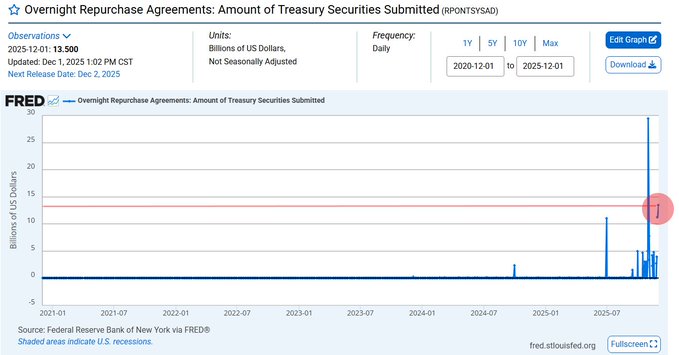

The Federal Reserve has injected $13.5 billion into the U.S. banking system, marking the second-largest injection since the COVID pandemic.

This significant liquidity move comes as financial markets continue to navigate economic uncertainties. The Fed's action demonstrates ongoing efforts to maintain stability in the banking sector.

- The injection represents a substantial intervention in financial markets

- This follows previous large-scale monetary interventions during the pandemic era

- Banking system liquidity remains a key focus for monetary policy

The timing and scale of this injection suggests the Fed is taking proactive measures to ensure adequate liquidity flows through the financial system.

The Fed just pumped $13.5B into U.S banking system marking the 2nd largest injection since Covid

BREAKING 🚨: U.S. Banks Fed Reserve just pumped $13.5 Billion into the U.S. Banking System through overnight repos 🤯 This is the 2nd largest liquidity injection since Covid and surpasses even the peak of the Dot Com Bubble 👀 Probably Fine, carry on

🚀 Elon's SpaceX-xAI Merger

Elon Musk is reportedly planning to merge SpaceX and xAI, his artificial intelligence company, creating confusion across the tech and space industries. **Key Details:** - The merger would combine SpaceX's space exploration capabilities with xAI's AI technology - xAI recently raised $15 billion in equity funding at a significant valuation - Industry observers are questioning the strategic rationale behind combining a rocket company with an AI firm **Why It Matters:** The move could reshape how AI and space technology intersect, though stakeholders remain uncertain about the practical implications. [Read full article](<https://wallstmemes.com/news/elon/elon-to-merge-spacex-and-xai-and-everyones-very-confused/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles>)

Tesla Discontinues Model S and X as Elon Musk Pivots Company Focus to Robotics

Tesla is discontinuing its Model S and Model X vehicles as Elon Musk shifts the company's strategic focus toward robotics development. This decision marks a significant departure from Tesla's traditional automotive business model. **Key Points:** - Model S and X production will cease as resources redirect to robotics initiatives - The move raises questions about Tesla's identity as an automotive manufacturer - This pivot comes alongside Musk's plans to merge SpaceX and xAI, adding to confusion about his companies' future directions The discontinuation of these flagship models represents a major strategic shift for Tesla, which has built its reputation on electric vehicles. The company appears to be betting its future on robotics technology rather than expanding its car lineup. [Read full article](https://wallstmemes.com/news/elon/elon-cancels-model-s-and-x-to-focus-on-robotics-is-tesla-a-car-company-any-more/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

S&P 500 Crosses 7000 Milestone for First Time

The S&P 500 index has broken through the 7,000 mark for the first time in history, reaching a new all-time high. This milestone comes roughly seven months after the index first crossed 6,000 in June 2025, representing continued strength in equity markets. **Key Points:** - First time S&P 500 has traded above 7,000 - Follows previous milestone of 6,000 reached in June 2025 - Represents significant market momentum The breakthrough marks another chapter in the ongoing bull market, though the specific catalysts driving this latest surge warrant closer examination. [Read full analysis](https://wallstmemes.com/news/stonks/sp-500-breaks-7000-ath-for-first-time-and-the-reason-why-is-insane/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

💸 Dollar Drops Immediately After Trump's Reassurance

**Market Irony Strikes Again** The U.S. dollar experienced an immediate decline following President Trump's public statement that the currency is performing well. The incident highlights a recurring pattern where presidential reassurances about economic indicators often precede opposite market movements. **Key Points:** - Trump declared the dollar was doing great - Currency value dropped shortly after the statement - Pattern echoes previous Trump-related market volatility, including a 40% crypto plunge in 26 minutes last December The timing suggests markets may be reacting skeptically to official optimism, or that underlying economic concerns outweigh verbal reassurances. This follows a trend of Trump-related assets experiencing sharp volatility in response to public statements. [Read full analysis](https://wallstmemes.com/news/stonks/trump-just-said-the-dollar-is-doing-great-and-it-immediately-took-a-nose-dive/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

🐂 Trump's Asia Tariffs Spark Unexpected Market Rally

Despite new tariffs targeting Asia, markets defied expectations with a surprising rally. The counterintuitive response suggests traders may be pricing in factors beyond the immediate trade restrictions. **Key Points:** - Fresh tariffs imposed on Asian markets - Stocks rallied instead of declining - Market behavior mirrors April 2025 pattern when Trump paused tariffs The unexpected positive market reaction raises questions about whether investors are anticipating policy adjustments or have already priced in worst-case scenarios. [Read full analysis](https://wallstmemes.com/news/stonks/new-trump-tariffs-just-hit-asia-but-somehow-stocks-rallied-heres-how/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)