ETH vs BTC Yield Battle: A Tale of Two Strategies

ETH vs BTC Yield Battle: A Tale of Two Strategies

🏆 Sound Money vs Yield Machine

Bitcoin and Ethereum continue their distinct paths in the crypto ecosystem, with BTC trading at $109,603 and ETH at $2,669. While Bitcoin maintains its position as sound money, Ethereum offers additional utility through yield-bearing opportunities.

- ETH enables multiple earning streams:

- Network security through staking

- Supporting layer 2 rollups

- DeFi yield generation

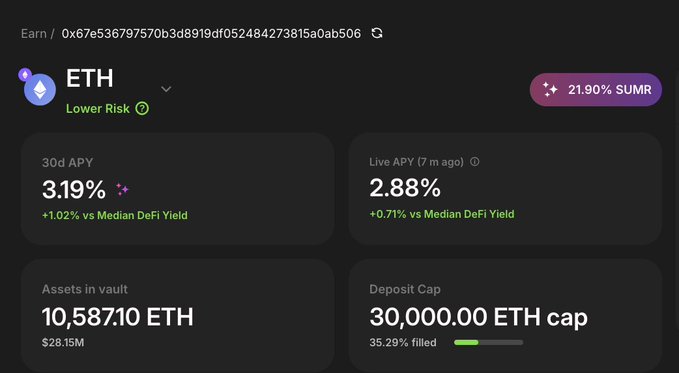

Summer.fi provides a platform for ETH holders to participate in these yield-generating activities. The platform offers various options for putting ETH to work in the DeFi ecosystem.

Current market conditions present an interesting comparison between BTC's store of value proposition and ETH's yield-generating capabilities.

📊 ETH vs BTC — Who wins the yield war? BTC: $109,603 — sound money. ETH: $2,669 — yield-bearing money. While $BTC climbs, #ETH works — securing Ethereum, fueling rollups, and earning yield. At summer.fi, you can put your ETH to work. summer.fi/earn/mainnet/p…

Lazy Summer DAO Reaches Key Governance Milestones

Lazy Summer DAO has transitioned from experimental phase to structured governance in May 2025. Key developments include: - First RFCs converted to formal on-chain proposals - Active delegate participation in protocol direction - Strategic integration updates - Enhanced governance transparency Three critical proposals are currently up for vote: - SIP2.7: Integration of sUSDS into USDC fleet - SIP5.4: New AdmiralsQuarters contract roles - SIP3.3: 90-day extension of governance staking rewards The DAO demonstrates progress toward full decentralization with increased community participation and structured decision-making processes. [Read full update](https://blog.summer.fi/the-state-of-lazy-summer-dao/)

Lazy Summer Launches New USDC.e Yield Strategies with Triple Rewards

Lazy Summer has upgraded its USDC.e Sonic Vault with three new yield strategies: - **Apostro**: Lending vault with 99.97% utilization and proven borrowers - **Varlamore**: Stable Silo vault focused on predictable collateral (76.35% utilization) - **Re7labs**: Early-stage market with growth potential The platform offers: - 7.27% APY - Triple rewards (SUMR + Sonic + Silo points) - AI-powered rebalancing - Professional risk management by Block Analitica Users can deposit at [summer.fi](https://summer.fi) and earn passively while the system automatically optimizes yields across all three strategies.

Lazy Summer Protocol Automates DeFi Yield Management

The Lazy Summer Protocol demonstrates significant impact in its first week of operation: - **$27.05M** Total Value Locked - **214** Active Users - **910** Automated Rebalance Actions - **72.8 hours** of user time saved - **$5,470.25** in gas cost savings The protocol's AI-powered keepers automatically handle yield optimization and risk management within governance parameters. This automation allows users to step away from manual position monitoring and transaction execution. [Watch the detailed breakdown](https://youtu.be/-0dbc5rM5YM) by @samehueasyou

VaultSwitch Launches on Summer.fi: One-Click Yield Position Switching

Summer.fi has launched VaultSwitch, a new feature enabling users to reposition between ETH and stablecoin yield strategies in a single transaction. The tool addresses key market challenges: - Switch between ETH and stablecoin vaults without losing yield - Maintain exposure during volatile market conditions - Keep earning $SUMR rewards while repositioning Currently live on Mainnet, Base, and Arbitrum networks. Future updates will include BTC vaults and higher-risk USDC options. [Try VaultSwitch on Summer.fi](https://summer.fi/earn)

May 2025 Rebalancing Report: ETH Strategies Lead Capital Flows

May 2025 saw a significant shift in capital allocation within the protocol, with ETH-denominated strategies dominating inflows. Key movements: - MorphoLabs Flagship WETH - Euler Finance Prime WETH - Morpho Steakhouse WETH These three strategies captured the majority of user capital both in TVL share and absolute dollar terms. Meanwhile, conservative stablecoin vaults like Morpho Gauntlet USDC experienced outflows as users sought higher yields in volatile strategies. [Read the full analysis](https://blog.summer.fi/lazy-summer-monthly-rebalance-trends-may-2025/)