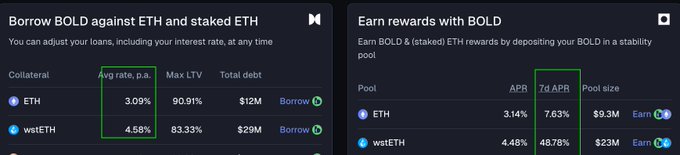

Liquity V2 now offers ETH borrowing at just 2% interest rates, making it the cheapest lending platform over the past 90 days.

Key Features:

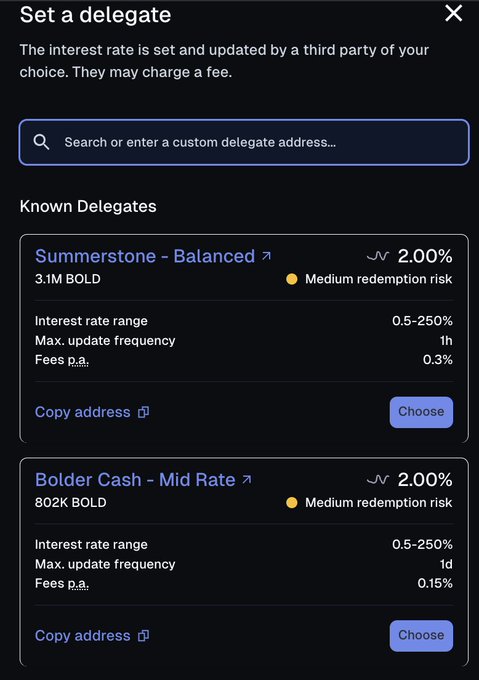

- Set your own fixed borrow rates

- Delegate rate management to services like Summerstone and Bolder Cash

- Full control over borrowing costs

This flexibility has positioned Liquity as the most cost-effective borrowing venue in DeFi, beating traditional lending protocols.

Borrowers can now secure loans against ETH and liquid staking tokens with predictable costs and high capital efficiency.

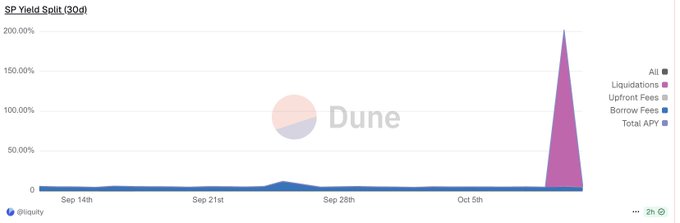

3.6% ROI in one day (1000%+ APR) It pays to be a Stability Pool depositor, or hold sBOLD / ysyBOLD.

Liquity V2 passed its first big stress test yesterday with flying colors. - ~ $3.4m liquidations processed - wstETH Stability Pool $BOLD depositors made ~3.6% APR in 1 day🤯🤯 - BOLD remained always @ $1 all done via immutable smart contracts. it pays to be BOLD.

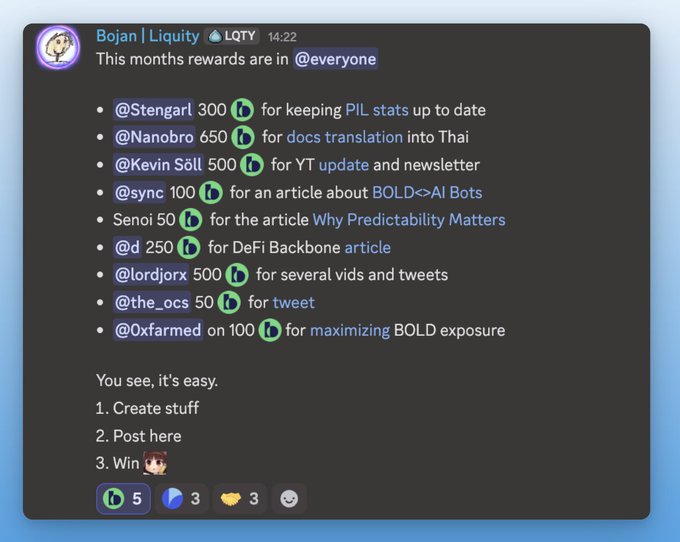

5,000 $BOLD every month - for creators, writers, and meme lords. Make content, spread awareness, earn rewards. Topic ideas: 1️⃣ The recent spike in sBOLD & ysyBOLD yield - what happened, why it matters, and how to use them across DeFi. 2️⃣ Yield strategies - LPing on Ekubo,

ysyBOLD (staked SP $BOLD from @yearnfi) can be used as collateral on @asymmetryfin Liquidation gains meant ~85.8% APR 🤯 With the 10x loop on Asymmetry @ 83.33% LTV: +85.8% ysyBOLD (85.8% x 10) −19.6% USDaf cost (1.96%×10) ≈ ~437% APY in $BOLD (+ fork airdrops) guide 👇

borrow low, yield high. capture the spread. Avg. borrow rates on Liquity V2 for ETH & wstETH are 3% and 4.5% respectively, with SP depositors earning 48% + APR ‼️ 🤯 With yield-bearing variants in @yearnfi ysyBOLD & @k3_capital's sBOLD, you can use it across DeFi too 👇

Liquity V2 is the cheapest venue to borrow against your ETH & LSTs. be BOLD.

