Enzyme Launches Two-Tier Infrastructure for Real World Assets

Enzyme Launches Two-Tier Infrastructure for Real World Assets

🔄 Two Ways to Token

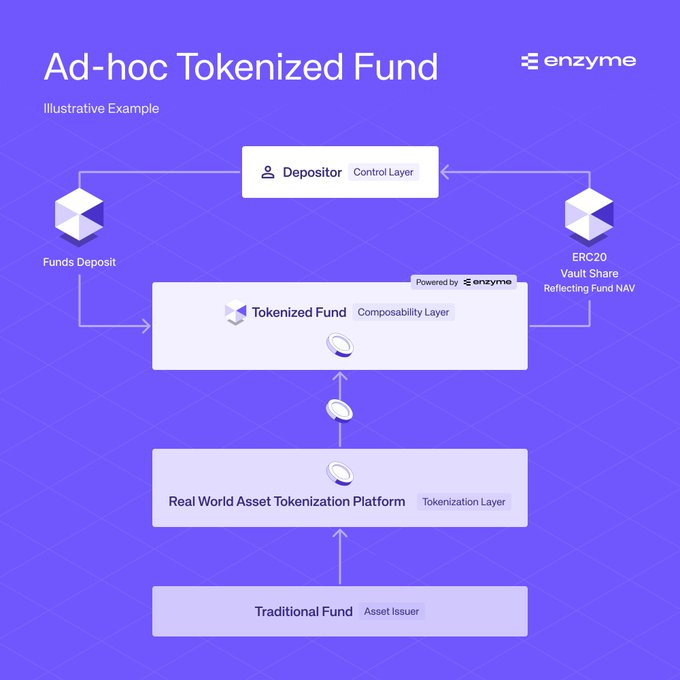

Enzyme has introduced two key solutions for bringing real-world assets (RWAs) onchain:

- Enzyme.Blue: An all-in-one vault platform for creating and managing tokenized strategies

- Enzyme.Onyx: A wallet tokenization layer that integrates with existing custody solutions

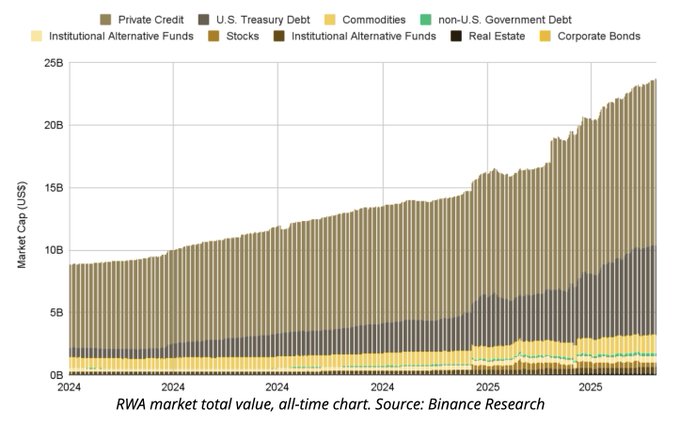

This launch comes amid significant growth in RWA tokenization, with Binance reporting 260% growth in H1 2025 reaching $23B valuation. The infrastructure supports various use cases including tokenized funds, liquidity strategies, and financial instruments.

Key features include:

- Vault customization

- Modular structure

- Onchain transparency

- Automation capabilities

- Cross-chain compatibility

According to a recent report from @binance, the RWA tokenization market has experienced a remarkable 260% growth in the first half of 2025, reaching a valuation of $23 billion. 📈 This surge is largely attributed to increasing regulatory clarity in the industry, which has

How are real-world assets tokenized? Here’s a quick breakdown, from legal structuring to onchain deployment👇 1/🧵

