Euler Finance Surpasses $1.5B TVL Milestone

Euler Finance Surpasses $1.5B TVL Milestone

🏦 Euler's Billion Dollar Move

Key DeFi protocol updates for the week:

- Cork Protocol now available on OpenCover platform

- Morpho Labs launches Morpho Lite with streamlined Earn and Borrow features

- Arcadia Finance reports 47% month-over-month TVL growth in April

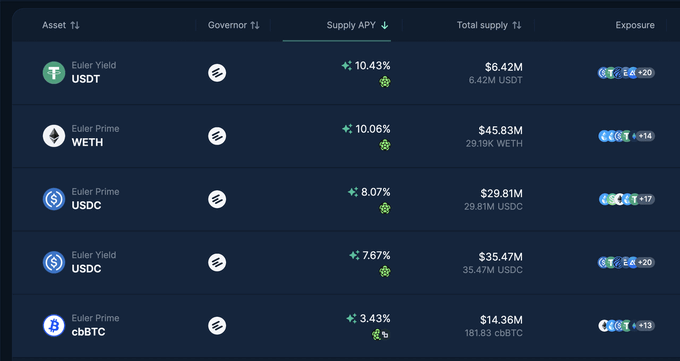

- Euler Finance achieves significant milestone, surpassing $1.5B in Total Value Locked

These developments signal continued growth in DeFi infrastructure and user adoption across multiple protocols.

🛡️ BEEFY MULTI PROTOCOL UPDATE 🛡️ Our @beefyfinance Multi Protocol Cover now includes beS, aka Beefy Sonic. Learn more 👇 docs.beefy.finance/beefy-products…

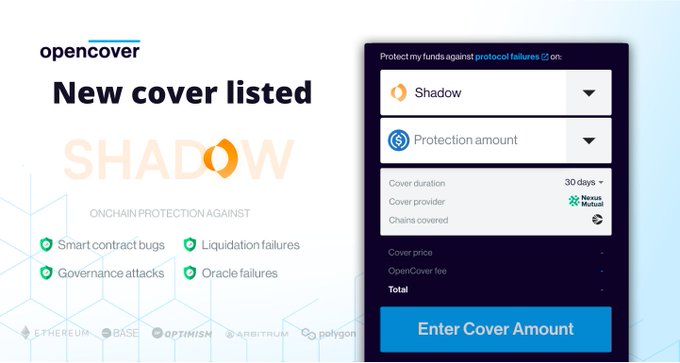

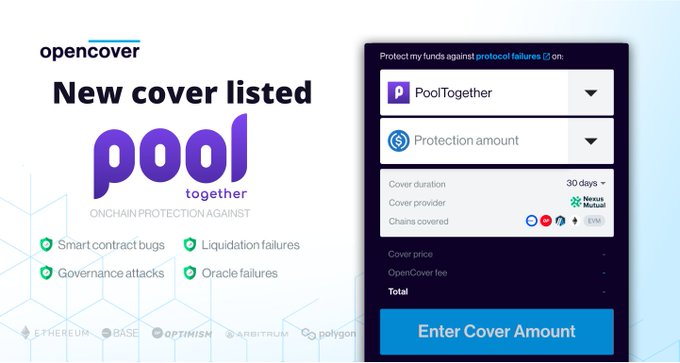

🔔 Weekly industry update 🛡️ OpenCover: 🔹 @ShadowOnSonic and @PoolTogether_ are officially live on OpenCover. 🚨 Hacks: 🔹$5m worth of ZK tokens were stolen from a compromised ZKsync admin account. 🌀 Protocols: 🔹 @Euler was awarded a 500k OP grant to bring the lending app

🛡️ NEW COVER LISTED 🛡️ @ShadowOnSonic is officially available on OpenCover 🚀 🔸 Keep your assets safe on Shadow with @NexusMutual and streamline cover management. Learn more and find onchain peace of mind 👇 opencover.com/shadow

