Euler Finance Achieves $1B Lending Milestone

Euler Finance Achieves $1B Lending Milestone

🎯 Euler's Billion Dollar Move

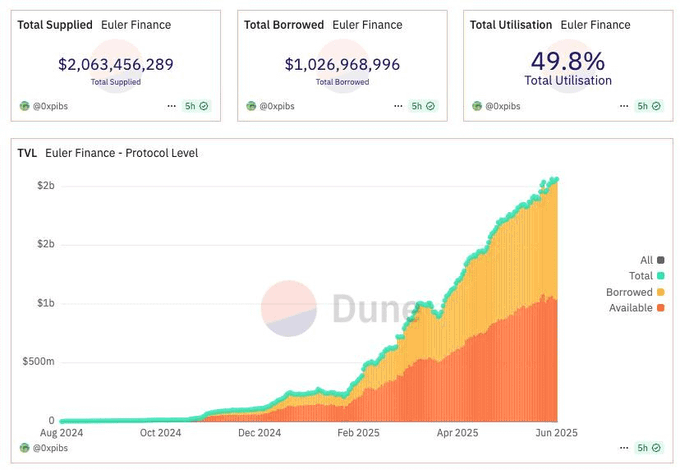

Euler Finance has reached a significant milestone, surpassing $1 billion in total borrows. The protocol demonstrates strong capital efficiency with utilization rates approaching 50%.

Key metrics:

- Total borrows: >$1B

- Utilization rate: ~50%

- Total deposits: $1B+

The platform combines flexibility with capital efficiency, setting it apart from competitors who typically excel in only one of these aspects.

For detailed analytics, view the Dune dashboard created by @0xpibs.

Euler officially crosses $1B in total borrows. With utilisation approaching 50% it shows that Euler isn't just flexible but also truly capital efficient. Accelerate.

Euler Expands on Avalanche with weETH Integration

Euler has achieved a significant milestone as the first lending protocol to integrate Ether.fi's weETH on Avalanche (AVAX). The protocol continues to expand its presence on AVAX with multiple specialized markets: - K3 Capital's market offers bluechip assets with high LTVs - Re7Labs focuses on institutional-grade DeFi opportunities - MEV Capital provides AVAX-native optimized looping strategies Users can earn $AVAX rewards through various activities including supplying and borrowing stablecoins. A $500,000 incentive program for stables is currently active. [Explore Euler on Avalanche](https://app.euler.finance/?network=avalanche)

Inverse Finance Launches sDOLA Market on Euler Frontier

Euler Finance has launched a new isolated market featuring Inverse Finance's sDOLA, a yield-bearing stablecoin. The market offers: - Full loopability with unlimited caps - 94% max LTV ratio - $20,000 in incentives - Isolated risk architecture - Current 90-day average APY of 7.80% sDOLA generates yield organically through fixed-rate loans on Inverse's FiRM market. The asset is fully decentralized and operates without governance token boosters. [Explore the market](https://app.euler.finance/?asset=sDOLA&network=ethereum) Note: Euler Frontier operates as a permissionless template for isolated markets without active governance.

Euler's Fair Liquidation System Continues to Benefit Users

Euler's reverse Dutch auction liquidation system remains a standout feature in DeFi lending. The protocol automatically adjusts liquidation bonuses based on health scores, offering key advantages: - Prevents excessive penalties for borrowers - Ensures fair treatment during market volatility - Zero liquidation fees maintained This system has proven effective since 2022, protecting users during market turbulence while maintaining protocol stability.

EUL Launches New Cross-Chain Bridge Solution

EUL.Hermes has launched a new bridging solution built on LayerZero's OFT protocol, enabling seamless cross-chain transfers of EUL tokens. Key features: - Near-zero slippage on transfers - No size limitations on transfers - Compatible with multiple chains including Mainnet, Base, Sonic, and Arbitrum This upgrade builds on EUL's existing omnichain functionality through Stargate Finance, further expanding cross-chain accessibility.