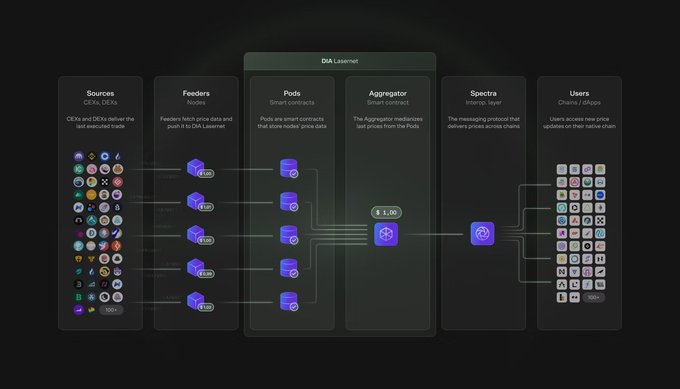

DIA unveils its complete oracle architecture with three core workflows ensuring full transparency from data collection to delivery.

The Three-Step Process:

- Data Sourcing: Independent Feeder nodes collect live trades directly from 100+ exchanges, DEXs, bridges, and traditional markets

- Price Calculation: Smart contracts on Lasernet process raw data using customizable methodologies (TWAP, VWAP, custom algorithms)

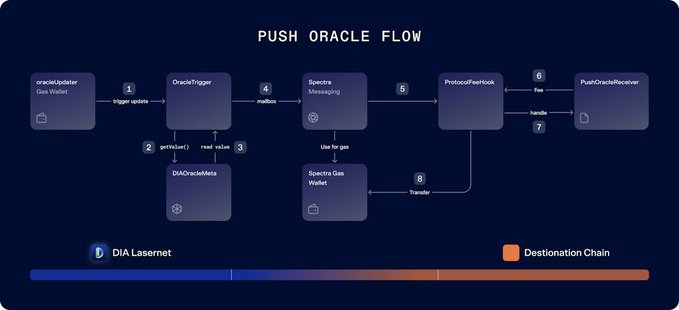

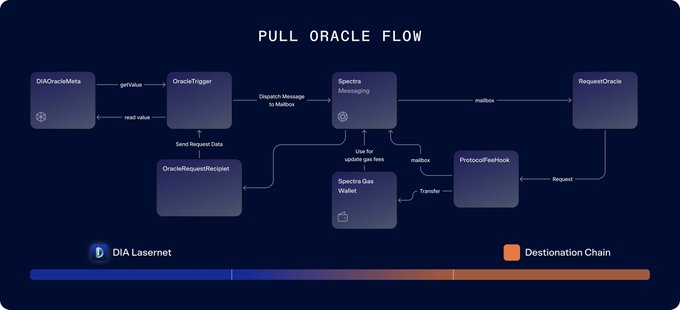

- Data Delivery: Spectra transmits calculated prices across 60+ blockchains using push/pull models

Key Features:

- No intermediaries or third-party aggregators

- Every calculation happens onchain and is verifiable

- Protocols choose exact data sources and update triggers

- Complete audit trail from source to smart contract

This creates a trustless oracle network where protocols can verify every data point, eliminating hidden aggregation and opaque processes.

August was a breaking month for DIA. 4M+ $DIA staked, first Oracle Grant approved, world's first trustless RWA oracle stack launched, plus record partnerships spanning AI, ReFi, and RWA tokenization. The foundation for verifiable data is scaling across ecosystems.

🏗️ Monthly Recap: August 2025 Last month was stacked for DIA: → 4M+ $DIA staked → First DIA Oracle Grant approved → Launched the world's first fully trustless RWA oracle stack → Record number of partnerships and integrations Catch the full recap 🧵

