Envelop Project Proposes Solution to VC Token Dump Problem with Tamper-Proof Transparency System

Envelop Project Proposes Solution to VC Token Dump Problem with Tamper-Proof Transparency System

🔒 VCs dump without crashing

The Challenge: Startups need VC funding but face community trust issues when early investors dump tokens, crashing prices and damaging project vibes.

Traditional Solutions Fall Short: Manual token locks, clunky contracts, and endless legal processes are slow, expensive, and fragile.

Envelop's Approach: The project claims to offer a balanced solution where:

- VCs get liquidity without betraying projects

- Startups protect against dumps while retaining control

- Communities get fair participation without FOMO pressure

- Built-in royalties and tamper-proof transparency

The system appears designed to let VCs trade future tokens without immediately impacting current token prices, addressing a key pain point in crypto fundraising.

5/5 Benefits stacked: VCs get liquidity without betrayal; Startups protect from dumps & retain control; Communities get fair play without FOMO. Plus, royalties & tamper-proof transparency. This is crypto sanity. x.com/Envelop_projec…

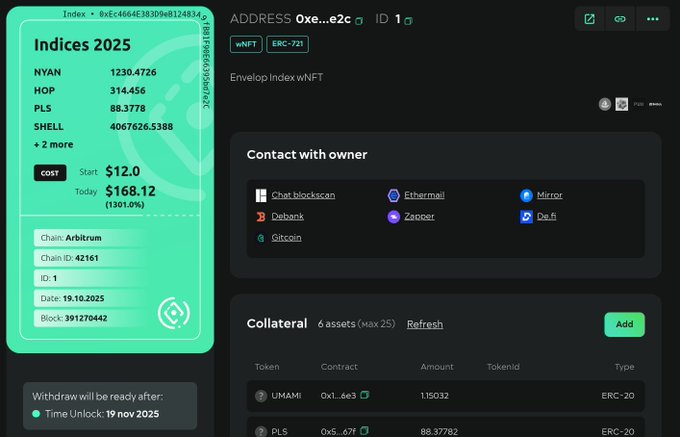

1/ Envelop is web3 index engine @Envelop_project isn’t just another wrapping tool — it’s the decentralized engine turning any token or NFT into programmable, tradable indexes.

🔥 Envelop Burns Another 200,000 NIFTSY Tokens

Envelop Protocol executed another token burn on January 29, 2026, removing 200,000 NIFTSY tokens from circulation. **Key Details:** - 200,000 NIFTSY tokens were redeemed and permanently burned - Transaction recorded on [Envelop's platform](https://app.envelop.is/token/1/0x27772e884e9d238f5478c07d44c515bcae585b1d/97) - This follows a similar 200,000 NIFTSY burn the previous day Token burns reduce the total supply of a cryptocurrency, which can impact tokenomics by decreasing available circulation. Envelop continues its regular burn mechanism as part of its protocol operations.

SBTs Transform Web3 Beyond Memes: Reputation Becomes Revenue Stream

**Soulbound Tokens (SBTs)** are emerging as Web3's answer to moving beyond speculation and memes. These non-transferable NFTs represent identity, achievements, and credentials - but Envelop's upgradable version makes them dynamic. **Key Applications:** - **Gaming**: Players buy ERC-20 "power" or "armor" tokens to upgrade NFT assets, creating new revenue streams - **Reputation Systems**: Drop reputation tokens into SBTs for completed quests or contributions, leveling from "Junior" to "Legend" - **Event Access**: Fan badges that brighten with attendance, providing tokenized loyalty rewards Unlike static credentials, these **upgradable SBTs** can be enhanced with ERC-20 tokens, making them living representations of user progress. In DAOs, they track actual contributions across skills like development and marketing. The model enables **free NFT launches** with monetized skill sales, combining user growth with revenue generation through transparent, provable achievements.

Envelop and Animoca Brands Pioneer First SAFT NFT Test in 2021

**SAFT NFTs revolutionize token distribution** by wrapping locked tokens in tradeable ERC-721 NFTs. VCs can trade these NFTs on marketplaces while underlying tokens remain locked until vesting. **Real-world implementation:** In October 2021, Envelop partnered with Animoca Brands for the first SAFT NFT test, achieving 100% on-chain distribution with secure token locks. **Key benefits:** - No paperwork or escrow required - Pure code-based solution - Maintains token vesting schedules - Enables secondary market trading This approach eliminates traditional friction in token sales while preserving investor protections through smart contract automation. [Read more about the partnership](https://blog.envelop.is/envelop-receives-investment-from-animoca-brands-to-build-a-protocol-providing-vault-and-oracle-56221a71518d)

New Solution Tackles VC Token Dump Problem Without Price Crashes

**The Challenge** Startups need VC funding but face a critical problem: early token dumps by investors destroy trust, crash prices, and damage community sentiment. Current solutions are inadequate: - Manual token locks - Complex legal contracts - Expensive implementation - Fragile systems **The Innovation** A new approach allows VCs to trade future tokens without immediately impacting market prices. This could solve the fundamental tension between: - Startups needing capital - VCs wanting liquidity - Communities fearing price manipulation **Why This Matters** The crypto industry has seen numerous projects damaged by premature VC exits. Low float launches with high fully diluted valuations have created unsustainable growth patterns. This solution could preserve: - **Community trust** - **Price stability** - **Long-term project viability** *Ready to see how this changes VC-startup dynamics?*