DIA Staking Launch Announcement

DIA Staking Launch Announcement

🔥 Staking Changes Everything

DIA is launching mainnet staking to power its oracle economy. The system will use $DIA tokens for all onchain updates, creating a circular value flow where fees are redistributed to stakers. Key features include:

- Feeders stake $DIA to submit data

- Rewards for accurate data, penalties for bad data

- Token holder delegation to trusted Feeders

- All updates verified by smart contracts

- Transparent fee distribution

The infrastructure is already proven across 60+ chains and 200+ dApps. Initial beta launch will include delegation and slashing mechanisms.

🧠 Oracles Got Boring. How Did We Get Here? Legacy oracles have become opaque and centralized. DIA Lumina offers a fresh approach with its fully on-chain, verifiable, and trustless architecture. Read more ↓ diadata.org/blog/post/orac…

📺 Join us live for a developer codelab with @Somnia_Network tomorrow. DIA's Technical Product Manager @xchaiboba will walk through deploying DIA oracles on the Somnia testnet, covering real use cases, tools, and how to get started. 🗓️ May 28, 3 PM UTC 2025 📍 Live on X

🌐 DIA's Vision for RWAs Tokenized real-world assets are reshaping DeFi, but trustless infrastructure is key. DIA is building the oracle layer for RWAs, supporting verifiable data feeds for stocks, bonds, FX, and more. Learn more ↓ diadata.org/blog/post/dias…

🗺️ The RWA space is vast. We mapped it. Explore the Ultimate RWA Map, the most comprehensive directory of tokenized finance, sorted by use case. Dive in → diadata.org/rwa-real-world…

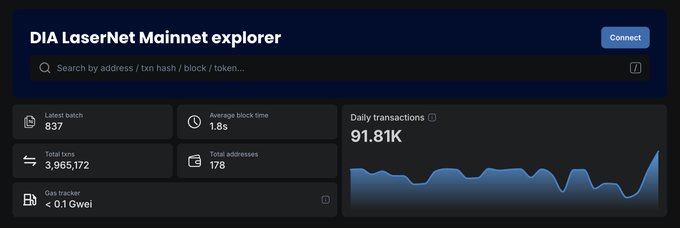

⛓️ DIA’s Lasernet rollup quietly powers the coordination and execution of oracle operations onchain. Now processing 90K+ daily transactions with fast block times and stable performance. Explore it here: explorer.diadata.org

💥 DIA didn’t just ship another update. We built Lumina, a fully modular oracle stack with its own rollup, cross-chain infra, and distributed feeder network. Designed for verifiability, scale, and a multichain future.

📹 Lumina marks a new chapter for DIA - one where trustless data becomes a reality. At the core is Lasernet, DIA’s custom rollup purpose-built for oracles. From data sourcing to onchain delivery, everything is open, verifiable, and permissionless. Learn more ↓

🏗️ Tokenized treasuries, commodities, equities, onchain. DIA xReal provides secure, verifiable price feeds for the RWA economy. Explore the oracle layer for tokenized assets ↓ diadata.org/real-world-ass…

🔍 Not all oracles are built the same DIA sources data directly from the origin and runs all oracle operations onchain via Lasernet. That means full transparency, verifiability, and trustless execution from source to smart contract. How it works → diadata.org/blog/post/why-…

🌐 Scaling trustless data requires scalable messaging. Spectra, DIA’s custom @hyperlane deployment, connects Lumina to 150+ chains, ensuring verifiable data feeds can move cross-chain with minimal trust assumptions. Dive deeper → diadata.org/blog/post/hype…

🔍 Missed the DIA Lumina launch? Catch up on how our modular, rollup-powered oracle stack brings verifiability, transparency, and decentralization to oracle infrastructure. Deep dive → diadata.org/blog/post/dia-…

⛓️ Most oracles rely on external relayers. DIA runs its own Layer 2. That’s not an experiment. That’s end-to-end control. A sovereign oracle rollup designed for verifiable data flows. diadata.org/blog/post/insi…

🤔 Why did DIA build its own rollup for oracles? Lasernet, the core of DIA Lumina, processes oracle data directly onchain, removing opacity from source to delivery. → diadata.org/blog/post/insi…

🏦⛓️ RWA Weekly: Institutional Onboarding Goes Onchain From BlackRock to Thailand, major players are no longer testing, they’re deploying. RWAs are becoming the interface between traditional capital and crypto rails. Catch this week’s biggest moves in tokenized finance: 🧵👇

🌐 Cross-chain data, delivered trustlessly. With @hyperlane, DIA can now deliver verifiable oracle data to 100+ chains, securely, and fully onchain. Proud to build with the best in cross-chain infrastructure.