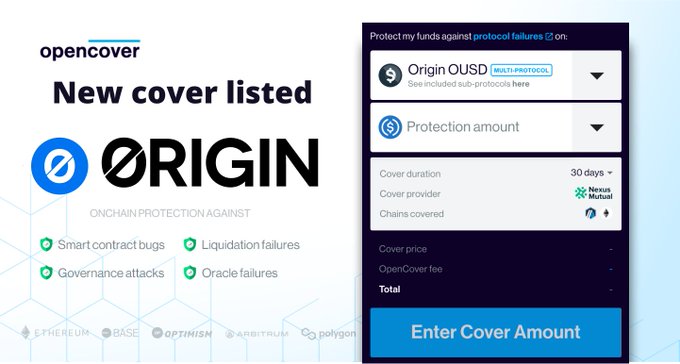

🔔 Weekly industry update 🛡️ OpenCover: 🔹 @OriginProtocol is officially available on OpenCover. 🔹 We redesigned our Discord server. 🌀 Protocols: 🔹 @eulerfinance launched a new $260,000 incentives package > x.com/eulerfinance/s… 🔹 @ExtraFi_io issued its monthly review >

Euler is the best place to be sidelined. New $260,000 supply incentives now live: - $USDC, $WETH, $cbBTC, $USDT, $WBTC All now getting yields above market average.

🔔 Weekly industry update 🛡️ OpenCover: 🔹 We released the April issue of OpenCover Alpha, our monthly newsletter > tinyurl.com/2x34hav5 🔹 @0xCoinshift csUSDL is officially available on OpenCover 🔒 Industry: 🔹 A $16 million, record-breaking bug bounty is live. Powered by

🛡️ NEW COVER LISTED 🛡️ @PoolTogether_ is now live on OpenCover 🚀 Stay safe on PoolTogether - protect your assets against onchain risks with @NexusMutual. Save $50+ in gas fees on L2. Learn more and get covered👇 opencover.com/pooltogether

🌟 OpenCover just got even easier to use 🪄 Our new cover selector lets you choose between Protocol Cover, Depeg Cover, and Custody Cover in just one click. Try it now 👇 opencover.com/app/?invite=LN…

🔔 Weekly industry update 🛡️ OpenCover: 🔹 @beefyfinance Multi Protocol Cover now includes beS, aka Beefy Sonic. 🌀 Protocols: 🔹 @superformxyz Rewards are live. 🔹 @SiloFinance redesigned their V2 UI. 🔹 @symbioticfi raised $29m in a Series A, led by @PanteraCapital.

🔔 Weekly industry update 🛡️ OpenCover: 🔹 We introduced the most significant upgrade to the @Base Pass. 🚨 Hacks: 🔹 Abracadabra Money was hacked for $13m. 🔒 Industry: 🔹 @NexusMutual's proposal to stake Kiln ETH in Enzyme Vault on @ether_fi is open for voting. 🌀

🛡️ Custody Cover is officially live on OpenCover 🛡️ Protect your digital assets from significant centralized exchange and custody risks, such as bankruptcy, hacks, and frozen withdrawals. Get started 👇 tinyurl.com/mrxz8jtj

🛡️ NEW COVER LISTED 🛡️ @OriginProtocol is officially available on OpenCover 🚀 Cover your $OUSD + underlying protocols, and protect your Super OETH assets from depeg risk. Learn more and get covered👇 opencover.com/originousd

