Ethereum Foundation features Aave on its new institutional website, highlighting the protocol's growing institutional adoption.

Horizon RWA market dominance:

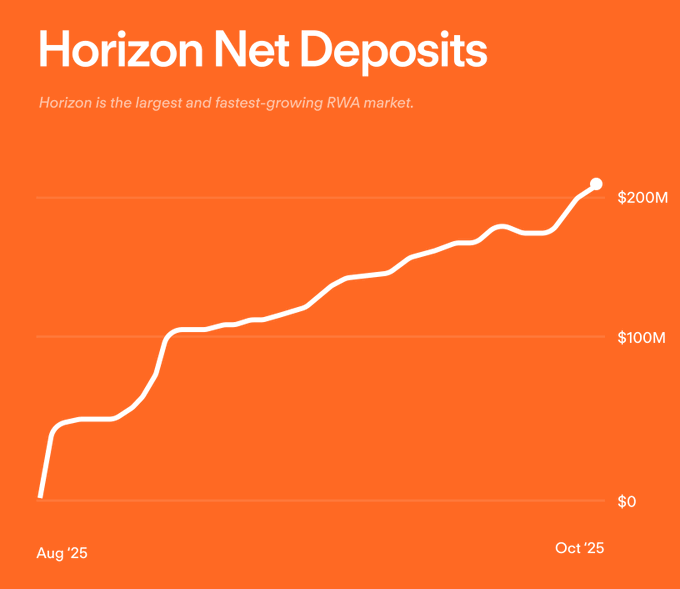

- Became the largest and fastest-growing RWA-backed lending venue

- Achieved this milestone in just two months

- Demonstrates strong institutional interest in DeFi

The recognition from Ethereum Foundation signals Aave's position as a leading institutional-grade DeFi protocol.

Horizon crosses $200M deposits, making it the largest and fastest-growing RWA market.

Aave V4 doubles down on what makes Aave successful: its liquidity. New collateral types, new markets, and new use cases will all have access to the deepest liquidity in DeFi.

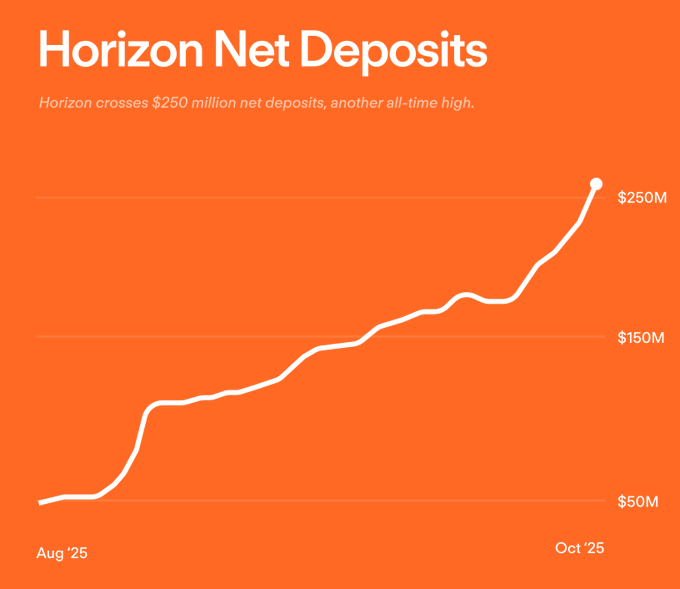

Aave's Horizon RWA market sets another all-time high. $250M net deposits.

Aave is featured on @ethereumfndn's new institutional site. The Horizon RWA market has become the largest and fastest-growing venue for RWA-backed loans in just two months. Institutions are here.

1/ Now live: the Ethereum for Institutions site Ethereum is the neutral, secure base layer where the world's financial value is coming onchain Today, we’re launching a new site for the builders, leaders, and institutions advancing this global movement

Aave V4 will unify Aave's liquidity, benefitting users and builders alike. V4 will also position Aave at the center of the next wave of financial apps, bringing the next trillion dollars onchain. Read more below ↓

Aave's Horizon RWA market is the largest and fastest-growing in DeFi. To further scale Horizon, @grovedotfinance will supply RLUSD and USDC to add depth for RWA-backed borrowing.

Aave's Horizon RWA market crosses $300M net deposits. Up and to the right.

Watch @MorganKrupetsky, Head of Onchain Finance at @avalabs, explain the importance of bringing real yield onchain through RWAs. Aave is leading RWA-backed loans in DeFi through the Horizon market with over $350 million net deposits.

🏛️ Aave Founder Takes DeFi Case to Washington

**Aave founder Stani Kulechov met with key U.S. policymakers** in Washington D.C., engaging directly with officials from: - The White House - Securities and Exchange Commission (SEC) - Federal Reserve payments division The meetings represent a **significant step in DeFi's institutional outreach**, with Kulechov receiving support from Chainlink during the visit. This follows Kulechov's previous statements about institutional DeFi's growing influence on the global financial system. Earlier this year, he noted that even the Ethereum Foundation now uses Aave for both lending and borrowing. *The direct engagement with top-tier regulators signals DeFi's push for mainstream acceptance and regulatory clarity.*

Circle Launches Arc Public Testnet with Aave as Early Ecosystem Partner

**Circle has launched the Arc public testnet**, a new EVM Layer 1 blockchain that uses USDC as its native gas token. **Aave joins as early ecosystem participant**, building on their existing relationship where nearly $7 billion in USDC is currently supplied to the Aave protocol. Key features of Arc: - EVM-compatible Layer 1 blockchain - **USDC serves as the gas token** - Designed specifically for real-world finance applications - Public testnet now live for developers and users The partnership leverages USDC's role in DeFi growth, where Aave has become one of the most popular use cases for the stablecoin. [Learn more about Arc testnet](https://www.arc.network/blog/circle-launches-arc-public-testnet)

Aave V4 Introduces Unified Liquidity Architecture with Hubs and Spokes System

**Aave V4 transforms DeFi lending** with a revolutionary architecture that unifies liquidity across markets. **Key Innovation: Hubs and Spokes** - Hubs store liquidity pools - Spokes implement custom lending rules and market logic - Multiple markets can draw from the same liquidity source **Benefits for Users and Builders:** - Enhanced capital efficiency across all markets - Specialized markets can access deep liquidity from day one - Custom lending parameters without liquidity fragmentation **Real-World Applications:** - Pendle markets accepting multiple PTs as collateral - Uniswap LP-focused lending markets - Shared ETH liquidity across different use cases **Strategic Impact:** V4 positions Aave as DeFi's operating system, enabling previously unviable markets while maintaining security and efficiency. This architecture supports the migration of global finance onchain by serving specialized needs without sacrificing liquidity depth. [Read the full unified liquidity thesis](https://aave.com/blog/aave-v4-unified-liquidity-thesis)

Aave V3 Launches on Plasma Blockchain with Six Initial Assets

**Aave V3 is now live on Plasma**, a high-performance blockchain designed specifically for stablecoins. **Initial asset support includes:** - USD, USDe, sUSDe - XAUt (gold-backed token) - WETH and weETH The deployment was handled by BGD Labs on behalf of Aave DAO, with comprehensive risk analysis from Chaos Labs and Llama Risk. **Chainlink provides price feeds** for secure operations. Plasma's focus on scalability and stablecoin infrastructure makes it a strategic addition to Aave's multi-chain presence. Supply and borrow caps are detailed in the [governance proposal](https://governance.aave.com/t/arfc-deploy-aave-v3-on-plasma/21494). Users can access the new market through the [Aave app](https://app.aave.com/markets/?marketName=proto_plasma_v3) immediately.