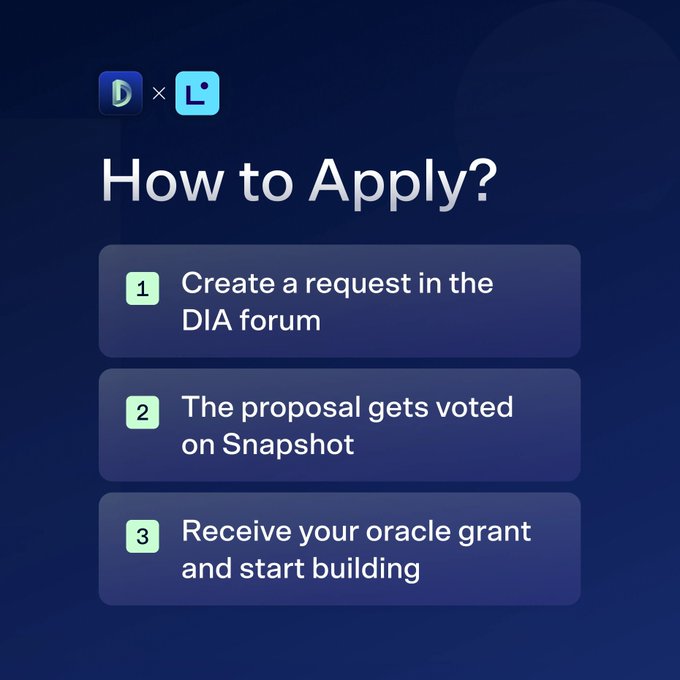

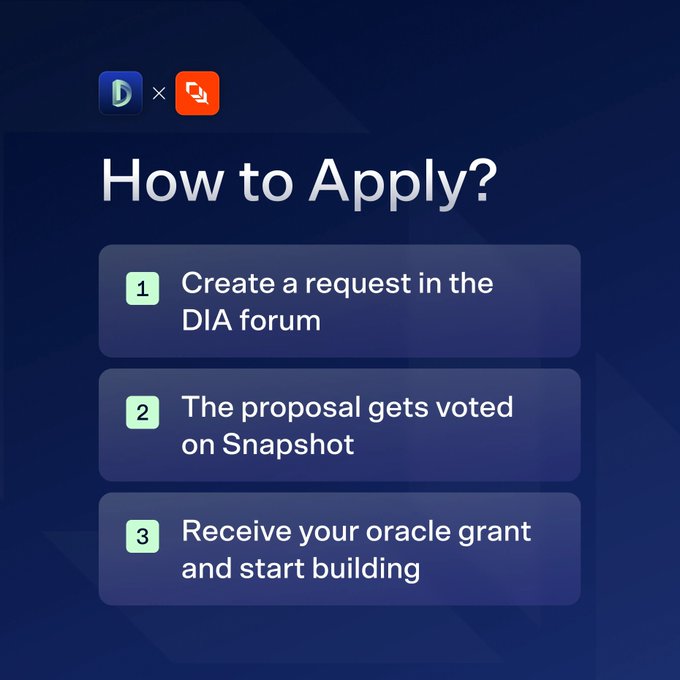

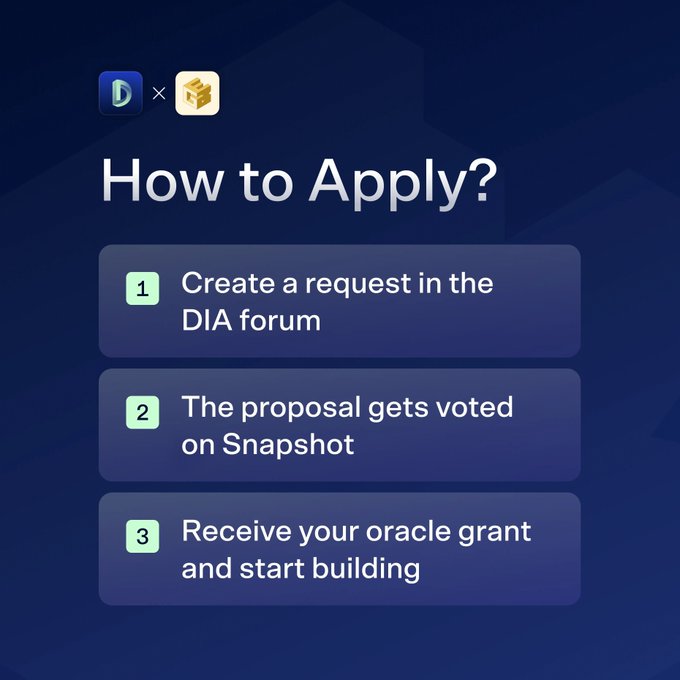

🧠 Smart automation now powered by smart data. @gelatonetwork builders can apply for DIA Oracle Grants. Integrate transparent, zero-cost oracles into your execution flows, bots, and cross-chain automations.

🧑💻 DIA x Gelato Oracle Grants Builders can now apply for DIA Oracle Grants to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

DIA now provides the NGN/USD price feed. The Nigerian Naira is Nigeria's official currency, serving Africa's most populous nation. The NGN/USD price feed is production-ready and fully auditable from source to destination chain. Get the feed: diadata.org/app/rwa/NGN/

📹 Lowering costs, unlocking speed for Aurora builders DIA Oracle Grants give projects on @auroraisnear instant access to 10,000+ live feeds; crypto, FX, RWAs, and more, at zero cost. Charlie Bussat shares why this removes key bottlenecks for early-stage teams ↓

💰 DIA Oracle Grants are live on @LineaBuild Details: • Zero-cost DIA oracle access for up to 1 year • Available to any dApp on Linea • Fast, simple application Apply now 👉 diadata.org/blockchain-ora…

Partnership with @Unilendone DIA has integrated its verifiable oracle infrastructure with Unilend, a decentralized lending and borrowing protocol on @UnitsNetwork. Transparent, tamper-resistant price feeds now power their lending operations. 🧵

💰 DIA Oracle Grants are live on @build_on_bob Details: • Zero-cost DIA oracle access for up to 1 year • Available to any dApp on BOB • Fast, simple application Apply now 👉 diadata.org/blockchain-ora…

Partnership with @Protocol_Blend DIA has partnered with Blend to bring verifiable oracle infrastructure to their lending and borrowing markets on @educhain_xyz. Institutional-grade data feeds powering education-focused DeFi with complete transparency. 🧵

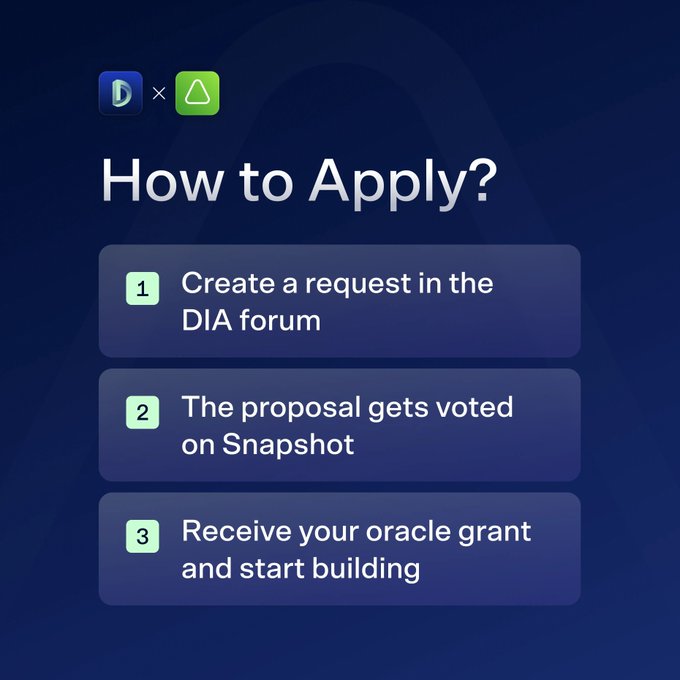

🧑🎨 Empowering digital identity and creativity. @lukso_io builders now get access to DIA Oracle Grants. Deploy onchain data for social tokens, marketplaces, and the new creative economy. Cost-free, custom-fit.

