dYdX Chain Protocol Upgrade Brings New Features and Improvements

dYdX Chain Protocol Upgrade Brings New Features and Improvements

🔥 Major Protocol Upgrade

The recent dYdX Chain protocol software upgrade introduced several new features and enhancements. The x/authz module enables wallet address authorization for improved operational security and efficiency. Community-enabled slashing through a new governance module and MsgSlashValidator message type provides a robust measure against MEV abuses. The upgrade also included expedited proposals with shorter voting durations and higher tally thresholds. Other improvements include IBC withdrawal rate limiting, subaccount withdrawal gating, and governance-enabled slashing.

Sheeeesh! What a milestone! dYdX Chain has officially passed $50B in trading volume 🤑

uno más dydx.trade

All your trades in plain sight 👀 The @dydx_ops_subdao has updated its front end to allow you to see all your orders directly on the chart.

1/ dYdX Chain is available for iOS ✨ The same dYdX Chain trading experience you know and love—now directly in your pocket.

dYdX Chain has reached $20 BILLION in lifetime trading volume 🚀🚀🚀

The dog is movin' 🐶 Open interest on dYdX Chain for $DOGE has increased by 10.4X in one month 👀

$GRT is now available for trading on dYdX 📈📊

Ready to start trading on dYdX Chain? 😎 Deposit crypto in a flash from wherever you like.

14 new markets have been added to dYdX Chain in the past month 🔥🔥🔥 Start trading them now 👉 dydx.trade

The new markets don't stop coming 💪 $HBAR is now available to trade in dYdX Chain.

everybody say woooo !!! $WOO is now available for trade on dYdX Chain 🥳

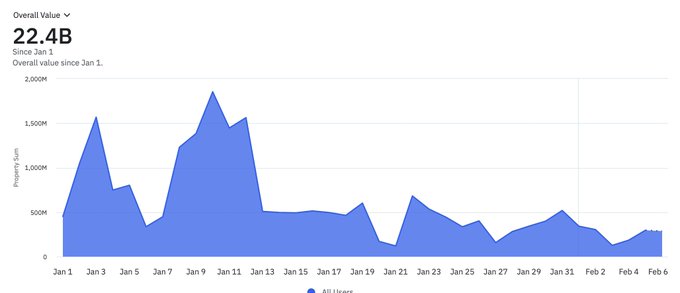

dYdX Chain is growing but v3 is still pumping! YTD volume on dYdX v3 is ~$22.4B 💪

Transferring funds from CEXs to dYdX Chain has never been easier!

CCTP is now fully integrated on dYdX Chain 🥂 Get Cosmos native USDC from Etheruem, Avalanche, or other chains with ease 😌 Try it out: dydx.trade

gm! Happy Monday 😄Over the past week dYdX Chain has seen: 💰 $4.2B in volume 🤝 360 NEW traders 🏆 BTC, ETH, SOL as the top three markets

The recent dYdX Chain protocol software upgrade brought a ton of new features and improvements💡 This post deep dives; 🛠️ The x/authz Module 🤝 Community-enabled Slashing ⚡ Expedited Proposals dydx.foundation/blog/dydx-chai…

Market listings were on fire this month 🔥🔥🔥 15 new markets were added to dYdX Chain in March alone!

Just think about how much money having a gf would have cost you today ahaaa am i rite fellas?🙂🔫 Why not just trade perps?

$ARKM is now available to trade on dYdX!

Trading for $MANA is now live on dYdX Chain 🌞

dYdX Chain 7 day stats are: 💰 $4.2B in volume 🤝 ~300 new traders 🏆 LINK + AVAX + FIL as the largest markets under ETH, BTC, SOL

$STRK is liveeee for trading ✨

You can now trade $AAVE on dYdX Chain 👻🚀

Start trading faster 🏃💨 USDC can be deposited directly to dYdX Chain from @coinbase! Try it out at: dydx.trade

dYdX Chain trading volume has now passed $40 BILLION 🚀 dydx.trade

1/ $5 MILLION in trading rewards have been airdropped to dYdX Chain users for launch incentives szn 2🤑 💸 And another $5 MIL is on the table for szn 3. Take a look at the details 👇

y'all can trade $ICP now too 💯 dydx.trade

v4.0 of our dYdX Chain software has been released! The release consists of various features, risks, governance and performance upgrades. See more in thread and blog below 🧵 dydx.exchange/blog/dydx-chai…

$AEVO is now available to trade on dYdX Chain!

dYdX Chain trading rewards are live and paid out after every trade 🤝 A new update lets you see your entire trading reward history directly in the interface 👇

Due to scheduled maintenance for @axelarnetwork and @squidrouter, deposits and withdrawals will be impacted on dYdX Chain for roughly two hours! Status will be updated in real time here: status.dydx.trade

Last week was a big on for dYdX Chain. It saw: 🤑 $9.8B total volume 😀 ~1.8k daily active traders 😮 5 new market listings Add to the stats: dydx.trade

Lifetime trading volume on dYdX Chain has passed $90B! 🔥🔥🔥

One week. $100. Rumor has it, traders who trade 7 days in a row on dYdX Chain will earn $100. Learn more 👇

$IMX is now available to trade on dYdX Chain!

dYdX Chain has officially crossed $80 BILLION in lifetime trading volume ✨

new market printer go brrrrr You can now trade $PYTH on dYdX Chain 🐍

$SNX is now available to trade on dYdX Chain 🔥

another one

that's hot 🔥

Looking for some swag to go with your juicy dYdX Chain yield? We’ve got you. The dYdX Chain Collection is dropping next week (January 30th) 💜⛓️ Featuring 3M® reflective prints, New Era headwear, and jackets made for ambitious treks and easy hikes. Stay tuned for further