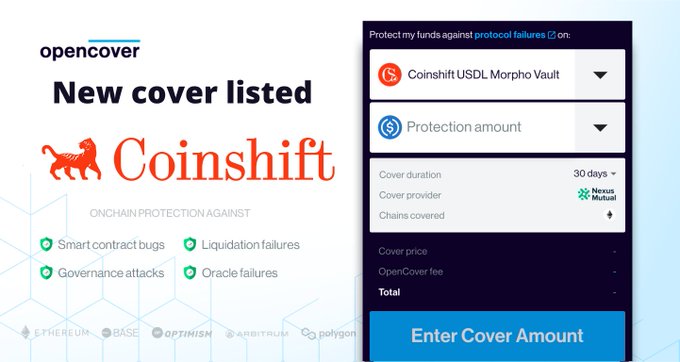

🛡️ NEW COVER LISTED 🛡️ @0xCoinshift csUSDL is officially available on OpenCover 🚀 This exclusive cover was developed with @NexusMutual, with institutions and businesses in mind. Secure your positions on Coinshift csUSDL 👉 opencover.com/coinshift

🛡️ OpenCover Alpha – April 2025 🛡️ Explore what we’ve been up to this month – introducing Custody Cover and the Base Pass V2, our brand new UI, and more 📊 tinyurl.com/2x34hav5

OpenCover Alpha February 2026 Update

OpenCover has released its February 2026 alpha update, detailing recent developments in their onchain risk protection platform. The newsletter covers: - Latest platform improvements and features - Updates on their coverage offerings for smart contract risks - Community initiatives and engagement activities - Progress on their underwriter network OpenCover continues to focus on making portfolio protection accessible and affordable for users navigating onchain risks like smart contract exploits and oracle failures. [Read the full update](<https://open.substack.com/pub/opencover/p/opencover-alpha-february-2026?r=2chtfi&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true>)

OpenCover Launches Onchain Risk Map 2026 and CAP Protection

OpenCover released its February 2026 update, highlighting several key developments: - **Onchain Risk Map 2026**: The first comprehensive taxonomy of DeFi risk, developed with Nexus Mutual for risk professionals, protocols, and institutional users. Full report and webinar scheduled for February 11. - **CAP in-dApp Protection**: New protection feature now available within the application. - **DAF London**: Participation in decentralized finance events in London. The risk map aims to standardize how blockchain risk is understood and managed across the DeFi ecosystem, providing a structured framework for evaluating onchain vulnerabilities. [Read the full update](https://open.substack.com/pub/opencover/p/opencover-alpha-february-2026)

YO Protocol Launches Governance Token and Expands to Arbitrum

**Key Updates from Covered Yield Protocols:** - **YO Protocol** introduced its governance token $YO and expanded support to Arbitrum yield sources, starting with Revert's Lend USDC integration into yoUSD - **Cap** launched the Cap Homestead Program **Recent OpenCover Developments:** - Protocol Cover now available for [Hybra Finance](https://opencover.com/hybra) on Hyperliquid, covering protocol hacks, oracle manipulation, liquidation failures, and governance attacks at 0.46% monthly - Depeg Cover launched for Neutrl USD and Spark - Integration with Cap enables users to purchase cover directly within the Cap dApp for their positions, including Pendle YT/PT tokens

OpenCover Launches Protection for Hybra Finance Positions at 0.46% Monthly

OpenCover now offers coverage for Hybra Finance positions at a monthly rate of 0.46%. Users can protect their assets while earning yields on stablecoins within the Hyperliquid ecosystem. **Key Features:** - Monthly coverage cost: 0.46% - Earn approximately 9% on USDC/USDT0 - Protection available for Hyperliquid-ecosystem assets The service allows users to safeguard their DeFi positions while maintaining earning potential on their holdings. [Learn more about Hybra coverage](https://opencover.com/hybra)

Hybra Finance Protocol Cover Now Protects Against Hacks, Oracle Manipulation, and Governance Attacks

OpenCover has launched Protocol Cover for Hybra Finance, the public liquidity layer on Hyperliquid. **Coverage includes protection against:** - Protocol hacks - Oracle manipulation - Liquidation failures - Governance attacks Hybra Finance has processed over $3 billion in volume as a liquidity infrastructure on Hyperliquid. The Protocol Cover acts as insurance for users' positions against these specific onchain risks. This coverage is underwritten through Nexus Mutual, which has covered $6B+ in onchain risk to date.