🧑💻 DIA x LUKSO Oracle Grants Builders can now apply for DIA Oracle Grants on @lukso_io to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

🤖 Partnership with Nuklai AI agents need more than just reasoning. They need reliable data. @NuklaiData is building a next-gen platform for agentic AI. DIA now brings verifiable, on-chain real-world data to fuel those agents in Nexus. A step toward trustless AI.

Nuklai and @DIAdata_org are teaming up to bring verifiable real-world data to AI agents. Agents in Nexus will be able to query live FX rates, protocol metrics, and more — with transparency and trust built in. 📖 nukl.ai/blog/nuklai-an… #NexusLive #RealStartsHere $NAI 🤝 $DIA

🍏 New RWA Feed Live: $AAPL @Apple stock pricing is now available onchain through DIA's verifiable oracle infrastructure. Production-ready for tokenized equity platforms, RWA protocols, and cross-chain applications. Explore feed: diadata.org/app/rwa/AAPL/

⛓️ Integration with @UnitsNetwork DIA has integrated verifiable oracle infrastructure with Units.Network, providing developers with transparent, trustless data feeds for building robust DeFi applications. Critical infrastructure as a common good for the ecosystem.

We did a deep dive into RWA markets, and the results are surprising. The gap between trillion-dollar projections and current on-chain reality is larger than most realize. A data-driven look at where tokenized assets actually stand today. diadata.org/blog/post/opin…

⛓️ Next-gen DeFi infrastructure meets transparent oracles. @UnitsNetwork developers can now access DIA's verifiable feeds for core assets. @UniLend_Finance has already adopted DIA's trustless pricing for their lending protocol.

⛓️ Integration with @UnitsNetwork DIA has integrated verifiable oracle infrastructure with Units.Network, providing developers with transparent, trustless data feeds for building robust DeFi applications. Critical infrastructure as a common good for the ecosystem.

"RWA data infrastructure" isn't just a buzzword anymore. Tokenized treasuries, stocks, and real estate need real-time, verifiable pricing. Not black box feeds or "trust us" data. DIA xReal powers transparent data for $25B+ in on-chain real-world assets. diadata.org/real-world-ass…

RWA tokenization hit $33.65B on-chain, up 15% in just 30 days. This week alone: $1B to BNB Chain, Uganda's $5.5B project, and major M&A activity from Ondo and Plume. Institutional capital is flooding into tokenized assets.

🏘️ RWA Weekly News: Capital Floods In $1B commits to BNB Chain, $30M to AiRWA on Solana, Uganda's $5.5B tokenization project launches, Ondo acquires broker-dealer capabilities, and Plume announces Dinero acquisition. Major capital deployment week in the RWA markets. 🧵

🌐 GOAT Network is building a modular rollup to supercharge Bitcoin and Ethereum. Now, builders on @GOATRollup can tap into DIA Oracle Grants, giving them zero-cost access to oracles for up to 1 year. Infra and capital aligned. Time to build.

🧑💻 DIA x GOAT Network Oracle Grants Builders can now apply for DIA Oracle Grants on @GOATRollup to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

🧑💻 DIA x Ankr Oracle Grants Builders can now apply for DIA Oracle Grants to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

🧑💻 DIA x LUKSO Oracle Grants Builders can now apply for DIA Oracle Grants on @lukso_io to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

🏘️ The Ultimate RWA Map 60+ RWA projects mapped across tokenized real estate, private credit, commodities, and securitized debt. The complete ecosystem breakdown showing who's building what and where capital is flowing in tokenized assets. diadata.org/rwa-real-world…

🏘️ Real-world assets won’t onboard the next billion users. Apps that use them will. DIA xReal powers them with verifiable, on-chain data. diadata.org/blog/post/dia-…

DIA oracles now support new token and RWA price feeds: $ONDO - @OndoFinance protocol token $MA - @Mastercard stock $PENDLE - @pendle_fi's yield trading protocol token $MSTR - @MicroStrategy stock Production-ready with verifiable data. Explore: diadata.org/app/price/

DIA oracles now support $ONDO price feed. Ondo Finance manages $1.5B+ in tokenized real-world assets, including Treasuries and tokenized equities. The feed is production-ready with verifiable on-chain data for DeFi integrations. Access the feed: diadata.org/app/price/asse…

🤝 Partnership with @GraphAIOfficial GarphAI is delivering real-time blockchain intelligence to power onchain AI agents integrating Real World Assets (RWAs). Now enhanced with DIA's real-world data feeds covering FX, commodities, and ETFs for richer blockchain insights.

Partnership with @GraphAIOfficial DIA is integrating real-world data feeds into GraphAI's AI-native blockchain knowledge graphs. This provides a global market context for on-chain activity through natural language queries and enriched subgraphs. 🧵

DIA Feeders collect data directly from 100+ sources: DEXs, CEXs, and primary markets. No 3rd-party aggregators. Every trade tick is sourced 1st-party, aggregated on-chain via Lasernet, and delivered with complete transparency. Browse integrated sources: diadata.org/app/source/def…

🏘️ DIA xReal is the first oracle suite purpose-built for tokenized RWAs. From tokenized stocks, bonds, FX & commodities to proof-of-reserve and interest rate data, DIA delivers fully verifiable, on-chain infrastructure for real-world assets. Explore: diadata.org/real-world-ass…

DIA xReal is the first oracle suite purpose-built for tokenized RWAs. From stocks and ETFs to commodities, FX rates, and bond yields - 1,000+ assets with fully verifiable pricing from source to smart contract. Built for institutional RWA applications. diadata.org/blog/post/veri…

📹 Powering seamless development on Linea @suzapolooza_eth from @LineaBuild shares how DIA Oracle Grants cover gas costs for oracle updates, removing barriers and enabling builders to launch dApps faster and with ease. Hear why this matters ↓