Over the past week dYdX Chain has seen: 💰 $4.5B in volume 🤝 ~335 new traders 🏆 LINK + AVAX as the largest markets under ETH, BTC, SOL

Since the new market widget was added to dYdX Chain, the community has listed 5 new markets. New governance proposals are being initiated by community members on a daily basis! What other markets would you like to see added by the community? 🤔 dydx.exchange/blog/new-marke…

dYdX 🤝 Circle dYdX v3 and dYdX Chain both settle all trades in USDC and couldn’t function without the team at @circle 💫 Dive into our ecosystem spotlight with Circle here:

In our latest Ecosystem Spotlight, we highlight how integrating native $USDC and #CCTP has helped @dYdX Chain software process over $10 billion in trading volume. See how the dYdX team is making it easier for users across blockchains to onboard directly to their leading DEX

Oh btw, $BNB is live now too 💛 dydx.trade

dYdX Chain has officially passed $70 BILLION in lifetime trading volume!!

dYdX Chain has passed $25 Billion in lifetime trading volume 🔥🔥🔥

$BONK is now live for trading on dYdX Chain 🐶‼️

dYdX Chain has officially passed $30 BILLION in lifetime trading volume 🥵

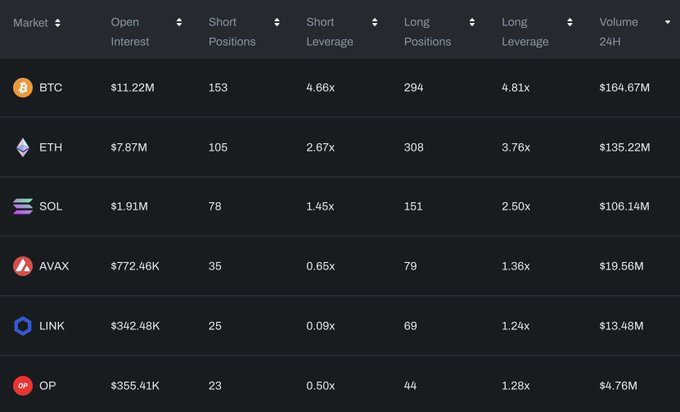

BTC, ETH, and SOL are still king 👑 But we’re seeing AVAX, LINK, and OP with some impressive 24H volume on dYdX Chain 👀 Trade your faves 👉 dydx.trade

You can now trade $DYM on dYdX Chain 😤

dYdX Chain is now the largest DEX in the world by volume 🔥🔥🔥

24 hour trading volume on dYdX Chain is over $930 Million !! ✨🤑

Introducing the New Market Widget – an easy way to propose new markets on dYdX in less than 60 seconds! Read more at dydx.exchange/blog/new-marke…

dYdX Launches Surge Season 11 with $100K Trading Competition and Zero-Fee Bitcoin Trading

**dYdX Surge Season 11 is now live**, introducing several trader incentives: - **$100K trading competition** hosted on [bonk.trade](http://bonk.trade) - **Zero-fee perpetuals** for $BTC and $BONK trading pairs - **Liquidation rebates** offering up to $1M in returns - **$200K Affiliate Booster Program** for referrals The competition leaderboard is already active, with traders competing for rewards on the dYdX-powered platform. [Learn more about Season 11](http://www.dydx.xyz/blog/february-kickoff-surge-season-11-and-200k-affiliate-booster-program)

dYdX Trading League Rewards Claim Deadline Today

**Final hours to claim dYdX Trading League rewards** Traders who participated in dYdX Trading Leagues have until **January 31** to claim their rewards. This is the last opportunity to collect any earned incentives from the competition. **Key details:** - Claims close today, January 31 - Participants should check eligibility status - Unclaimed rewards will be forfeited after the deadline Traders can verify their eligibility and claim rewards at [dydx.xyz/trading-league-rewards](https://dydx.xyz/trading-league-rewards?utm_source=dYdXTwitter&utm_medium=GlobalSocial&utm_campaign=GlobalSocial) **Action required:** Check your account and claim any pending rewards before the deadline passes.

dYdX Expands Affiliate Program with $100K Whale Bonuses

dYdX has upgraded its Affiliate Booster Program for January-February 2026 with significant enhancements: **Key Updates:** - Up to **$100K in whale bonuses** now available - Enhanced rewards for top-performing affiliates - $100K total reward pool based on referral volume - Higher volume generates larger reward share The program maintains the same basic structure while offering substantially increased incentives. Affiliates can register through the [official form](https://docs.google.com/forms/d/e/1FAIpQLSdEwim0YvS-KHpyEsV1JCuDU3ax3GWqr9bfRsAzYvlIJQJkPg/viewform). Registration is open for those looking to participate in the expanded program.

dYdX Opens Liquidation Rebate Claims for Surge Season 10 Traders

dYdX has activated liquidation rebate claims for the first half of January, targeting traders who participated in **Surge Season 10**. **Key Details:** - Traders who were active during Surge Season 10 may qualify for rebates - Claims are now available for the first half of January 2026 - Eligible users can check their status and claim at [dydx.xyz/liquidation-rebates](https://dydx.xyz/liquidation-rebates) This follows a similar program for Surge Season 9, which offered up to $1M in liquidation rebates to participants. *Check your eligibility and claim any available rebates through the official portal.*

dYdX Client Libraries Compromised on PyPI and NPM

**Malicious versions** of dydx-v4-clients were uploaded to PyPI (version 1.1.5.post1) and NPM (versions 3.4.1, 1.22.1, 1.15.2, 1.0.31). **If you're using these versions, your funds are at risk.** The official versions hosted on the dydxprotocol GitHub repository are **safe and do not contain malware**. - Check your dependencies immediately - Update to verified versions from official sources - Review recent transactions if you used affected versions