dForce Launches AI Yield Aggregators for Automated DeFi Optimization

dForce Launches AI Yield Aggregators for Automated DeFi Optimization

🤖 AI Takes Over

AI agents are replacing manual DeFi yield farming with autonomous optimization systems that work 24/7.

How AI yield aggregators work:

- Data ingestion: Analyze onchain and offchain market signals in real-time

- Strategy formulation: Create dynamic strategies that adapt to changing conditions

- Smart contract execution: Automatically rebalance vaults and optimize yields

- Feedback optimization: Learn from outcomes to improve future performance

Key benefits:

- Accessible to everyday users without technical expertise

- Continuous risk monitoring and automated protection

- Integration with tokenized real-world assets (RWAs)

- Machine-speed precision replacing static strategies

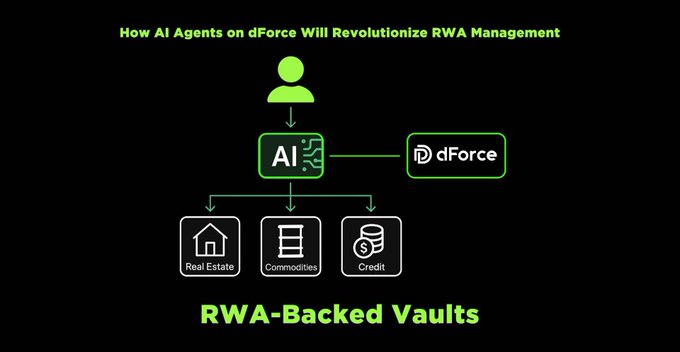

dForce is building this DeFAI infrastructure to make intelligent yield management available across RWA-backed vaults and DeFi markets globally.

Read the full technical breakdown: How AI Yield Aggregators Work

🚀 Meet DeFAI on dForce: where AI agents will soon take the wheel in managing onchain RWAs. Instead of juggling strategies, users will soon be able to simply interact with dForce vaults through AI agents handle. Seamless, intelligent RWA management — tailored for the future of

🚀 The future of onchain finance is here: DeFAI — where AI agents can also meet Real-World Assets (RWAs). By integrating intelligent automation into its RWA vaults, we at dForce are soon making complex strategies simple, adaptive, and accessible—especially for Chinese users. 🔗

DeFi has unlocked yield opportunities—but with complexity, risk, and constant manual management. ⚙️ Now a new era is emerging: AI Agents in DeFi. 🤖 dForce is entering this space, and here’s why it matters. 🔗 Read our full article on the topic here: dforcenet.medium.com/the-rise-of-ai… Or

DeFi promised 🌍 open access to yield. But manual farming is complex, time-consuming, and stressful. Now a new player is entering the arena: 🤖 AI yield aggregators. But how do they exactly work? 🔗 Read our full article on the topic: dforcenet.medium.com/how-ai-yield-a… Or keep reading

Conflux Extends CFX Rewards for AxCNH on Unitus Finance

Conflux Network continues its incentive program on Unitus Finance, distributing rewards for AxCNH activity. **Key Details:** - **175,000 CFX** total rewards over two weeks - **120,000 CFX** allocated to suppliers - **55,000 CFX** allocated to borrowers - Program runs from February 13th for 14 days Users can earn rewards by supplying or borrowing AxCNH on [Unitus Finance](http://unitus.finance). This marks a continuation of previous reward distributions, with Conflux maintaining consistent incentive levels from prior periods.

🎉 CFX Rewards Boost

**Conflux Network** is significantly increasing rewards for **AxCNH** users on [Unitus Finance](http://unitus.finance). Starting **December 5th**, the platform will distribute: - **120,000 CFX** for Suppliers - **55,000 CFX** for Borrowers This **two-week program** represents a major boost from previous reward distributions, which typically ranged from 30,000-70,000 CFX total. **Key Details:** - Program runs for two weeks starting Friday - Focuses on AxCNH stablecoin activities - Available on Conflux eSpace network This continues Conflux's pattern of regular incentive programs to drive adoption of their **CNH-based stablecoin** infrastructure. *Consider exploring AxCNH lending opportunities while enhanced rewards are active.*

dForce Launches AxCNH and USDT0 Markets on Conflux with CFX Incentives

**dForce successfully launched two new markets on Unitus Conflux:** - **AxCNH market** - Offshore Chinese Yuan stablecoin with 30,000 CFX for suppliers and 40,000 CFX for borrowers - **USDT0 market** - Can be used as collateral, earning 1,000 CFX every two weeks for deposits **Key updates:** - sUSX saving rate increased to **5%** following DIP072 approval - USX circulating supply reached **$126.31M** across multiple networks - dForce Swap accumulated **$276.8M** in total volume - New AI-driven protocol launch approaching Incentives are distributed biweekly on Conflux Network. USDT0 offers 85% loan-to-value ratio as collateral. [Read full report](https://dforcenet.medium.com/dforce-ecosystem-report-november-2025-05e593f61968)

🔋 dForce RWA Battery Power

**dForce launches second season of RWA market** on Conflux Network, offering **8% APY** on renewable energy battery-swapping collateral. **Key Details:** - EAG market Season 2 now live - Powered by Ant Digital's renewable energy infrastructure - Battery-swapping technology as underlying asset - Available at [rwa.dforce.network](http://rwa.dforce.network) **Beyond Traditional DeFi** This expansion shows dForce moving beyond standard DeFi and AI integration into **real-world asset tokenization**. The platform connects traditional renewable energy infrastructure with decentralized finance. **Investment Opportunity** Users can earn yield backed by physical battery-swapping operations, bridging the gap between sustainable energy and crypto returns. *Explore RWA vaults and start earning on renewable energy infrastructure.*

dForce Launches Renewable Energy RWA Market with Conflux Network

dForce is launching an isolated market on Conflux Network that enables users to use Ant Digital's renewable energy battery-swapping RWA as collateral. The initiative connects 4,000+ battery-swapping stations across China to blockchain technology. Key points: - Users can earn yield by providing stablecoins to power battery-swapping infrastructure - Partnership ensures regulatory compliance in Chinese markets - Market value of RWAs recently exceeded $10 billion according to DeFillama - Platform will operate through Unitus.fi protocol The integration represents a significant step in connecting traditional green energy infrastructure with DeFi capabilities.