📹 Scaling Ethereum, supporting builders. We sat down with @suzapolooza_eth from @LineaBuild to talk about: • Building Linea as the next-gen zkEVM L2 • How Linea enables seamless UX and scalability • Why DIA Oracle Grants help devs ship faster on Linea Full interview 👇

🤝 Partnership with @Unilendone Unilend is a permissionless DeFi protocol on @UnitsNetwork, enabling lending and borrowing of any ERC20 token through isolated dual-asset pools on multiple blockchains. DIA's verifiable oracles now power their lending operations with transparent

Partnership with @Unilendone DIA has integrated its verifiable oracle infrastructure with Unilend, a decentralized lending and borrowing protocol on @UnitsNetwork. Transparent, tamper-resistant price feeds now power their lending operations. 🧵

🌐 Polygon’s modular ecosystem just got a data upgrade. DIA Oracle Grants are now live for builders across Polygon’s chains, from PoS to CDK-powered L2s, unlocking access to zero-cost, high-integrity oracles tailored to every stack. Ready to build the next data-powered dApp?

🧑💻 DIA x Polygon Oracle Grants Builders can now apply for DIA Oracle Grants on @0xPolygon to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

"Trillions in RWAs are coming to blockchain." We looked at the actual data. The gap between promise and reality is massive. A data-driven analysis of where tokenized assets really stand: diadata.org/blog/post/opin…

What makes oracle data "verifiable"? Three requirements: 1. Transparent data sources (where it comes from) 2. On-chain computation (how it's processed) 3. Auditable methodology (how it's calculated) DIA does all three. Most oracles do none.

New DIA price feeds deployed and ready for production: • $NFLX – @Netflix stock (RWA feed) • $BNB – @BNBCHAIN token • XAGG/USD – Silver price feed • $PAXG – @Paxos gold-backed token Fetch verifiable data for any asset: diadata.org/app/

New RWA feed: $XAGG/USD Silver trades near $48/oz, up 49% YoY, driven by solar, EV, and clean energy demand due to being a key component in solar panel production. The Silver price feed is production-ready with verifiable onchain data. Live feed: diadata.org/app/rwa/XAGG/

DIA xReal now provides NG/USD price feed. Natural gas is one of the world's largest physical commodity futures contracts, traded on NYMEX, with use growing across energy markets. The feed delivers verifiable RWA pricing onchain. Get the feed: diadata.org/app/rwa/NG/

⛓️Bringing the tokenized economy into sharper focus. @AtivoLabs now taps into DIA’s live, trustless oracle infrastructure, powering real-time monitoring of DeFi, NFTs, and RWAs across 150+ chains. The data layer for on-chain asset intelligence just leveled up. 👇

Announcing: AtivoLabs × DIA We’ve teamed up with DIA (@DIAdata_org), the fully open-source, cross-chain oracle network, to supercharge AssetLink with live, trustless price feeds. Now you get transparent, on-demand data from 150+ blockchains, powering robust monitoring of

RWA tokenization hit $33B on-chain, up 13% in 30 days alone. As treasury funds, commodities, and equities move on-chain, every tokenized asset needs accurate pricing data. That's where verifiable oracles become critical infrastructure - not optional tooling.

🏘️ RWA Weekly News: Treasury, Equity & Commodities Expand Circle's $635M fund hits Solana, $200M gold tokenized via RAAC, Ondo crosses $300M in stocks, and WLTH opens SpaceX access to 73K users. Check out this week's RWA news 👇🧵

How DIA oracles work: Complete Architecture Protocols need transparent oracle data with verifiable sourcing and auditable calculation methods. DIA makes every step transparent - from trade collection to final delivery, everything happens onchain and is fully auditable. 🧵

New RWA feed: $META/USD @Meta owns Facebook, Instagram, WhatsApp, and Reality Labs with 3.3B+ users and a $1.8T market cap. The Meta stock price feed is production-ready with verifiable onchain data. Price feed: diadata.org/app/rwa/META/

🧑💻 DIA x Linea Oracle Grants Builders can now apply for DIA Oracle Grants on @LineaBuild to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

💰 DIA Oracle Grants are live on @plumenetwork Details: • Zero-cost DIA oracle access for up to 1 year • Available to any dApp on Plume • Fast, simple application Apply now 👉 diadata.org/blockchain-ora…

🎓 Education meets DeFi infrastructure. @Protocol_Blend's multi-asset lending protocol on @educhain_xyz now runs on DIA's verifiable oracle architecture, covering EDU, WBTC, and more with complete transparency. Institutional-grade data feeds for the next generation of Edu-Fi.

Partnership with @Protocol_Blend DIA has partnered with Blend to bring verifiable oracle infrastructure to their lending and borrowing markets on @educhain_xyz. Institutional-grade data feeds powering education-focused DeFi with complete transparency. 🧵

🧑💻 DIA x Somnia Oracle Grants Builders can now apply for DIA Oracle Grants on @Somnia_Network to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

💰 DIA Oracle Grants are live on @auroraisnear Details: • Zero-cost DIA oracle access for up to 1 year • Available to any dApp on Aurora • Fast, simple application Apply now 👉 diadata.org/blockchain-ora…

🧑💻 DIA x GEB Oracle Grants Builders can now apply for DIA Oracle Grants on @BitAgere to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

🤝 DIA x Azos Finance @AzosFinance is pioneering a stablecoin backed by tokenized impact assets, bringing green bonds, carbon credits, and sustainable commodities into DeFi. With DIA oracles, these assets are now verifiably priced and usable onchain.