Every day there’s more teams building @hyperlane deep into their stack @Calderaxyz @VelodromeFi @gelatonetwork @eco @dangoXchg @skate_chain @EclipseFND @tradeparadex @MitosisOrg @EverclearOrg @DIAdata_org @OmniFDN @khalani_network And many more 🫡

📹 Oracles should be verifiable, not trusted. DIA Co-Founder @pclaudius on how Lumina was built to fix a broken standard: fully on-chain, transparent, and verifiable oracle data. No black boxes. No blind trust. Watch ↓

🏘️ Tokenized assets are only as strong as the data behind them. DIA’s xReal delivers the oracle layer needed for RWAs, bringing stocks, commodities, FX, and credit data fully on-chain, with full transparency from source to settlement. Learn more → diadata.org/blog/post/dias…

🧠 What makes an oracle "trustless"? This simplified breakdown covers how Lumina sources, computes, and delivers on-chain data, with verifiability at every step. 🧵 👇

🧠 Lumina Explained: The Future of Transparent Oracles Oracles send real-world info—like stock or crypto prices to smart contracts. But most act like black boxes. You don’t know where the data came from, or if it’s been tampered with. DIA Lumina changes that. Here’s how 🧵 👇

🏠⛓️ RWA Weekly: From Headlines to Hard Capital From treasuries to tokenized real estate, this week saw institutions go from watching to building. RWAs are scaling into real markets, and fast. Here’s your roundup of the biggest moves in on-chain finance: 🧵👇

📹 Scaling Oracles Across Chains — Powered by Hyperlane In Bangkok, we sat down with @hyperlane's @connormcewen to dive into how Hyperlane enables DIA Lumina to deliver permissionless, push/pull oracle data to any chain, fast, trustless, and modular. Watch the full convo ↓

🏠 ⛓️ RWA adoption is happening. Governments, TradFi giants & crypto-native builders are all making moves. This week alone: BlackRock, Thailand, VanEck, Goldman, Aave, Synthetix. The onchain asset era is in motion.

🏦⛓️ RWA Weekly: Institutional Onboarding Goes Onchain From BlackRock to Thailand, major players are no longer testing, they’re deploying. RWAs are becoming the interface between traditional capital and crypto rails. Catch this week’s biggest moves in tokenized finance: 🧵👇

⛓️ Everyone deserves a chain and reliable data to power it. DIA is proud to be among the first oracle providers integrated into the @auroraisnear Cloud Console Marketplace, giving builders direct access to trustless data from day one. ACC Marketplace: marketplace.auroracloud.dev

Everyone deserves a chain. 200 launched. 1,000 coming. And now, they’re launching with more than Aurora & @NEARProtocol They are launching with the best of Web3, already plugged in. Introducing the Aurora Cloud Console Marketplace 🛠️👇

🏦⛓️ RWA Weekly: Wall Street Meets Web3 This week, tokenization takes center stage: • Kraken introduces tokenized stocks on Solana • JPMorgan settles treasuries on a public blockchain • Galaxy Digital lists on Nasdaq, eyes tokenizing its shares See the latest RWA news 🧵👇

📹 Lumina’s modular architecture unlocks a new level of flexibility. @dillonhanson12 shares how Lumina was built to adapt, supporting permissionless deployments, zero-knowledge upgrades, and custom oracle use cases across any chain. Watch the clip ↓

📆 Monthly $DIA recap: April 2025 From Lumina integration on @arbitrum, to new integrations with @PeapodsFinance & @educhain_xyz, and exciting X spaces, April was a fruitful, productive month for DIA. Check out the full recap ↓

🏗️ Monthly Recap: April 2025 The main highlights from last month include: → DIA Lumina Security Audit by @MixBytes → DIA Lumina Integration on @arbitrum Mainnet → Integrations with @PeapodsFinance & @educhain_xyz Read the full download 🧵

💥 ⛓️ Lasernet is the backbone of DIA Lumina. A purpose-built rollup where data is aggregated, validated, sequenced, and made fully transparent before being dispatched to destination chains. Meet trustless oracle execution, onchain. Learn more: diadata.org/blog/post/insi…