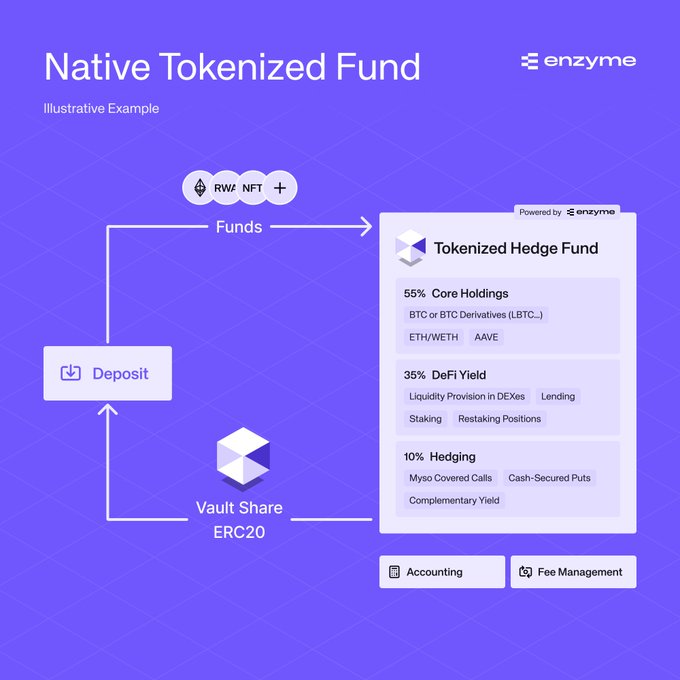

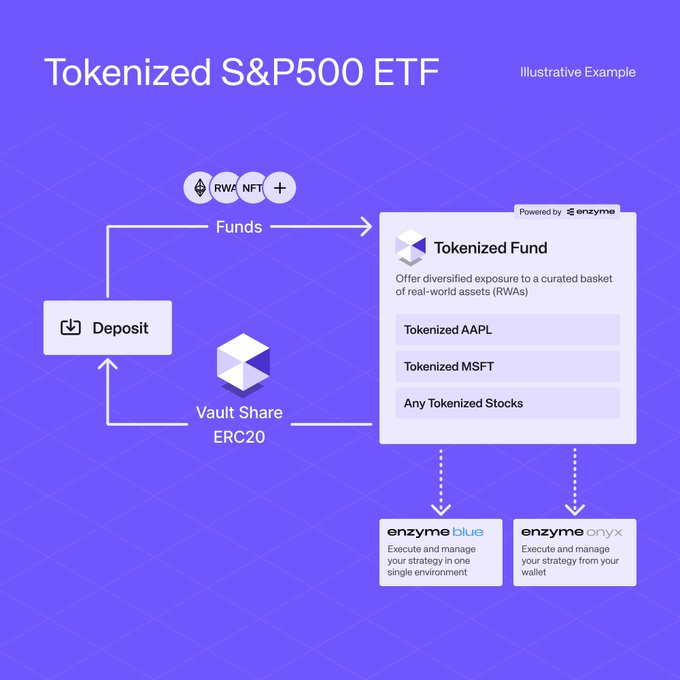

Right now, everyone talks about tokenized funds, but there are two very different ways to build them. The first, and most common today, is ad-hoc tokenization: wrapping existing offchain funds into an onchain wrapper via RWA platforms. The second is building natively tokenized

Organizations are bringing real-world assets onchain, and they need the right infrastructure to do it. Enzyme delivers: • Enzyme.Blue → all-in-one vault platform • Enzyme.Onyx → ultimate wallet tokenization layer Learn more: enzyme.finance/use-cases/rwa

Enzyme Protocol Announces Three Events at EthCC [8] in Cannes

![Enzyme Protocol Announces Three Events at EthCC [8] in Cannes](https://outpostscdn.com/file/outposts/de7b80fc-50be-4614-8db4-75f8cdc7c807/content-images/ee3ac1f5-722b-4670-b656-be4c2aa64b56.jpg)

Enzyme Protocol will participate in EthCC [8], Europe's largest Web3 event, with three curated networking events in Cannes: - **Sea, DeFi & Sun** (June 30): Seaside brunch gathering - **Sunset & Assets** (July 1): Evening event on La Croisette with NexusMutual and Sygnum, bridging TradFi and Web3 - **Brunch by the Net** (July 2): Casual meetup with Chain Security Events focus on connecting traditional finance with DeFi and exploring on-chain asset management. Team available for meetings throughout the week. [RSVP for Sea, DeFi & Sun](http://lu.ma/ysr426xa) [RSVP for Sunset & Assets](http://lu.ma/in5916cw) [RSVP for Brunch by the Net](http://lu.ma/a3x8i24h)

Enzyme Protocol Outlines Key Requirements for Institutional Onchain Operations

Enzyme Protocol details four essential components for institutions transitioning to onchain operations: - **Enterprise Security**: End-to-end audited workflows with operational guardrails and institutional custody compatibility - **Investor Experience**: White-labeled tools offering 1-click deposits and 24/7 access - **Compliance Framework**: Integrated KYC/KYB, role separation, and transparent operational processes - **Technical Flexibility**: Support for complex assets, cross-chain deployment, and wallet-agnostic vaults Enzyme's platform enables institutions to deploy regulated investment vehicles and structured products with rapid time-to-market and reduced operational overhead. [Learn more at Enzyme Finance](https://enzyme.finance)

Tokenized Securities Market Projected to Reach $45T by 2030

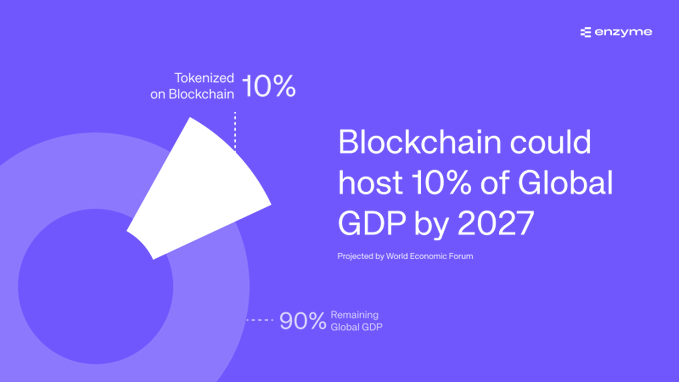

Major financial institutions are forecasting significant growth in tokenized assets: - Citi projects tokenized securities market could reach $45T by 2030 - WEF estimates 10% of global GDP could be blockchain-tokenized by 2027 - McKinsey reports shift from pilot to at-scale deployment Key trends expected in next cycle: - Shift to natively tokenized funds - Increased institutional adoption - Integration with DeFi infrastructure - Clearer regulatory framework Traditional finance faces challenges from outdated systems, while tokenized vehicles offer programmability and global accessibility. Enzyme Protocol is positioning to support this transition with native tokenization capabilities. [Learn more about tokenized funds](http://enzyme.finance/use-cases/tokenized-funds)

Tokenized Real-World Assets Hit Major Milestone

Real-world assets (RWAs) tokenized on blockchain have reached a significant milestone, surpassing $10B in Total Value Locked (TVL). This marks a crucial shift in how traditional assets are being brought on-chain. Key developments: - Over $18B in assets now tokenized (excluding stablecoins) - Infrastructure development becoming priority for operational use - Integration possibilities include RWA funds, ETPs, and indices Enzyme Protocol enables users to leverage these tokenized assets within investment strategies, marking a practical step toward mainstream RWA adoption. Learn more about tokenized asset infrastructure: [Chainlink's Guide](https://blog.chain.link/definitive-guide-to-tokenized-assets/)