💥 Partnership with @AzosFinance DIA and Azos Finance partner to bring verifiable oracle data to climate impact assets onchain, powering a new stablecoin standard backed by real-world, regenerative value. Trustless data for a regenerative economy. 🧵👇

Trustless RWA Oracles Now Live on @BNBChain DIA has now integrated its verifiable oracle infrastructure for 1,000+ RWAs on the world's most active blockchain ecosystem. Every RWA price feed is fully auditable from source to smart contract. 🧵

🧑💻 DIA x Aurora Oracle Grants Builders can now apply for DIA Oracle Grants on @auroraisnear to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

From gaming equity to S&P 500 funds, AI-powered real estate to privacy infrastructure - this week showed RWAs expanding into every sector of finance. $30B+ onchain and accelerating. Full RWA landscape update 👇

🏘️ RWA Weekly News: Giants Go Multi-Chain @BlackRock drives Solana to $671M, @FTI_US expands to @BNBCHAIN, @Centrifuge tokenizes S&P 500 on @base. Meanwhile, China signals regulatory pause. Major moves amid policy shifts. 👇🧵

How DIA oracles work: Data Sourcing Price calculation requires accurate trade data. Independent Feeder nodes - operated by infra providers, data specialists, and validators - monitor live trades across 100+ exchanges. Direct connection to every source. No intermediaries. 🧵

💥 Partnership with @AzosFinance DIA and Azos Finance partner to bring verifiable oracle data to climate impact assets onchain, powering a new stablecoin standard backed by real-world, regenerative value. Trustless data for a regenerative economy. 🧵👇

🤖 Partnership with @Gaianet_AI Gaia is a decentralized, open-source AI infrastructure that empowers developers to create and deploy AI agents across diverse knowledge bases. Through DIA’s verifiable oracle infrastructure, Gaia nodes can now access over 20,000+ assets with

💥 Partnership with @Gaianet_AI DIA has partnered with Gaia to bring verifiable oracle infrastructure to decentralized AI agents. This enables AI agents to access real-world data with complete transparency and verification across 600,000+ nodes globally.

🪶 New RWA Feed Live: $HOOD @RobinhoodApp is building their L2 on @arbitrum to bring trading onchain. Now their stock is available onchain too through DIA's verifiable oracles - ready for tokenized equity platforms. Explore feed: diadata.org/app/rwa/HOOD/

Building DeFi on unverifiable price feeds creates systemic risk. DIA supports 20,000+ assets across 60+ chains with complete source-to-contract transparency. Developers can verify every data point rather than trusting opaque aggregators.

💰 DIA Oracle Grants are live on @GOATRollup Details: • Zero-cost DIA oracle access for up to 1 year • Available to any dApp on GOAT Network • Fast, simple application Apply now 👉 diadata.org/blockchain-ora…

Trustless RWA Oracles Now Live on @bobanetwork DIA has now integrated its verifiable oracle infrastructure for 1,000+ RWAs on the multichain L2 solution with hybrid compute capabilities. Every RWA price feed is fully auditable from source to smart contract. 🧵

RWAs are projected to hit $10T by 2030, but are built on unverifiable data. DIA xReal on Lumina changes that. Every stock price, treasury bill, and commodity feed now runs on transparent, auditable infrastructure. The trustless future of real-world assets starts here.

Introducing Trustless Oracles for Real-World Assets DIA xReal, the industry's first comprehensive oracle suite for RWAs is now powered by Lumina, our rollup infrastructure for verifiable computation. Every RWA price feed is fully auditable from source to smart contract. 🧵

Most oracles return a price with no proof of how it was calculated or where it came from. DIA makes every computation verifiable on-chain through rollup infrastructure. Protocols can audit the entire data pipeline from source to smart contract for any asset.

RWA oracles deployed this week across @arbitrum @plumenetwork @BNBCHAIN @kadena_io @SonicLabs. Our goal: RWA feeds live on all major chains in the coming weeks. Builders can leverage DIA Oracle Grants to get custom feeds deployed or offset operational costs.

Introducing Trustless Oracles for Real-World Assets DIA xReal, the industry's first comprehensive oracle suite for RWAs is now powered by Lumina, our rollup infrastructure for verifiable computation. Every RWA price feed is fully auditable from source to smart contract. 🧵

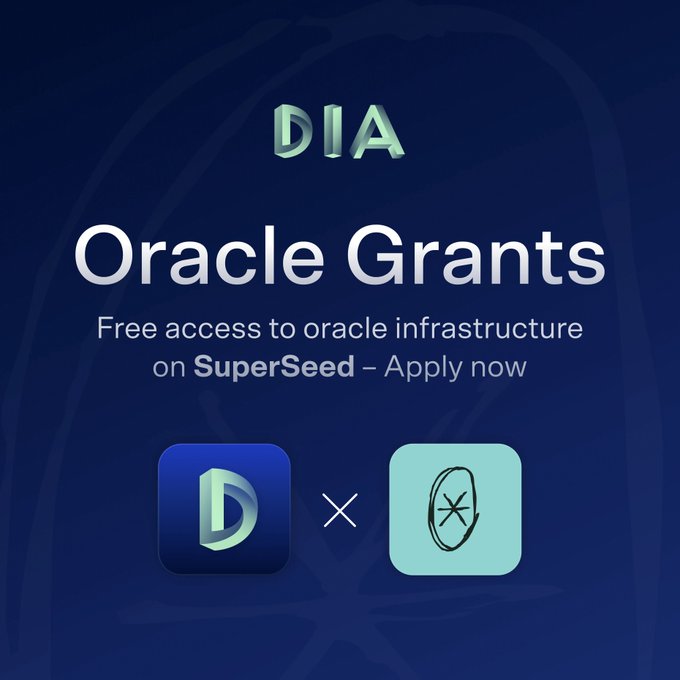

🧑💻 DIA x Superseed Oracle Grants Builders can now apply for DIA Oracle Grants on @SuperseedXYZ to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

New DIA price feeds deployed and ready for production: → NGN/USD - Nigerian Naira exchange rate (RWA feed) → $META - @Meta stock (RWA feed) → $ZEC - @zcash privacy-focused cryptocurrency Fetch verifiable data for any asset: diadata.org/app/

⚡ Turbocharged infra deserves turbocharged data. @SonicLabs builders can now tap into DIA Oracle Grants to access high-speed, cost-free oracle feeds. Power your dApps with real-time, transparent data with no infra fees. Apply now and build fast.