🏗️ Monthly Recap: April 2025 The main highlights from last month include: → DIA Lumina Security Audit by @MixBytes → DIA Lumina Integration on @arbitrum Mainnet → Integrations with @PeapodsFinance & @educhain_xyz Read the full download 🧵

🔥 DIA is scaling beyond price feeds. With Lumina, Spectra, and xReal, we’re building the trustless oracle backbone for DeFi, RWAs, gaming, and beyond. Data transparency and verifiability aren’t optional, they’re foundational. diadata.org/blog/post/why-…

🧠 Trustless by design. Modular by architecture. Live on mainnet. DIA Lumina is our oracle stack built for verifiable, onchain data at scale. Explore how Lumina reshapes oracle infrastructure ↓ diadata.org/lumina/

🗺️ Navigating the RWA ecosystem? Explore the Ultimate RWA Map: The largest and most up-to-date resource for discovering real-world asset projects, sorted by category, asset type, and use case. A go-to guide for builders, investors, and analysts. → diadata.org/rwa-real-world…

🌐 Modular oracle stack meets modular interoperability. With @hyperlane, DIA’s Lumina stack can deliver verifiable data to any chain permissionlessly at any time. Spectra + Lasernet = unstoppable oracle routing.

Fast oracle updates to any chain. Permissionless expansion to 150+ chains. Discover how the @DIAdata_org team expanded their oracle offering with Hyperlane interoperability. Read Here ⏩ hyperlane.xyz/post/builder-j…

🎮 Somnia isn’t just a gaming chain, it’s an execution layer for the next era of onchain dApps. From SocialFi to fully onchain games and metaverse economies, @Somnia_Network is reimagining what can live on-chain. Now powered by DIA’s trustless, modular oracle stack.

💥 DIA oracles are now live on @Somnia_Network testnet – powered by Lumina, DIA’s fully onchain oracle stack. This integration brings a transparent, real-time data infrastructure to one of the most promising new gaming-centric Layer 1s. 🧵👇

⛓️ Another major chain, another Lumina deployment. DIA oracles are now live on @Optimism, bringing fully onchain, modular, and trustless data to the heart of Ethereum’s scaling ecosystem. One oracle stack. Infinite use cases.

💥 DIA oracles are now live on @Optimism mainnet - powered by Lumina, DIA’s fully onchain oracle stack. This integration brings real-time, verifiable price feeds to builders on Optimism, with full support for both push and pull-based data flows. 🧵👇

💥 DIA oracles are now live on @base mainnet - powered by Lumina, DIA’s fully onchain oracle stack. This integration brings real-time, verifiable price feeds to the Base ecosystem, supporting both push and pull-based oracle models for any dApp. 🧵👇

🔮 Introducing DIA Lumina: The Rollup-Enabled Oracle DIA Lumina is a fully modular, trustless, and on-chain oracle stack that redefines transparency and verifiability for Web3. Dive into how Lumina is setting new standards for oracles: 👉 diadata.org/lumina/

💎 Trustless oracles need a trustless security layer We are getting closer to the launch of $DIA mainnet staking, which will power a new trustless engine behind fully verifiable onchain oracles. Here’s how staking turns data updates into protocol value and economic alignment.

⛓️ DIA’s Distributed Feeder Network has been running live on mainnet for over a month with strong, consistent performance. Feeding verifiable data to Lasernet, day in, day out. More on how DFN works → diadata.org/blog/post/dia-…

📹 RWAs are moving from narrative to reality, and the infrastructure is catching up fast. Back in Denver earlier this year, @dillonhanson12 shared with @DefiantNews how DIA Lumina is built to deliver trustless, verifiable data feeds for the next wave of RWA innovation.

💥 DIA oracles are now live on @Somnia_Network testnet – powered by Lumina, DIA’s fully onchain oracle stack. This integration brings a transparent, real-time data infrastructure to one of the most promising new gaming-centric Layer 1s. 🧵👇

📹 Building the future of RWA data infrastructure. With DIA xReal, DIA is expanding beyond on-chain price feeds, creating a trustless bridge for off-chain RWA data. @dillonhanson12 shares how we’re setting new standards for security, sourcing, and transparency in RWAs.

⛓️💥 The future of oracles is trustless, verifiable, and on-chain. DIA Lumina delivers fully modular oracle infrastructure, powered by Lasernet and Spectra, enabling builders to deploy scalable, secure, and transparent data feeds across 150+ chains.

💥 DIA Lumina Mainnet is now LIVE! The era of black-box oracles is over. Let there be light. DIA’s new oracle architecture Lumina is here, ushering in a new era of radical verifiability and trustless execution for onchain data.

