The Exactly Protocol has successfully implemented EXAIP-16, increasing the esEXA Reserve ratio to 35%. This change aims to enhance protocol stability for long-term holders.

Key points:

- New Reserve ratio: 35%

- Implementation date: October 16, 2024

- Goal: Improve protocol stability

This update follows the recent implementation of EXAIP-15, which adjusted Interest Rate Model Parameters across various markets.

For more information on these changes and their potential impact, visit the Exactly governance forum.

[EXAIP-16] Increasing the esEXA Reserve was successfully implemented, with the new Reserve ratio set at 35%.

🗳️ [EXAIP-16] Increasing the esEXA Reserve A proposal to set the esEXA Reserve to 35%, enhancing protocol stability for long-term holders. Voting starts tomorrow 🔔

🗳️ [EXAIP-15] Interest Rate Model Parameters Update Introducing a better alignment of rates and supporting the upcoming @Exa_App. Voting starts tomorrow 🔔

📢 [EXAIP-15] Interest Rate Model Parameters Update and [EXAIP-16] Increasing the esEXA Reserve have passed the voting process and will be implemented on Wednesday.

🗳️ [EXAIP-16] Increasing the esEXA Reserve A proposal to set the esEXA Reserve to 35%, enhancing protocol stability for long-term holders. Voting starts tomorrow 🔔

[EXAIP-15] Interest Rate Model Parameters Update was successfully implemented, with the rates for each market now as follows:

🗳️ [EXAIP-15] Interest Rate Model Parameters Update Introducing a better alignment of rates and supporting the upcoming @Exa_App. Voting starts tomorrow 🔔

🗳️ EXAIP-27 Voting Open

**EXAIP-27** is now live for community voting on Snapshot. The proposal seeks funding for **Exa Labs** to continue development work through Q1 2026, focusing on: - Exa App development - Exactly Protocol growth initiatives This follows the previous EXAIP-22 proposal from March 2025 that funded development activities for the year. Voting is currently open on the governance platform. Community members can review the full proposal details and cast their votes. [Vote on EXAIP-27](https://snapshot.box/#/s:gov.exa.eth/proposal/0x383bb45b5705754f6265477fc09dbc478a43fa43ce9f4c183397d1c0179d8c23)

Exactly Protocol Scales Onchain Credit to One Million Users by 2026

**Exactly Protocol** achieved major milestones in 2025, transforming from concept to live product processing millions in onchain credit card volume monthly. **Key 2025 Developments:** - **February**: Partnership with **Uphold** to integrate Exa Credit Card and Loans - **March**: Launched [Exa App](https://www.exactly.app/) for crypto-to-credit conversion - **July**: Added Exa Loans and LiFi Swaps to DeFi section - **September**: Deployed Exa Mini App on Base App during BaseCamp - **November**: Launched **KYC-enabled Exactly Protocol on Base** for regulated fintech integrations - **November**: First Exa Card purchase completed directly in Uphold App The platform now processes a new Exa Card purchase every two minutes, with [live statistics](https://dune.com/exactly/exa-app-stats) showing consistent growth. **2026 Goal**: Scale to **one million Exa users** across multiple platforms including Exa App, Uphold App, Base App, and new partnerships. The protocol creates a global, onchain fixed-rate credit market without traditional banking infrastructure, allowing users to maintain crypto holdings while accessing instant credit through their Visa Signature Credit Card.

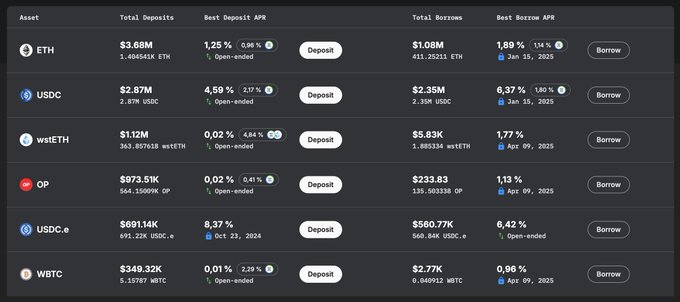

Exactly Protocol Launches on Base Network

**Exactly Protocol has officially deployed on Base**, expanding its decentralized lending platform to Coinbase's Layer 2 network. The protocol offers both **variable and fixed-rate lending** options: - Variable rates through liquidity pools - Fixed rates via maturity-specific pools - Interest rates determined by supply and demand This deployment gives Base users access to: - **Non-custodial lending and borrowing** - Autonomous interest rate markets - Time-value exchange for crypto assets Exactly's unique approach allows users to choose between traditional variable rates or lock in fixed rates for specific time periods, providing more predictable returns for lenders and borrowing costs. [View smart contract addresses](https://docs.exact.ly/guides/smart-contract-addresses#base)

Exactly DAO Continues EXA Token Buyback Program Progress

**Exactly DAO Treasury** completed another buyback of **15,986 EXA tokens**, bringing the cumulative total to **92,458 EXA tokens** acquired. This represents **76% progress** toward the 122,000 EXA token target approved in EXAIP-25. **Recent DAO improvements include:** - Streamlined asset management structure - **Treasury Multisig**: handles treasury fees, sends 50% of USDC fees to EXA stakers - **Savings Multisig**: manages other DAO assets (USDC, EXA, etc.) The buyback program demonstrates consistent execution of the approved governance proposal, with regular token acquisitions supporting the protocol's tokenomics.

Exa App Launches USDC Funding Feature with Crypto Collateral

The Exa App introduces a new USDC funding feature powered by the Exactly Protocol. Users can now use crypto assets (ETH, WBTC, USDC, OP, wstETH) as collateral to access instant USDC funding. Key features: - No credit score or paperwork required - Fixed interest rates - Up to 8 installment payments - Flexible first payment date selection - All transactions executed on-chain The funding amount is determined by collateral value, existing loans, and linked card purchases. This development represents a significant step in making DeFi tools more accessible through a simple mobile interface. Follow updates on [Twitter](https://x.com/ExactlyProtocol) or join the [Discord](https://discord.com/invite/eNTyPvgA4P).