🧑💻 DIA x Sonic Oracle Grants Builders can now apply for DIA Oracle Grants on @SonicLabs to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

⚡ Fueling one of the busiest ecosystems in Web3. @BNBCHAIN devs can now apply for DIA Oracle Grants to access zero-cost, trustless oracle infrastructure. From DeFi to GameFi, every data-driven dApp gets the boost it needs to build faster and better.

🧑💻 DIA x BNB Chain Oracle Grants Builders can now apply for DIA Oracle Grants on @BNBCHAIN to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

🏘️ RWA Weekly News: Compliance & Scale Converge Dubai approves first tokenized fund, China Merchants Bank launches $3.8B onchain, BlackRock CEO reaffirms tokenization vision, and RWA market hits $34B - up 10% in 30 days. Institutional RWA infrastructure matures 🧵

Everyone's hyping RWAs as the next trillion-dollar crypto wave... While the current RWA market size is $300B, 92% of it ($278B) is just stablecoins. Let's break down where RWA tokenization is actually working. A thread 🧵

🤝 New partnership: DIA x @NuklaiData Nuklai’s AI agents in Nexus can now access live, verifiable data from DIA, including FX rates, protocol metrics, and tokenized RWAs. Trustless data infra meets autonomous agents. The future of AI x RWA is here.

Nuklai and @DIAdata_org are teaming up to bring verifiable real-world data to AI agents. Agents in Nexus will be able to query live FX rates, protocol metrics, and more — with transparency and trust built in. 📖 nukl.ai/blog/nuklai-an… #NexusLive #RealStartsHere $NAI 🤝 $DIA

💰 DIA Oracle Grants are live on @avax Details: • Zero-cost DIA oracle access for up to 1 year • Available to any dApp on Avalanche • Fast, simple application Apply now 👉 diadata.org/blockchain-ora…

🤝 DIA x InflectiveAI @inflectivAI builds infrastructure for AI agents to own, trade, and monetize datasets on-chain. DIA brings verifiable oracle infrastructure with 20,000+ assets from 100+ sources, powering their AI agents with trustless data.

💥 Partnership with @inflectivAI We're bringing verifiable oracle infrastructure to power AI agents and tokenized datasets. With 20,000+ assets and 100+ direct data sources, DIA delivers the verifiable feeds that AI needs to act on-chain. 🧵 👇

Oracle infrastructure is evolving from price feeds to complete data verification systems. DIA delivers first-party data integration across 20,000+ assets and 60+ chains - not just aggregated prices, but full audit trails from source to smart contract. Verify Everything.

1,000+ RWA feeds now live across major blockchain networks. Stocks to commodities - all priced with complete source transparency. The only oracle infrastructure built for institutional RWA adoption. diadata.org/blog/post/veri…

🌼 Five years ago, @BNBCHAIN began reshaping Web3. Today, it's home to millions of users and thousands of applications. DIA's role? Quietly powering builders with the verifiable oracle infrastructure they need to innovate. #BNBDay #BNBChainTurns5

New DIA price feeds deployed and ready for production: $ZORA - @zora NFT marketplace token $VIRTUAL - @virtuals_io AI agent protocol token VTI/USD - Vanguard Total Stock Market ETF (RWA feed) Need a custom price feed for any token or RWA? Let us know.

New price feed available: $VIRTUAL @virtuals_io is an AI agent launchpad, enabling users to create, tokenize, and deploy autonomous AI agents across applications. The $VIRTUAL feed is production-ready for DeFi integrations. Access the feed: diadata.org/app/price/asse…

$28B in tokenized RWAs on-chain and growing fast. Infrastructure: Ready. Adoption: Happening. Verifiable pricing: Live. DIA xReal is the first trustless oracle suite purpose-built for RWAs. diadata.org/blog/post/veri…

💥 DIA oracles now power @rezervemoney's $RZR vault deployment on @eulerfinance. Euler's permissionless lending protocol with vaults and cross-collateral capabilities is secured by a transparent price infrastructure. Institutional DeFi is utilizing data you can actually verify.

💥 DIA Oracle Grants are now live across 20+ chains. From Arbitrum to Polygon, Plume to Sonic, builders can now access DIA’s fully transparent oracles at zero cost. Power your DeFi, RWA, or gaming app with trustless data.

💥 DIA Oracle Grants are now live with 20 leading blockchains. Builders on @arbitrum, @0xPolygon, @BNBCHAIN, @SonicLabs, @LineaBuild, @plumenetwork & more can now access DIA’s transparent oracles, at zero cost. Here’s how it works & how to apply 👇

Rollup-based oracle architecture means every computation happens on-chain. From sourcing to validation to distribution - transparent methodologies, cryptographic security, and complete data traceability. No trust assumptions. @dillonhanson12 breaks it down for @DefiantNews.

Last week's RWA developments signal infrastructure maturation across the space. From multi-VM chains to institutional funding - the foundations for trillion-dollar tokenized markets are being built today. Dive into the full breakdown 👇

🏘️ RWA Weekly News: Infrastructure Scaling & Institutional Capital Funding flows accelerate, multi-VM chains launch, and RWAs evolve from simple wrappers to core DeFi building blocks. Total onchain value hits $30.26B (+9.31% from 30d ago). 🧵

$PAXG price feed is now live via DIA oracles. @Paxos gold-backed token: each $PAXG represents one troy ounce of LBMA gold. The $PAXG price feed is production-ready with verifiable onchain data. Live feed: diadata.org/app/price/asse…

💥 Partnership with @zoniqxinc DIA and Zoniqx partner to deliver verifiable oracle data for institutional tokenized assets on XRP Ledger @RippleXDev. Transparent feeds for RWA compliance and trust.

