The final Executive Vote of the year is now live on the Maker Governance portal. MKR holders and delegates have the opportunity to vote on various changes including decreasing the PSM-GUSD-A Debt Ceiling, increasing the Coinbase Custody (RWA014-A) Debt Ceiling, decreasing the WBTC-A, WBTC-B, and WBTC-C Stability Fee, optimizing the Smart Burn Engine parameters, approving an RWA Foundation Dao Resolution, and more.

⚡️ @sparkdotfi's user experience is being boosted through the following changes, scheduled for deployment tomorrow, November 21, at 15:45 UTC: • WBTC market reactivation allows users to borrow DAI using WBTC collateral. • Spark D3M increases from 400 million DAI to 800

The final Executive Vote of the year is live on the Maker Governance portal. 🗳️ vote.makerdao.com/executive/temp… MKR holders and delegates can use their voting power to deploy the changes listed below, if they support them. ↓ Decrease PSM-GUSD-A Debt Ceiling If this executive

With the recent enactment of the Executive Vote by Maker Governance, the following changes are set to take effect tomorrow, Tuesday, November 21, at 15:45 UTC. To Spark: Increase the Spark D3M Maximum Debt Ceiling from 400 million DAI to 800 million DAI. Increase the SparkLend

Endgame Introduces NewStable and NewGovToken

Endgame unveils NewStable (NST) and NewGovToken (NGT), upgraded versions of DAI and MKR. Key points: - DAI and MKR remain available indefinitely - 1 DAI = 1 NST, 1 MKR = 24,000 NGT - Upgrading is optional with seamless conversion - DAI to focus on crypto-native use, NST on mass adoption - NGT redenomination aims to boost governance engagement Users can continue using existing tokens or opt for upgrades. The ecosystem will explore ways to differentiate DAI and NST. This expansion offers new features while maintaining flexibility for token holders.

MakerDAO Governance Proposes Significant Protocol Changes

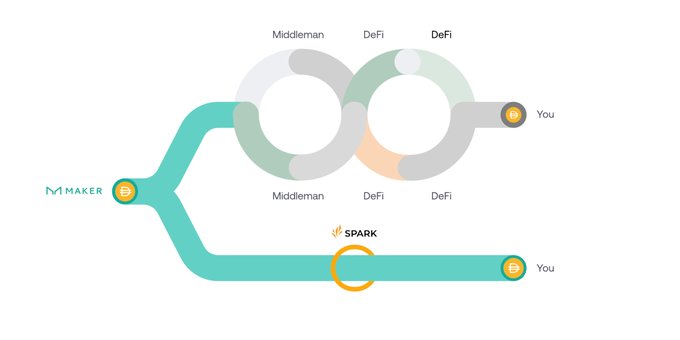

A new Executive Vote is currently open on the Maker Governance portal. If approved, it will implement several changes to the Maker Protocol, including reductions in Stability Fees for various collateral types and a decrease in the Dai Savings Rate from 8% to 7%. The proposal also includes updates to the Chainlink Keeper Network Treasury Address, an Aave-SparkLend revenue share payment, and Aligned Delegate Compensation for June 2024. Additionally, a Spark Proxy Spell will be triggered, reducing the Spark Effective DAI Borrow Rate and increasing the capacity of weETH. MKR holders and delegates are encouraged to participate in shaping MakerDAO's future by voting or delegating their MKR.

Governance Poll Approves Increase in weETH Capacity for SparkLend

The Maker Governance Poll to increase weETH capacity in SparkLend has been approved. The proposal, promoted by Phoenix Labs and supported by a risk analysis from BlockAnalitica, will be included in the next Executive Vote. If passed, it will increase the weETH Supply Cap Max to 200,000 weETH and the weETH Isolation Mode Debt Ceiling to 200 million DAI. This decision comes in response to strong demand for weETH since its integration into SparkLend in mid-June, with deposits reaching several million within the first weeks. The changes aim to enhance user experience and improve the ability to borrow DAI at scale on Ethereum Mainnet.

Proposal to Onboard Etherfi's weETH into SparkLend Open for Voting

A new proposal to list Etherfi's weETH, the largest Liquid Restaking Token (LRT) on the market, as collateral on SparkLend is now open for voting in the Maker Governance Portal. Phoenix Labs has proposed listing weETH to increase DAI borrowing on SparkLend, given the low competition for borrowing USD stablecoins using LRT collateral. The initial parameters and risk assessment are based on current market and liquidity conditions for weETH, with a proposed Loan to Value of 75%, Liquidation Threshold of 73%, and Supply Cap of 5,000 weETH. If approved, this change will be part of an upcoming Executive Vote in SparkLend.

Spark MetaMorpho DAI Vault Allocation Updated

The allocation strategy for the Spark MetaMorpho DAI Vault has been updated following recommendations from the BlockAnalitica team. The updates involve adjustments to the allocations across various USDe and sUSDe vaults with different Loan-to-Value (LTV) ratios. The total Direct-Deposit Module exposure remains unchanged. The updates aim to maintain an optimal balance between risk and return while keeping the overall exposure within sustainable limits.