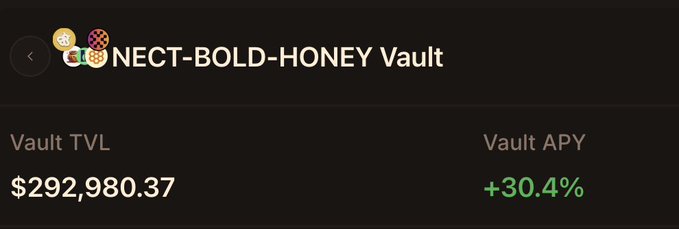

282% APY on $BOLD stablecoin pool 🤯 BOLD is now on @berachain 🐻 LPs can get 282% APY for providing liquidity on the BOLD / NECT / HONEY stable pool ‼️ The yield comes from dedicated fork rewards through @beraborrow fork rewards szn is upon us🍴 link below👇

We announced the September Community Rewards. Want to participate? It’s simple: - Create unique content around V2 / $BOLD - Post it in our discord - Win We value contributions that highlight the unique benefits of Liquity V2 and BOLD. The amount you win depends on quality

Liquity V2 passed its first big stress test yesterday with flying colors. - ~ $3.4m liquidations processed - wstETH Stability Pool $BOLD depositors made ~3.6% APR in 1 day🤯🤯 - BOLD remained always @ $1 all done via immutable smart contracts. it pays to be BOLD.

borrow with ETH at 2% interest 🔵 with Liquity V2, you can - set your own fixed borrow rates or - delegate it to rate managers like @summerstonexyz and Bolder Cash this flexibility has led to Liquity offering the cheapest loans over the last 90 days. own your costs link 👇

30% APY on a $BOLD stablecoin pool 🤯 BOLD is on @berachain LPs can get 30% APY for providing liquidity on the BOLD / NECT / HONEY stable pool, as well as @InfraredFinance points! 👀 yield is auto-compounded! link to the vault below 👇

BOLD Hits All-Time Highs as Liquity V2 Revenue Cycle Accelerates

**BOLD supply and TVL reach record levels**, driving protocol revenue higher in a self-reinforcing cycle. **Key metrics:** - 523K BOLD distributed through PIL program - $45K earned by LQTY stakers in bribes - Revenue growth fuels higher PIL rewards and bribes **The symbiotic system works:** As BOLD adoption increases, rewards grow for all participants. **For LQTY stakers:** Vote on liquidity allocation. New Uniswap v4 proposal aims to deepen liquidity pools. **For projects:** Propose initiatives to earn sustainable stablecoin rewards. **For borrowers:** Access DeFi's lowest borrowing rates. Check the [protocol dashboard](https://dune.com/liquity/protocol-incentivized-liquidity) for real-time metrics.

🏆 September Community Rewards

Liquity announced September Community Rewards for creators. **How to participate:** - Create unique content about V2 or $BOLD - Post in their Discord - Win rewards based on quality and reach The program values contributions highlighting Liquity V2's unique benefits and BOLD's advantages. Check [this week's winner](https://discord.com/channels/700620821198143498/1418719728352100493) for inspiration on successful submissions.

sBOLD Launch Brings Enhanced Yield and Airdrop Exposure

sBOLD, a new yield-bearing token, has launched on Spectra Finance with several key features: - Offers leveraged exposure to 20+ potential airdrops - Provides ~7% stablecoin base rate - Can be used as collateral on Euler Finance - Supports borrowing with up to 92.5% LTV (95% LLTV) - Auto-compounds BOLD yield - Audited by Chain Security and Dedaub The token enables users to earn protocol yield while borrowing, and can be integrated across DeFi platforms and money markets. Users can deposit sBOLD (earning 6%) and borrow USDC at 4.7% rates for additional leverage opportunities.

BOLD & sBOLD Collateral Features on Euler Finance

**Key Features of BOLD & sBOLD Collateral:** - Earn protocol yield while borrowing with sBOLD - Gain multiplied exposure to potential airdrops - Access high LTV ratios up to 92.5% (LLTV 95%) **Additional Benefits:** - Auto-compounding ETH rewards via yBOLD - Exposure to 15+ Liquity fork rewards through Stability Pool - Integration with platforms like Spectra Finance and Pendle for PT/YT trading **How to Get Started:** Visit [Euler Finance](https://app.euler.finance/?market=k3-liquity-hub&network=ethereum) to use BOLD & sBOLD as collateral