Push and pull-based oracles? Push oracles automatically update onchain at set intervals or when prices deviate. Pull oracles fetch data only when your contract requests it. DIA supports both models across 60+ chains.

🦋 DIA Powering Markets on Morpho DIA oracles now secure multiple markets and vaults on @MorphoLabs, the leading permissionless lending protocol. Morpho processes billions in volume. The kind of infrastructure that requires fully verifiable oracles.

Bitcoin L2 DeFi needs reliable price feeds. @xchaiboba explains how DIA's transparent oracle infra supports the @Stacks ecosystem with native asset pricing, custom methodologies, and DIA oracle grants. Great technical walkthrough with live code examples by @hirosystems.

"and even supporting $WELSH price feeds" Hear from @xchaiboba on how @DIAdata_org pulls in data from CEXs/DEXs to provide on-chain price feeds for many Stacks (STX) assets. Topics: ✔️DIA oracles explained ✔️MAIR explained ✔️DIA in Clarity demo ✔️DIA/Stacks Grants program

DIA xReal provides verifiable pricing for 1,000+ real-world assets, including stocks, ETFs, commodities, FX rates, and bond yields. Every feed maintains complete transparency from source to smart contract. Built for institutional RWA applications. diadata.org/blog/post/veri…

DIA oracles now support $ONDO price feed. Ondo Finance manages $1.5B+ in tokenized real-world assets, including Treasuries and tokenized equities. The feed is production-ready with verifiable on-chain data for DeFi integrations. Access the feed: diadata.org/app/price/asse…

📊 RWA momentum continues accelerating From tokenized stocks hitting $2B daily volume to Hong Kong launching official RWA registries, real-world assets are becoming core blockchain infrastructure. DIA xReal delivers the oracle layer making it all verifiable.

🏘️⛓️ RWA Weekly News: Policy, Liquidity & Markets Advance Hong Kong launches an official RWA registry, tokenized stocks surge 220% with @xStocksFi reaching $2B/day, BTC flows toward RWA yield via @SolvProtocol’s BTC+ vault, and major firms eye equity tokenization. Dive in 👇🧵

Trustless RWA Oracles Now Live on @auroraisnear DIA has now integrated its verifiable oracle infrastructure for 1,000+ RWAs on Aurora's NEAR-compatible Ethereum Layer. Every RWA price feed is fully auditable from source to smart contract. 🧵

Trustless RWA Oracles Now Live on @auroraisnear @avax @Somnia_Network @SuperseedXYZ @lukso_io This week, DIA has integrated its verifiable oracle infrastructure for 1,000+ RWAs across 5 new networks. Every RWA price feed is fully auditable from source to smart contract.

Trustless RWA Oracles Now Live on @Somnia_Network DIA has now integrated its verifiable oracle infrastructure for 1,000+ RWAs on the fastest EVM-compatible Layer-1 blockchain. Every RWA price feed is fully auditable from source to smart contract. 🧵

👨💻 Developers building onchain applications have two oracle choices: 1. Accept black box price feeds and hope for the best 2. Build with fully auditable, source-traceable data DIA Oracle Grants make the choice easier across 20+ partner chains. diadata.org/blockchain-ora…

$ZEC/USD feed now available through DIA oracles. @Zcash is a privacy-focused cryptocurrency using ZK proofs to enable shielded transactions while maintaining blockchain transparency. Verifiable data, production-ready for DeFi protocols. Feed: diadata.org/app/price/asse…

Trustless RWA Oracles Now Live on @0xPolygon DIA has now integrated its verifiable oracle infrastructure for 1,000+ RWAs on one of the leading Ethereum L2 scaling solutions. Every RWA price feed is fully auditable from source to smart contract. 🧵

DIA xReal delivers price feeds for 100+ real-world assets: stocks, bonds, commodities, exchange rates, and economic indicators. From $AAPL to treasury yields, every RWA feed is built with the same transparent, verifiable infrastructure. Explore: diadata.org/real-world-ass…

🤝 Partnership with AssetLink @AtivoLabs is redefining how tokenized assets are tracked, NFTs, DeFi, and RWAs across chains. With DIA integrated, users now get live, trustless price feeds from 150+ chains. Real-time, verifiable asset data—straight from the source.

Announcing: AtivoLabs × DIA We’ve teamed up with DIA (@DIAdata_org), the fully open-source, cross-chain oracle network, to supercharge AssetLink with live, trustless price feeds. Now you get transparent, on-demand data from 150+ blockchains, powering robust monitoring of

$300B in "RWAs" are on-chain today, but $277B of that is stablecoins. The actual tokenized asset market? $24-25B. The infrastructure gaps between today's reality and tomorrow's trillion-dollar ambitions are massive - but solvable. Read more ↓ diadata.org/blog/post/opin…

🧑💻 DIA x Stacks Oracle Grants Builders can now apply for DIA Oracle Grants on @Stacks to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

⛓️ Institutional-grade RWA tokenization needs data you can verify, not just trust. We’ve partnered with @zoniqxinc to bring transparent, real-time oracle feeds to the heart of Zoniqx’s tokenization stack, powering accurate pricing, onchain NAVs, and source-level auditability.

Fixing the Data Void in Tokenization: @zoniqxinc + @DIAdata_org 👉 When institutions talk about tokenizing the real world, there's one unspoken assumption: the data exists and can be trusted. While most platforms were focused on putting assets on-chain, #Zoniqx Inc was focused

How DIA oracles work: The Data Flow Most oracles provide prices with no way to verify their origin or calculation. DIA operates differently. Every step, from trade collection to price calculation, happens onchain, fully verifiable by anyone. 🧵

🏗️ Monthly Recap: September 2025 → Deployed a variety of new token & RWA price feeds → Launched an oracle testing sandbox for devs → New record number of partnerships and integrations Here's the full recap. 🧵👇

September delivered: • Dozen+ new token and RWA price feeds • Record partnerships and integrations across 11 chains • DIA Oracle Playground launch • Team at @token2049 and @kbwofficial • And much more Scaling verifiable oracle infrastructure that Web3 can trust.

