Financial Services Providers Project Trillions in New Value from Tokenization

Financial Services Providers Project Trillions in New Value from Tokenization

💰 Tokenization Goldmine Awaits?

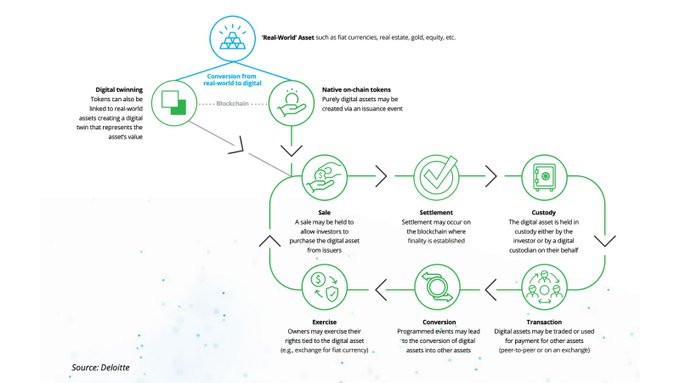

A report from Deloitte US states that various financial services providers are projecting that tokenization could generate trillions of dollars in new value for the industry this decade. The report highlights that these trillions would likely represent just a small fraction of global assets that have the potential to be tokenized, including real estate, private equity, venture capital funds, and exchange-traded products. Tokenization is described as the most significant transformation in modern financial markets, going beyond the digitalization of financial instruments in the second half of the 20th century.

Tokenization is the most significant transformation in modern financial markets, going far beyond the digitalization of financial instruments in the second half of the 20th century. A primer on this new megatrend in global finance ⬇️ blog.chain.link/tokenization/

“Various financial services providers are projecting that tokenization could generate trillions of dollars in new value for the financial services industry this decade,” states an industry report from @DeloitteUS. It highlights that those trillions would likely represent “just a

Convergence Hackathon Opens Today with Workshops and Office Hours

The **Convergence hackathon** kicks off today at 12PM ET with its opening ceremony. Participants can expect: - Full event breakdown and schedule - Workshop sessions - Office hours for direct support - Additional programming details The ceremony will provide essential information for developers looking to participate in the hackathon. Those interested can tune in at noon Eastern Time to learn about all available resources and opportunities throughout the event.

Chainlink Convergence Hackathon Opens Tomorrow with $100K in Prizes

The **Chainlink Convergence hackathon** begins February 7th, inviting developers to build CRE-powered solutions for onchain finance. **Key Details:** - $100K in total prizes available - Multiple tracks including AI, compliance, tokenization, and prediction markets - Focus on creating advanced smart contracts using Chainlink's Cross-Chain Interoperability Protocol (CRE) - Open to builders looking to develop practical applications for Web3 The hackathon aims to advance onchain finance infrastructure by encouraging developers to create solutions that connect real-world data and systems to blockchain networks. [Register for the hackathon](https://chain.link/hackathon/?utm_medium=social&utm_source=twitter&utm_campaign=convergence-hackathon)

Bitwise CIO: Chainlink Best Positioned for Crypto-Real World Convergence

Matt Hougan, Chief Investment Officer at Bitwise Invest, argues that **Chainlink is uniquely positioned** to capitalize on the inevitable convergence of crypto and traditional finance over the next decade. Hougan describes this intersection as "**the most obvious bet in finance**" and places Chainlink among the top-tier crypto assets. His thesis centers on Chainlink's role in connecting real-world data and systems to blockchain networks. Key points: - The crypto-real world intersection is accelerating - Chainlink's infrastructure enables this connection - Bitwise views Chainlink as a foundational crypto asset

Chainlink Reserve Accumulates 125K LINK Tokens, Total Holdings Reach 1.9M

The Chainlink Reserve has accumulated **125,454.48 LINK tokens**, bringing its total holdings to **1,899,670.39 LINK**. **Key Points:** - The reserve accumulates LINK through both offchain revenue from enterprise adoption and onchain revenue from network service usage - This represents the network's strategy to support long-term growth and sustainability - The accumulation demonstrates continued revenue generation from Chainlink's oracle services The reserve mechanism is designed to strengthen the Chainlink Network's economic foundation by converting operational revenue into LINK holdings. More details available at [reserve.chain.link](https://reserve.chain.link) and the [official blog post](https://blog.chain.link/chainlink-reserve-strategic-link-reserve).

Lombard Finance Integrates Chainlink Proof of Reserve for Bitcoin Collateral Verification

Lombard Finance, a BTCFi protocol managing over $1.1 billion in total value locked, has integrated Chainlink Proof of Reserve on Ethereum. The integration enables **real-time verification** of LBTC and BTC.b collateral backing, providing transparent on-chain proof of reserves. This follows a similar adoption pattern, with liquid restaking protocol Ether.fi previously implementing Chainlink Proof of Reserve in April 2025 for its $4B+ TVL protocol to verify 2.4M restaked ETH reserves.