system, and more. Watch this can't-miss interview ↓

.@Polymarket, the leading onchain prediction markets platform, has officially partnered with Chainlink to launch new 15-minute markets featuring near-instant settlement and industry-leading security. prnewswire.com/news-releases/… Starting with asset pricing, the integration combines

Lombard Finance Adds Symbiotic Layer for Enhanced Cross-Chain Bitcoin Security

**Lombard Finance** is upgrading its cross-chain LBTC transfers by integrating **Symbiotic** alongside Chainlink CCIP for additional security guarantees. **Key developments:** - Symbiotic LINK and BARD vaults will monitor LBTC cross-chain transfers - First implementation of CCIP's modular security features - Network designed to detect and flag potential anomalies during transfers **Technical innovation:** This collaboration leverages CCIP's support for custom safeguards, allowing token developers to add extra security layers when moving assets across blockchains. The partnership represents a **first-of-its-kind** approach to securing cross-chain Bitcoin transfers through cryptoeconomic guarantees.

Chainlink Adds 8 New Integrations Across 6 Blockchains

**Chainlink expanded its reach** with 8 new integrations this week across 4 services and 6 different blockchains. **Key networks involved:** - Aptos - Base - Bitlayer - Ethereum - Polygon - Sei **Notable new integrations include:** - AicroStrategy - Aptos - BitlayerLabs - Polymarket - SeiNetwork - stakedotlink This continues Chainlink's steady growth pattern, following 7 integrations the previous week and maintaining consistent adoption across multiple blockchain ecosystems. [Explore the complete Chainlink ecosystem](https://www.chainlinkecosystem.com/)

Chainlink Activates Revenue Reserve After Hitting Hundreds of Millions Milestone

**Chainlink reached a major financial milestone**, generating hundreds of millions in revenue before activating its reserve mechanism. Sergey Nazarov, Chainlink's co-founder, discussed this **key achievement** during an appearance on The Wolf of All Streets podcast with Scott Melker. The decision to "turn on the reserve" came specifically after crossing the hundreds of millions revenue threshold, marking a significant operational shift for the decentralized oracle network. This milestone demonstrates Chainlink's growing market position as the leading infrastructure provider connecting blockchain networks to real-world data and systems.

Chainlink Reserve Fueled by Enterprise Revenue Growth

**Chainlink reaches commercial milestone** as enterprise adoption drives revenue into the Chainlink Reserve system. **Key developments:** - Payment Abstraction converts both offchain enterprise revenue and onchain fees into LINK tokens - Strategic reserve accumulates LINK using revenue from large enterprise adoptions - System creates sustainable funding cycle for network growth **LINK token utility expands across five areas:** - Service payments for oracle data and interoperability - Simplified payment options through abstraction layer - Strategic reserve building from enterprise deals - Network security through staking mechanisms - Rewards program for active ecosystem participation **Smart Value Recapture milestone:** Over $1.1M recaptured from liquidation MEV, processing $32M+ in transactions with 80%+ recapture rates. The Reserve demonstrates how enterprise adoption directly supports network sustainability and growth.