🏗️ Monthly Recap: September 2025 → Deployed a variety of new token & RWA price feeds → Launched an oracle testing sandbox for devs → New record number of partnerships and integrations Here's the full recap. 🧵👇

🤖 GEB is building a new paradigm: agent-based systems that perceive and adapt to reality. With support from DIA Oracle Grants, developers can now deploy oracle-powered dApps on @BitAgere, bringing new utility to a programmable, Bitcoin-aligned base layer.

🧑💻 DIA x GEB Oracle Grants Builders can now apply for DIA Oracle Grants on @BitAgere to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

RWA tokenization crossed $33B on-chain. Treasury funds, equities, commodities - all moving onchain. Every tokenized asset needs verifiable pricing data. As RWAs scale, oracle infrastructure becomes critical, not optional.

Introducing Trustless Oracles for Real-World Assets DIA xReal, the industry's first comprehensive oracle suite for RWAs is now powered by Lumina, our rollup infrastructure for verifiable computation. Every RWA price feed is fully auditable from source to smart contract. 🧵

We mapped the entire RWA ecosystem so you don't have to. 60+ projects analyzed, categorized, and explained. From tokenized real estate to securitized debt - the complete landscape. Your shortcut to understanding trillion-dollar tokenization. diadata.org/blog/post/the-…

💰 DIA Oracle Grants are live on @BitAgere Details: • Zero-cost DIA oracle access for up to 1 year • Available to any dApp on GEB • Fast, simple application Apply now 👉 diadata.org/blockchain-ora…

Trustless RWA Oracles Now Live on @SonicLabs DIA has now integrated its verifiable oracle infrastructure for 1,000+ RWAs on the highest-performing EVM L1 blockchain. Every RWA price feed is fully auditable from source to smart contract. 🧵

💰 DIA Oracle Grants are live on @Stacks Details: • Zero-cost DIA oracle access for up to 1 year • Available to any dApp on Stacks • Fast, simple application Apply now 👉 diadata.org/blockchain-ora…

New RWA feed: $NFLX/USD @Netflix is the world's leading streaming platform with 300M+ subscribers and a $490B market cap. The Netflix stock price feed is production-ready with verifiable onchain data. Price feed: diadata.org/app/rwa/NFLX/

⚡ NEAR-speed, EVM compatibility, and now free oracle infra. DIA Oracle Grants are live on @auroraisnear. Builders can access gasless, fully verifiable data feeds to accelerate DeFi, gaming, and AI-enabled apps.

🧑💻 DIA x Aurora Oracle Grants Builders can now apply for DIA Oracle Grants on @auroraisnear to access DIA oracles cost-free for up to 1 year. Apply now and start building with transparent DIA oracles. 🧵👇

🔗 HBAR Oracle Integration

**DIA oracles now support $HBAR price feeds**, expanding data access for developers building on Hedera's network. **Key details:** - Hedera uses hashgraph consensus technology - Processes over 10,000 transactions per second - Offers minimal transaction fees - Enterprise-grade distributed ledger **For developers:** The new price feed integration allows dApps to access reliable HBAR market data through DIA's oracle infrastructure. [Integrate HBAR feed](https://www.diadata.org/app/price/asset/Hedera/0x0000000000000000000000000000000000000000/) into your application today.

🔥 Copper Breakthrough

**DIA oracles now provide $XG price feeds** for copper, marking a significant expansion into industrial metals. - Copper is essential for infrastructure, electronics, and power grids - Critical component in the global energy transition - Feed is production-ready for RWA (Real World Asset) protocols This follows DIA's recent launch of natural gas price feeds, showing continued growth in commodity data services. **Access the copper feed:** [DIA xReal Platform](https://www.diadata.org/app/rwa/XG/) DIA continues building infrastructure to bring traditional commodity pricing onchain for DeFi protocols.

🏦 BlackRock's $500M Aptos Move

**Tokenized assets reach $34.86B onchain**, marking a 12.79% increase over 30 days as institutional adoption accelerates. **Major developments this period:** - BlackRock deploys $500M to Aptos blockchain - Robinhood tokenizes 493 stocks on Arbitrum - Solana's RWA market crosses $700M milestone **Cross-chain momentum building** as capital and infrastructure converge across all major blockchain networks. The sustained growth follows previous months of consistent expansion in the tokenized asset space. *Traditional finance continues integrating with blockchain infrastructure at scale.*

Ethereum's Fusaka Upgrade Targets December 3 Launch with PeerDAS Innovation

**Ethereum's Fusaka upgrade launches December 3**, addressing crypto's biggest bottleneck: data availability for Layer 2s. **Key Innovation: PeerDAS (EIP-7594)** - Validators sample small data chunks instead of downloading full blobs - Each node checks ~1/8th of data while maintaining security - Drastically reduces bandwidth and storage requirements **Major Changes:** - Gas limit increases from 45M to 60M - Blob capacity expansion through new Parameter-Only forks - Hardware requirements stay manageable for validators **Impact on Layer 2s:** - Arbitrum, Optimism, Base can batch more transactions per blob - Lower data posting costs = reduced user fees - **10x throughput potential** without overloading nodes **Additional Features:** - Preconfirmations through deterministic proposer lookahead - Hardware wallet integration via Apple Secure Enclave - Passkey support for Ethereum accounts **Testing Timeline:** - Holesky testnet: Live - Sepolia testnet: Live - Hoodi testnet: October 28 - **$2M bug bounty** for security researchers Fusaka represents the infrastructure foundation for Ethereum's rollup-centric roadmap at scale. [Full details](https://ethereum.org/roadmap/fusaka/)