💥 Staking isn’t just another feature. It’s about to become the engine that turns DIA into a self-sustaining oracle economy. Every onchain update is paid in $DIA. Every action is aligned with value. Mainnet staking is coming. Soon.

💎 Trustless oracles need a trustless security layer We are getting closer to the launch of $DIA mainnet staking, which will power a new trustless engine behind fully verifiable onchain oracles. Here’s how staking turns data updates into protocol value and economic alignment.

🏘️⛓️ DIA xReal: Bridging TradFi and DeFi DIA xReal delivers real-time, verifiable price feeds for RWAs across multiple asset classes: • Tokenized stocks & ETFs • Bond yields & credit ratings • Commodities & FX & more Explore the RWA oracle suite: 👉 diadata.org/real-world-ass…

Base just got more transparent. DIA Lumina is now live on @base, bringing fully onchain, verifiable oracles to one of the fastest-growing ecosystems in Web3. Push or pull, DeFi or RWAs, all trustless.

💥 DIA oracles are now live on @base mainnet - powered by Lumina, DIA’s fully onchain oracle stack. This integration brings real-time, verifiable price feeds to the Base ecosystem, supporting both push and pull-based oracle models for any dApp. 🧵👇

📈 Tokenized assets are gaining momentum, but what powers their valuations? DIA provides onchain data for RWAs like stocks, FX, commodities, and credit indices. Developers can access these via API or request custom onchain feeds: diadata.org/app/rwa/

🎥 👨💻 Build with DIA oracles on @Somnia_Network testnet. This quick codelab shows how to fetch verifiable price data from DIA using both push- and pull-based feeds. Perfect for developers building onchain apps with real-time data needs.

🌐 The DIA Feeder Network has been live for over a month, delivering decentralized, high-frequency oracle data with outstanding uptime and consistency. Props to the node operators: @ChainbaseHQ, @StakinOfficial, @swyke_ai, @Liquify_ltd, @AiAleno, @stakecraft, @global_stake,

DIA Launches Prediction Markets for Meme Coins

DIA has partnered with @meme_prediction to launch the first dedicated prediction markets for meme coins. The platform enables users to stake on price movements of popular tokens like $PEPE and $WIF. Key features: - Live on Ethereum testnet - Covers 12+ meme coins including $DOGE, $SHIB, $BONK - Powered by DIA oracles pulling data from 100+ exchanges - Transparent & verifiable price feeds The system uses DIA's oracle infrastructure to provide accurate price data across 60+ chains, ensuring reliable market resolution. [Learn more about the partnership](https://www.diadata.org/blog/post/powering-onchain-prediction-markets/)

Infra Gardens Event Series Continues with Cannes Edition at EthCC

The next Infra Gardens villa gathering is set to take place during EthCC in Cannes. Following successful events like Infra Gardens Bangkok, which featured leaders from Celestia, Gelato, Hyperlane, Starknet, and Scroll. - Exclusive villa setting for Web3 builders and founders - Program includes panels and poolside networking sessions - Previous edition in Bangkok demonstrated strong industry participation Event registration is now open at [Infra Gardens Cannes](https://lu.ma/InfraGardens-Cannes) *Limited spots available - early signup recommended*

Guggenheim Partners with Ripple to Issue Tokenized Debt on XRP Ledger

Major financial institutions are rapidly expanding into tokenized assets on the XRP Ledger. **Guggenheim** has partnered with Ripple to issue digital debt products, while **Ondo Finance** is bringing tokenized US Treasuries to the platform. The total RWA market has reached **$23.48B** with 194 asset issuers across leading chains including Ethereum, ZKSync Era, Stellar, Solana, and Polygon. In other developments, Plume Network launched its Genesis mainnet with backing from Blackstone and Invesco, while Franklin Templeton introduced intraday yield tracking for tokenized funds on its Benji platform.

DIA Developer Codelab with Somnia Network Announced

DIA's Technical Product Manager @xchaiboba is hosting a live developer codelab focused on deploying DIA oracles on the Somnia testnet. The session will cover: - Real-world use cases - Essential tools - Getting started guide - Hands-on deployment walkthrough **Event Details:** - Date: May 28, 2025 - Time: 3 PM UTC - Platform: Live on X [Watch the broadcast](https://x.com/i/broadcasts/1lPKqMpvyrMKb) Join to learn practical oracle deployment skills and network with fellow developers.